From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS-Japan Trade Deal Spurs Optimism in Asia’s Auto Steel Sector Despite Lingering Tariffs

The Asian steel market shows positive sentiment driven by the recent US-Japan trade agreement. The news articles “US, Japan reach trade deal; steel tariffs remain” and “Japan’s steel industry welcomes tariff deal with US” highlight the lowered tariffs on Japanese goods (excluding steel and aluminum) entering the US, boosting the prospects for steel-intensive sectors like automotive. Satellite data indicates that the production activities remained at a high level and were less affected by the news.

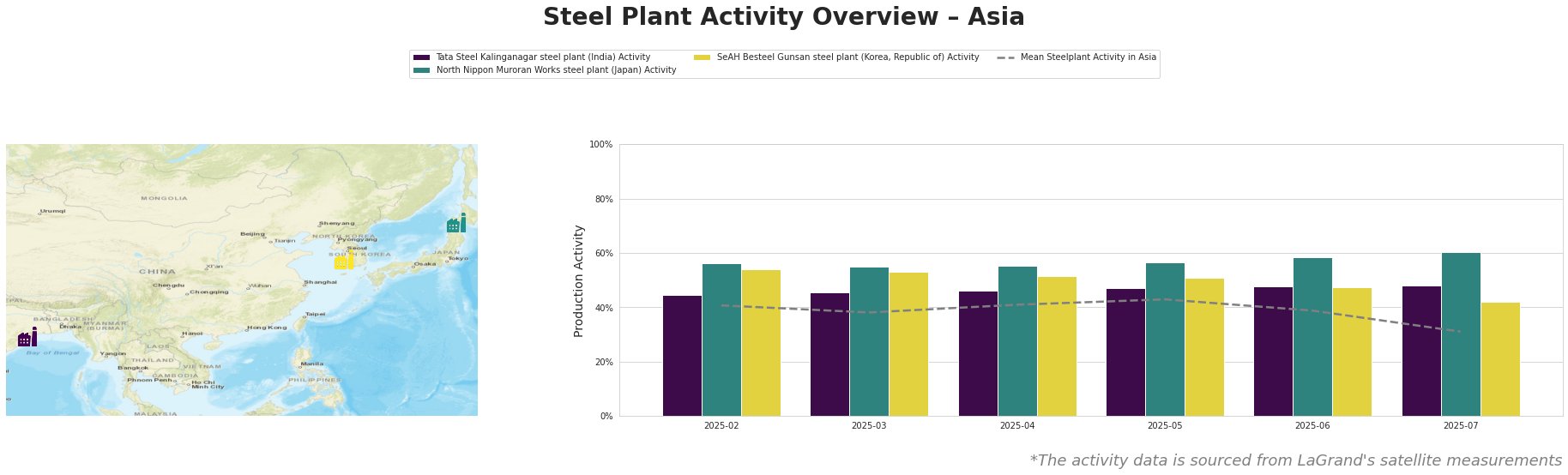

Monthly Steel Plant Activity in Asia

The mean steel plant activity in Asia has fluctuated over the past six months, ending with a significant drop to 31.0% in July.

Tata Steel Kalinganagar steel plant (India): Activity at this integrated (BF, BOF) steel plant in Odisha has steadily increased from 45.0% in February to 48.0% in June, and remained stable in July. No direct connection could be established between this trend and the provided news articles.

North Nippon Muroran Works steel plant (Japan): This plant, equipped with both BF/BOF and EAF technologies, shows a consistent upward trend in activity, rising from 56.0% in February to a peak of 60.0% in July. Considering the news article “Japan’s steel industry welcomes tariff deal with US” and the plant’s location in Japan with its automotive industry focus, the increased activity may be linked to anticipation of increased steel demand from the automotive sector due to reduced tariffs.

SeAH Besteel Gunsan steel plant (Korea, Republic of): This EAF-based plant experienced a gradual decrease in activity from 54.0% in February to 42.0% in July. No direct link can be established between this decline and the news articles. The plant focuses on special steel and auto parts.

Evaluated Market Implications

The US-Japan trade deal, as reported in “US, Japan reach trade deal; steel tariffs remain” and other related articles, signals increased demand for steel within the Japanese automotive sector. This sentiment is supported by the observed increase in activity at North Nippon Muroran Works steel plant, potentially indicating preparation for increased production to meet automotive demand.

Procurement Actions: Steel buyers should closely monitor Japanese steel prices, particularly for automotive-grade steel. Given the sustained 50% tariff on steel imports into the US, as noted in “US, Japan reach trade deal; steel tariffs remain,” Japanese steel producers may prioritize domestic and regional sales, potentially limiting export availability and increasing prices in other markets. Diversifying suppliers and securing contracts with producers outside Japan might mitigate price risks.