From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineVietnam Steel Market Navigates Tariffs & Duties: Plant Activity Signals Shifting Dynamics

Vietnam’s steel sector faces evolving trade dynamics amidst new tariffs and anti-dumping measures. The market’s response can be observed through steel plant activity. Vietnam has imposed definitive anti-dumping duties on hot-rolled steel products from China,” while “Vietnam Imposes Hefty Anti-Dumping Tariffs on Chinese Steel Imports,” potentially impacting the supply chain. These developments occur against the backdrop of “Vietnam und USA schließen Zollabkommen,” which introduces new export tariffs to the US. While activity data fluctuations can be observed in satellite imagery, it is not possible to directly connect this activity to these recent trade policy shifts.

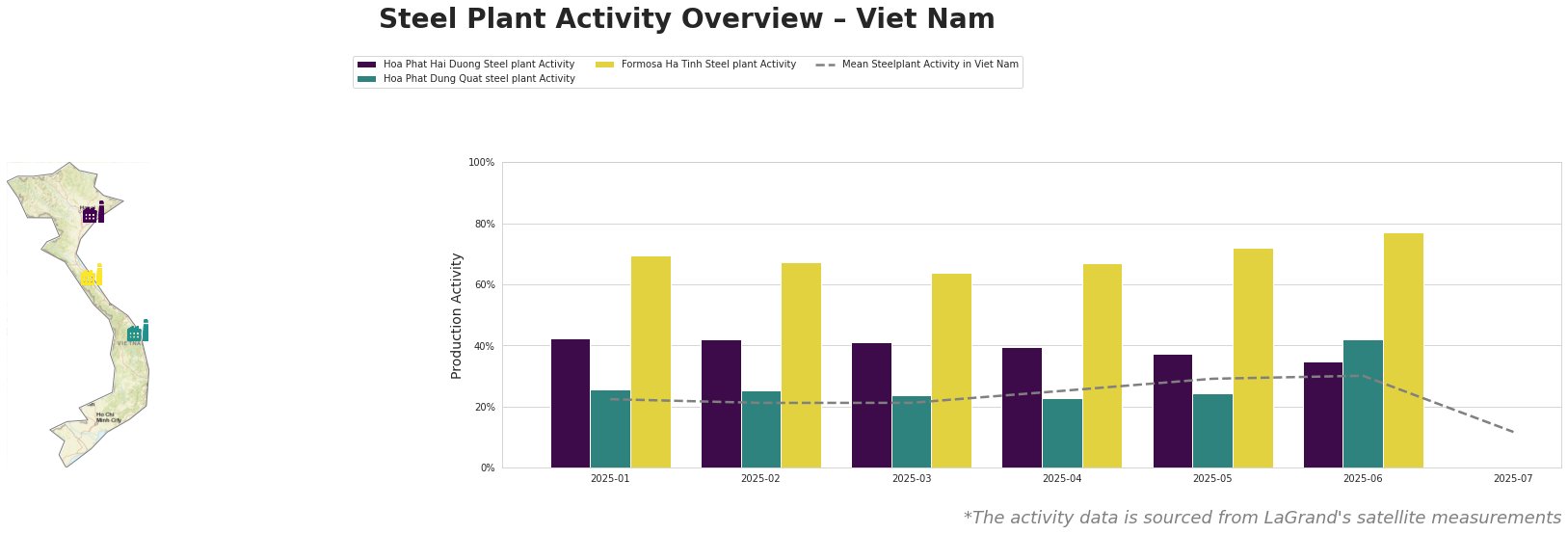

Overall steel plant activity in Viet Nam exhibited a steady increase from January (22%) to June (30%), peaking in June before experiencing a significant drop to 12% in July.

Hoa Phat Hai Duong Steel plant, an integrated steel plant with a 2.5 million tonne BOF capacity, showed a gradual decline in activity from 42% in January-February to 35% in June. No direct connection between this trend and the named news articles can be explicitly established.

The Hoa Phat Dung Quat steel plant, another integrated plant with a larger 5.6 million tonne BOF capacity primarily serving the building and infrastructure sectors, showed relative activity stability from January to May (26% decreasing to 24%), followed by a notable increase to 42% in June. No direct connection between this trend and the named news articles can be explicitly established.

Formosa Ha Tinh Steel plant, a major integrated steel producer with a 7.5 million tonne BOF capacity, demonstrated consistently high activity, ranging from 64% in March to 77% in June, exceeding the average across all plants. No direct connection between this trend and the named news articles can be explicitly established.

The recent imposition of anti-dumping duties on Chinese hot-rolled steel, as stated in “Vietnam has imposed definitive anti-dumping duties on hot-rolled steel products from China,” and “Vietnam Imposes Hefty Anti-Dumping Tariffs on Chinese Steel Imports”, coupled with tariffs on exports to the U.S. (“Vietnam und USA schließen Zollabkommen”), creates a complex situation. While the average plant activity decreased drastically in July, potentially indicating supply chain adjustments, no direct connection to these specific news events can be confirmed based solely on the provided data.

Procurement Actions:

Given the anti-dumping duties on Chinese hot-rolled steel, steel buyers should:

- Diversify sourcing: Actively explore alternative suppliers of hot-rolled steel beyond China to mitigate potential price increases and supply disruptions.

- Carefully Monitor Domestic Production: Track activity and pricing from domestic producers like Formosa Ha Tinh, Hoa Phat Hai Duong and Hoa Phat Dung Quat to assess if domestic capacity can fulfill the demand.