From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS-India Trade Talks: Tariff Uncertainty and Rashmi Metaliks’ Steady Output Impact Steel Market

India’s steel market faces uncertainty due to ongoing trade negotiations with the US. News articles titled “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US” (published multiple times on 2025-05-21) and “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8” highlight the potential for tariff changes impacting steel trade. While these articles discuss broader trade issues, no direct link to specific changes in activity levels at the observed steel plants can be established, however, the articles do mention “industrial products” in the context of the US seeking concessions.

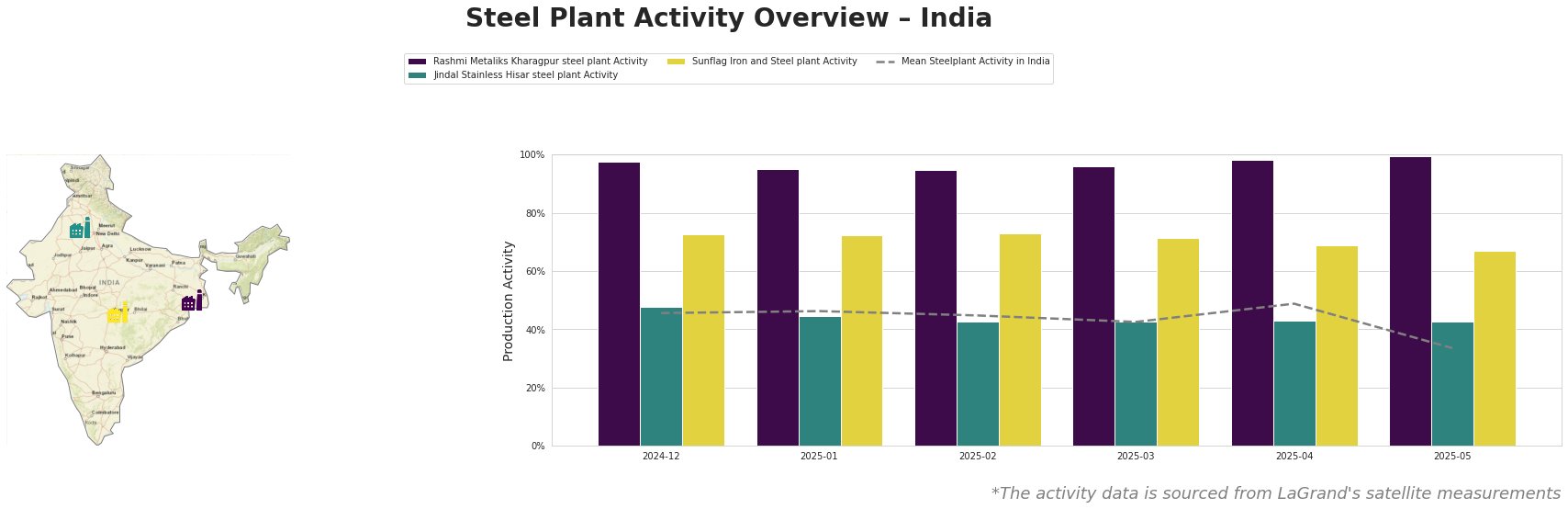

Recent activity trends for selected steel plants in India, observed via satellite, are shown below:

The mean steel plant activity in India saw a significant drop in May 2025 to 34.0, contrasting sharply with the 49.0 recorded in April, and signalling a potential slowdown in production across the sector.

Rashmi Metaliks Kharagpur steel plant: This plant, located in West Bengal, has a crude steel capacity of 1500 ttpa and utilizes both BF and DRI processes. The plant’s activity has remained consistently high, near its peak observed level, ranging from 95.0 to 99.0 over the observed period, significantly exceeding the national average and holding stable even as the national average decreases. This suggests a reliable supply of DRI, pig iron, billets, TMT bars, DI pipes, and wire rod from this plant, regardless of broader market fluctuations. No direct connection to the news articles regarding US-India trade talks can be established based on this data.

Jindal Stainless Hisar steel plant: Located in Haryana, this plant focuses on stainless steel production using EAF technology, with a crude steel capacity of 800 ttpa. The activity level has remained stable at 43.0 since February 2025, lower than the national average in all months observed. No direct correlation can be established between the plant’s activity and the news articles concerning US-India trade negotiations.

Sunflag Iron and Steel plant: This plant in Maharashtra has a crude steel capacity of 500 ttpa, employing both BF and DRI processes. Its activity has shown a gradual decline, decreasing from 73.0 in February 2025 to 67.0 in May 2025. This decline follows the trend of the national average decline, although less severe, and may reflect broader market conditions. No direct connection to the news articles regarding US-India trade talks can be established based on this data.

Evaluated Market Implications:

The continued high activity at Rashmi Metaliks, in contrast to a declining national average, suggests a potential shift in market share towards this plant.

Procurement Actions:

- Steel Buyers: Given the uncertainty surrounding potential US tariffs, steel buyers should consider prioritizing procurement from Rashmi Metaliks to secure supply, given its consistent high production levels.

- Market Analysts: Closely monitor the progress of US-India trade negotiations, focusing on announcements related to tariffs on “industrial products”. Track the mean steel plant activity closely for signs of further decline. This will provide insights into the overall health of the Indian steel sector.