From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS Tariff Uncertainty and Falling Plant Activity Signals Challenges for Indian Steel

India’s steel market faces headwinds due to ongoing trade negotiations with the US and recent declines in domestic plant activity. The articles titled “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US” and “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8” highlight the uncertainty surrounding potential tariffs. While these news articles outline the negotiation landscape, no immediate and direct impacts on the satellite-observed plant activity levels could be explicitly established.

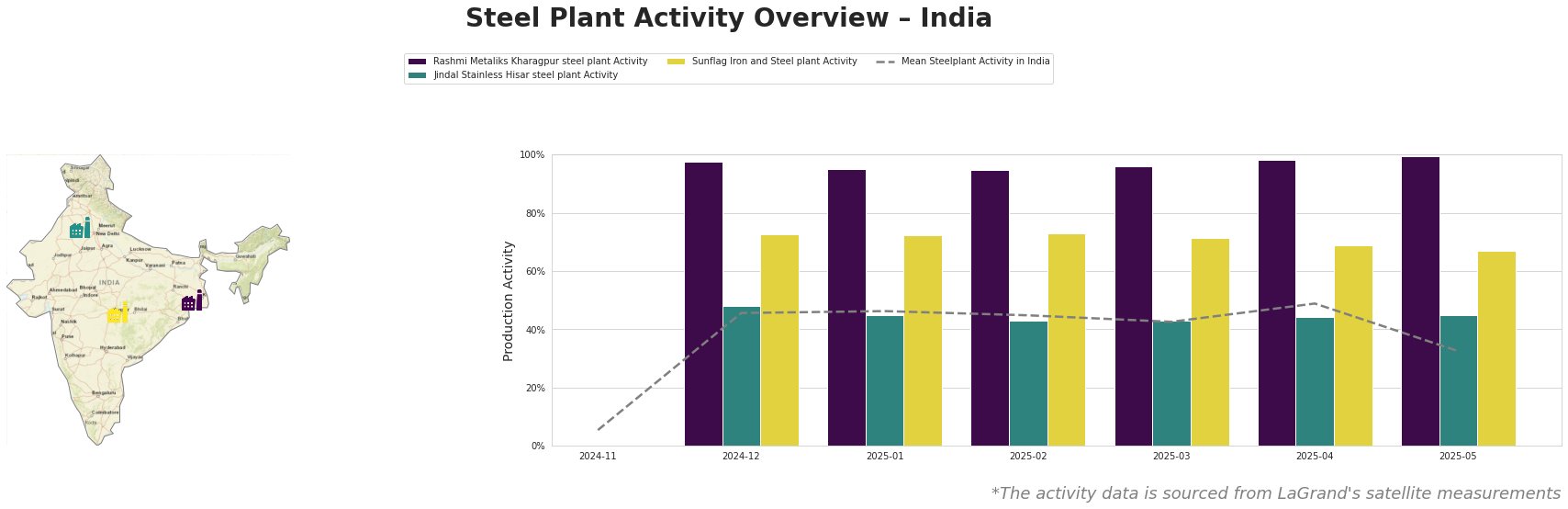

The mean steel plant activity in India shows a significant drop to 33% in May 2025, after peaking at 49% in April 2025. Rashmi Metaliks Kharagpur steel plant maintained a consistently high activity level, hovering near 95-99% throughout the observed period. Jindal Stainless Hisar steel plant exhibited relatively stable activity around 43-48%. Sunflag Iron and Steel plant displayed a gradual decline from 73% in December 2024 to 67% in May 2025.

Rashmi Metaliks Kharagpur, a DRI- and BF-based plant with a crude steel capacity of 1500 ttpa, has demonstrated consistently high activity levels, reaching 99% in May 2025. Despite ongoing trade negotiations as highlighted in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US,” its production remained robust. This suggests a strong domestic demand or pre-emptive production in anticipation of potential tariff implications; however, a direct link cannot be definitively established based on the provided information.

Jindal Stainless Hisar, an EAF-based plant with a crude steel capacity of 800 ttpa producing stainless steel and other finished rolled products, shows relatively stable activity. The plant’s activity fluctuated slightly between 43% and 48% over the observed period. While “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US” discusses potential tariff impacts on industrial goods, no direct impact on Jindal Stainless Hisar’s activity is evident from the satellite data.

Sunflag Iron and Steel, an integrated BF- and DRI-based plant with a crude steel capacity of 500 ttpa, experienced a gradual activity decline from 73% in December 2024 to 67% in May 2025. Although the news articles discuss potential US tariffs, a direct causal relationship to the observed decline in Sunflag’s activity cannot be explicitly established.

The significant drop in the mean steel plant activity across India, coupled with the ongoing US tariff negotiations, points to potential supply disruptions. The article “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8” suggests a possible resolution by July 8th; however, uncertainty remains. Steel buyers and market analysts should:

- Closely monitor the outcome of US-India trade negotiations: The resolution of the tariff issue will significantly impact import/export dynamics and domestic steel prices.

- Prioritize short-term procurement strategies: Given the uncertainty, focus on securing supply for immediate needs rather than long-term contracts.

- Assess alternative domestic suppliers: With potential disruptions, evaluate and diversify supply sources within India, noting the consistent high activity at Rashmi Metaliks Kharagpur as a potentially reliable supplier.

- Factor in potential price volatility: The combined impact of tariff uncertainty and fluctuating plant activity may lead to price fluctuations, requiring careful budgeting and risk management.