From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineVoestalpine Secures BYD Deal Amidst Rising European Steel Plant Activity

Europe’s steel market shows a positive trend, influenced by strategic partnerships and increasing plant activity. The recent news of “Voestalpine to supply steel for BYD’s Hungary plant” and “BYD selects Voestalpine as major steel supplier for upcoming plant in EU” directly reflect the growing demand and localization efforts within the European automotive sector. While these news articles highlight specific partnerships, no direct relationship to observed changes in activity levels at Dillinger Hüttenwerke, U. S. Steel Košice, or CMC Zawiercie could be established based on the provided data.

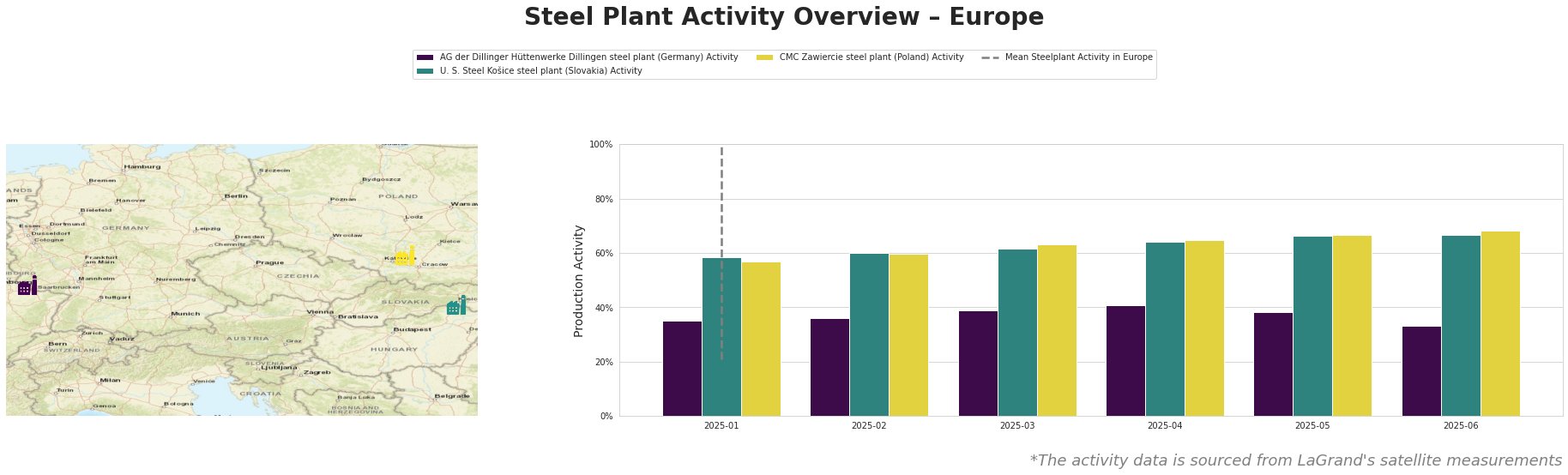

The mean steel plant activity in Europe fluctuates significantly across the observed period, with notable increases in February, March, April, and May, followed by a slight decrease in June.

AG der Dillinger Hüttenwerke Dillingen steel plant, an integrated BF-BOF plant in Germany producing mainly heavy-plate products, saw its activity fluctuate from 35% in January, peaking at 41% in April, then declining to 33% in June. Despite the news of “BYD selects Voestalpine as major steel supplier for upcoming plant in EU,” the Dillinger plant’s activity decrease in June does not directly correlate with the Voestalpine-BYD deal based on the available information, although the overall positive sentiment may indirectly impact future demand. The plant’s certifications, including ResponsibleSteel, position it favorably for supplying sustainably-conscious clients.

U. S. Steel Košice steel plant in Slovakia, another integrated BF-BOF plant focused on flat-rolled products, exhibited a steady increase in activity, rising from 58% in January to 67% in June. This upward trend suggests strong operational performance and demand for its products. No direct connection to the provided news articles could be established based on the current information. Its ResponsibleSteel certification is an advantage in the growing market.

CMC Zawiercie steel plant, an EAF-based plant in Poland, also demonstrated consistent growth in activity, increasing from 57% in January to 68% in June. This suggests healthy demand within its market segment, potentially driven by infrastructure projects. The plant’s exclusive use of EAF technology may make it attractive for green procurement strategies. No explicit link to the provided news could be established.

Based on the confirmed partnership highlighted in the articles “BYD selects Voestalpine as major steel supplier for upcoming plant in EU,” “BYD has chosen voestalpine as its steel supplier for its Hungarian car plant,” and “Voestalpine to supply steel for BYD plant in Hungary,” European steel buyers should anticipate increased demand for sheet steel, particularly from voestalpine. Steel buyers should proactively engage with voestalpine to secure supply agreements, leveraging the confirmed BYD partnership as a basis for negotiation. Buyers sourcing similar steel grades should explore alternative suppliers in Central and Eastern Europe (e.g., U. S. Steel Košice) to diversify their supply base and mitigate potential price increases driven by Voestalpine’s increased commitments.