From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS Tariff Uncertainty Clouds Asian Steel Market; Plant Activity Mixed

The Asian steel market faces uncertainty due to potential shifts in US trade policy. The impact on Asian steel producers is unclear, as court rulings challenge the legality of existing tariffs, but no direct connection to specific Asian steel plant activity can be established from the provided news and activity data. The articles “Trump’s tariff push overstepped presidential powers, appeals court says“, “US-Gericht erklärt Donald Trumps Strafzölle für illegal“, “US-Berufungsgericht erklärt Großteil von Trumps Zöllen für unzulässig“, “Experten-Analyse: US-Zölle: «Chancen vor Supreme Court sind eher gering»” and “FAQ: Wie es mit den US-Zöllen nach dem Gerichtsentscheid weitergeht” highlight the instability stemming from US tariff policies and legal challenges. “Wie Trump die Wirtschaft umbaut – und wie die Märkte darauf reagieren” describes the broader economic strategy driving these tariffs.

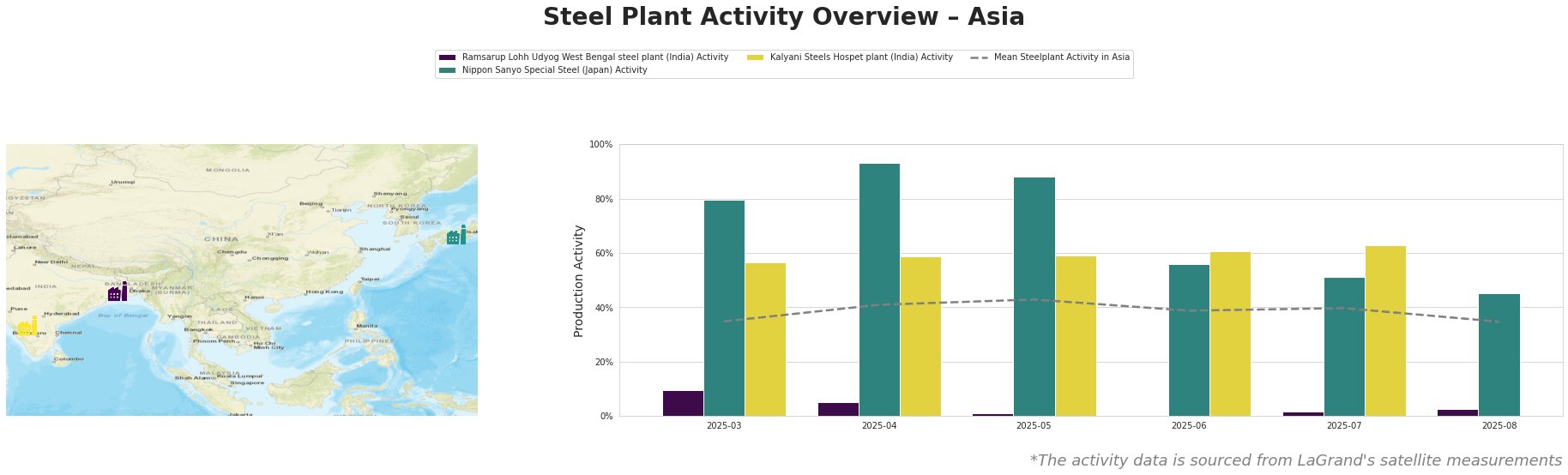

The average steel plant activity in Asia fluctuated throughout the observed period, peaking in May at 43% and then dropping to 35% in August. Ramsarup Lohh Udyog West Bengal steel plant consistently showed activity levels significantly below the Asian average, remaining below 10% and reaching its lowest point of 0% in June. Nippon Sanyo Special Steel initially exhibited high activity, peaking at 93% in April, but experienced a notable decline to 45% by August. Kalyani Steels Hospet plant maintained relatively stable activity levels, fluctuating between 57% and 63%, consistently above the Asian average. No direct link between activity variations at any of these specific plants and the US tariff-related news articles could be established.

Ramsarup Lohh Udyog, located in West Bengal, India, operates an integrated steel plant utilizing both blast furnace (BF) and direct reduced iron (DRI) processes, with a DRI capacity of 182 ttpa. The plant’s activity was consistently low, peaking at only 10% in March and dropping to 0% in June. The low activity levels suggest potential operational challenges. No direct connection between the tariff news and Ramsarup Lohh Udyog’s low activity could be established.

Nippon Sanyo Special Steel, located in the Kansai region of Japan, focuses on special steel production using electric arc furnaces (EAF) with a capacity of 1596 ttpa. The plant experienced a significant decline in activity, from 93% in April to 45% in August, indicating a potential reduction in production. The decline could be influenced by broader economic factors or changes in demand, but no direct link to the news articles regarding US tariffs can be established.

Kalyani Steels Hospet plant in Karnataka, India, is an integrated steel plant with both BF/BOF and DRI/EAF production routes. The plant maintained consistent activity levels above the Asian average, around 60% throughout the observed period. This stability suggests consistent production and demand for its rolled bar and round products, primarily for the automotive and infrastructure sectors. No direct connection between the tariff news and Kalyani Steels Hospet plant’s activity could be established.

Evaluated Market Implications:

Given the uncertainty surrounding US tariffs and the mixed activity levels in Asian steel plants, steel buyers should monitor the Supreme Court’s decision regarding the legality of Trump’s tariffs, as indicated in the articles “US-Berufungsgericht erklärt Großteil von Trumps Zöllen für unzulässig“, “Experten-Analyse: US-Zölle: «Chancen vor Supreme Court sind eher gering»“, and “FAQ: Wie es mit den US-Zöllen nach dem Gerichtsentscheid weitergeht“. The potential removal of tariffs could lead to increased steel imports into the US, potentially impacting global steel prices and demand for Asian steel.

Procurement Actions:

- For steel buyers: Given the stable activity at Kalyani Steels Hospet plant, buyers sourcing rolled bars and rounds for automotive and infrastructure should consider negotiating long-term contracts to secure supply.

- For market analysts: Track the legal proceedings related to the US tariffs and model potential scenarios for steel price fluctuations based on the outcome. Continuously monitor the activity levels of Nippon Sanyo Special Steel for signs of further decline, and investigate potential causes beyond US tariff impacts.