From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineWeakening Steel Production in China: Insights and Procurement Guidance

China’s steel market sentiment is trending negative, driven by recent production drops and regulatory changes. Reports such as “China’s Crude Steel Output Drops Below 70 Million Tons in November“ relate directly to a significant decline in crude steel production to the lowest levels of the year, while the impending “China to introduce export licenses for a wide range of steel products from 2026“ indicates a shift towards stricter export regulations amid weak domestic demand and record high export levels.

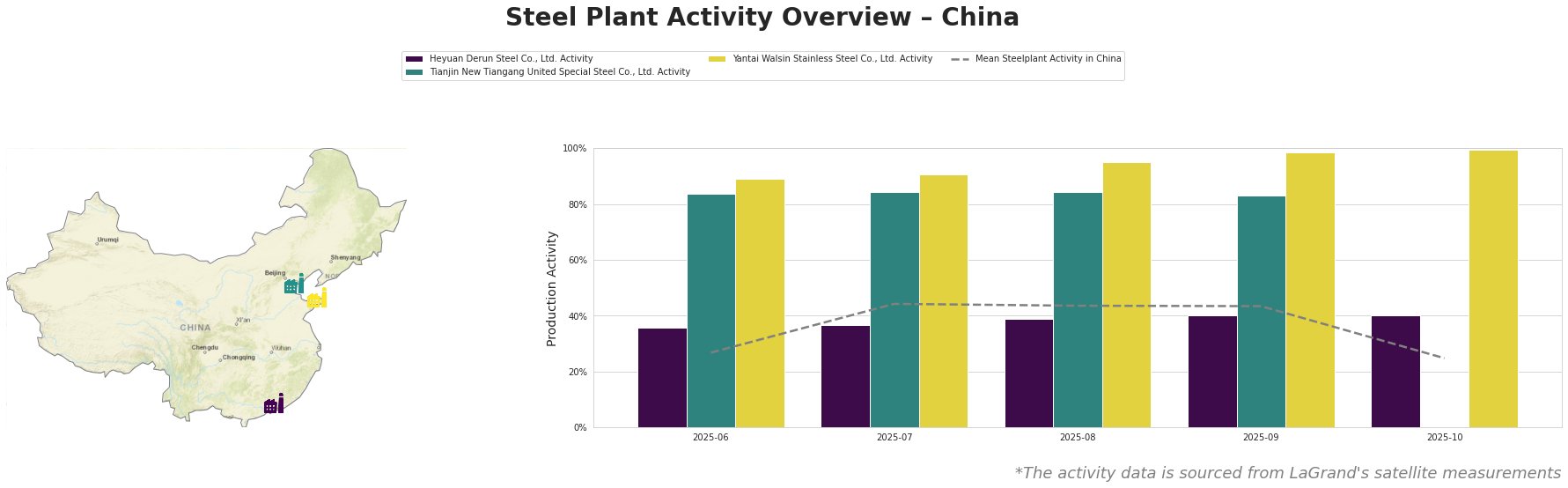

Measured Activity Overview

Activity levels have notably dropped, particularly in October 2025, where the mean activity level decreased to 25% from the previous month’s 44%. This decline aligns with the information in “China cut steel production to a two-year low in November,” suggesting that production cuts linked to environmental regulations are causing widespread reductions in operational activity.

Plant Insights

Heyuan Derun Steel Co., Ltd. reported a slight decrease in activity from 40% in September to 40% in October, indicating stability amid overall regional declines. Its reliance on electricity-based production and minimal certifications may limit its competitiveness under the new regulations. However, with “China issues new regulations for exports of steel products,” future operational flexibility may be further curtailed.

Tianjin New Tiangang United Special Steel Co., Ltd. faced a plateaued activity level with no recent data available for October due to a significant reliance on integrated production methods. The new export licensing may impact its operational efficiency and limit its ability to respond flexibly to fluctuating market demands, underscoring vulnerability amid the production slowdown.

Yantai Walsin Stainless Steel Co., Ltd. achieved peak activity at 100% in October, but the absence of production decline data may signify it is operating at full capacity — a response potentially influenced by “China to introduce export licenses…” creating an urgent need for competitive positioning prior to regulatory changes.

Evaluated Market Implications

Potential supply disruptions are anticipated across regions, particularly in areas heavily reliant on integrated steel production methods such as Tianjin, which may face challenges under new export regulations. For steel procurement professionals, immediate actions include:

- Prioritize sourcing from Yantai Walsin Stainless Steel Co., Ltd. due to its current operational strength and capacity to meet immediate demands.

- Monitor operational changes at Tianjin New Tiangang, preparing for possible procurement shifts before regulatory impacts take effect in 2026.

- Consider diversifying suppliers to manage risks stemming from reduced production outputs as noted in “China made significant reductions in steel output”, ensuring compliance with new regulations while maintaining supply stability.

Evidence from satellite data and current trends underscores the urgency of adapting procurement strategies to navigate the anticipated complexities in China’s steel market.