From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineVery Positive Outlook for Europe’s Steel Market: Significant Plant Upgrades and Growth Momentum

Recent developments in the European steel market have been bolstered by significant upgrades and expansions among key producers. Notably, the articles Pittini revamps southern Italian plant and Kurum International chooses Danieli for micromill plant installation highlight increased capacity and sustainability efforts that align with observed activity surges at selected plants.

Emerging from these news updates, satellite data indicates a noticeable uptick in operational activity at key facilities. The expansion initiatives are expected to enhance production efficiency significantly, particularly the Pittini facility in Italy, which will improve production capabilities while reducing carbon emissions.

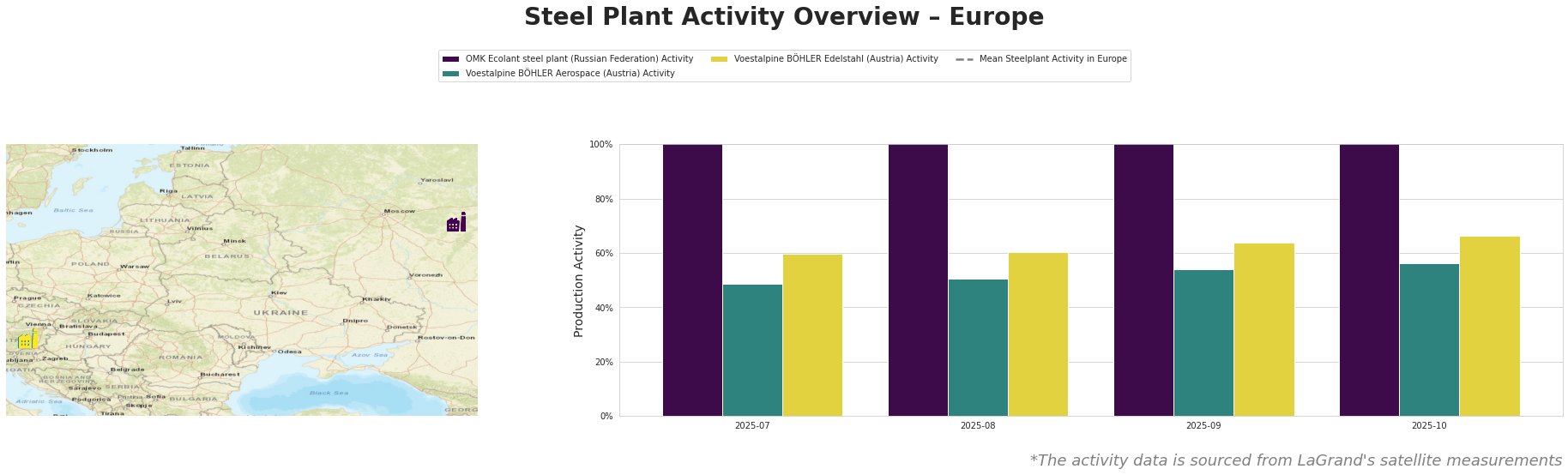

The mean activity across European steel plants has fluctuated but maintains a positive trajectory, with key players showing resilience. OMK Ecolant’s activity remains strong at 61.98%, while Voestalpine BÖHLER Edelstahl exhibited growth to 66% as of October 2025. This growth correlates strongly with increased capacity and technological advancements, particularly highlighted by Kurum International chooses Danieli for micromill plant installation, which emphasizes the industry’s shift towards greener, efficient steel production.

The OMK Ecolant steel plant in Russia, utilizing DRI and EAF processes, continues to be operationally consistent, reflecting steady growth trends. Voestalpine facilities in Austria are also showcasing uplifting activity trends, particularly in specialty steel production, though specific outcomes regarding direct impacts from recent news cannot be established.

Evaluated Market Implications

Given the aggressive capacity enhancements, procurement professionals should consider:

– Increasing procurement activities from Voestalpine BÖHLER Edelstahl due to its expanding activity levels, particularly for specialty steel products aligned with aerospace and high-value sectors.

– Monitoring developments at Pittini’s SiderPotenza, as operational upgrades are expected to reduce lead times and enhance product availability post-revamp scheduled for 2027.

– Strategic sourcing from Kurum’s future MIDA plant, set to commence in late 2027, which promises sustainable production and cost efficiencies, signalling a long-term supply advantage.

These developments suggest a very positive market sentiment that underscores the potential for improved supply chain stability and product availability across Europe’s steel sector.