From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS-China Trade Deal Optimism Fuels Asian Steel Production Surge, But October Slowdown Looms

Asia’s steel market exhibits a positive sentiment driven by hopes of a US-China trade resolution. This optimism, fueled by news such as “US, China Tee Up Sweeping Trade Deal For Trump, Xi To Finish” and “Treffen in Malaysia: Zölle, Tiktok: Vorläufige Einigung zwischen USA und China“, has encouraged increased steel production activity. However, recent data reveals a significant decrease in October activity, requiring careful analysis of its lasting impact.

The market anticipates further developments following reports like “Weißes Haus: Treffen von Trump und Xi in der kommenden Woche,” although no direct correlation to observed activity changes can be established at this point. The “Marktbericht: Was den DAX in dieser Woche bewegt“ indicates broader market gains due to trade hopes, potentially impacting steel demand indirectly.

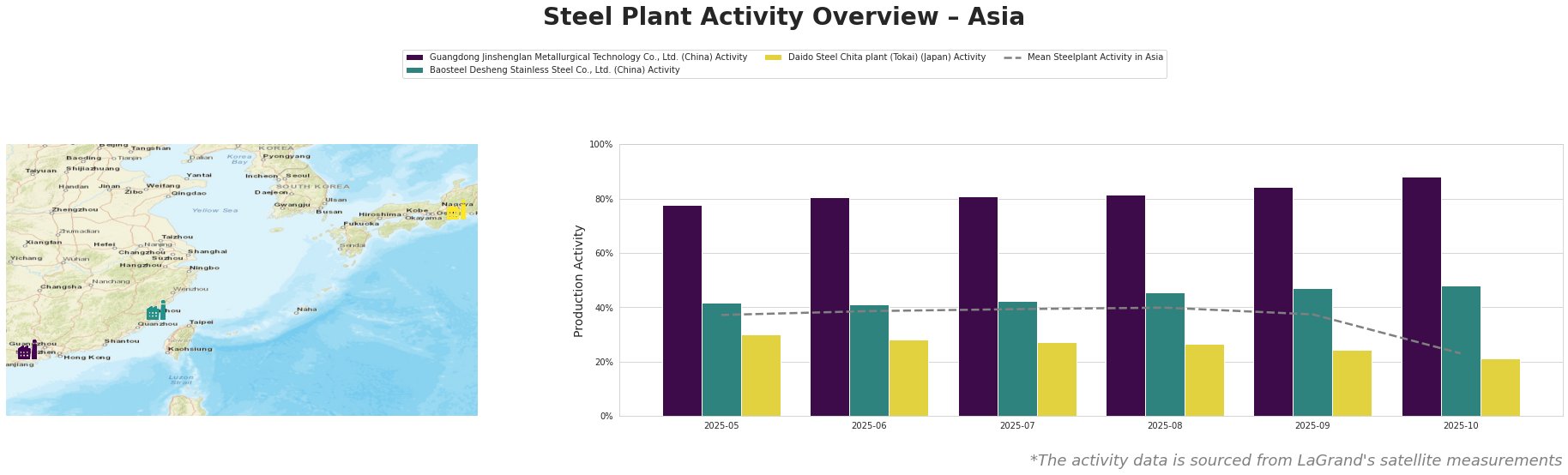

From May to September 2025, the mean steel plant activity in Asia showed a slight upward trend, peaking at 40.0% in August before declining to 23.0% in October. Guangdong Jinshenglan Metallurgical Technology Co., Ltd. consistently operated at significantly higher activity levels than the Asian mean, increasing from 78.0% in May to 88.0% in October. Baosteel Desheng Stainless Steel Co., Ltd.’s activity also remained consistently above the mean, increasing from 42.0% in May to 48.0% in October. Daido Steel Chita plant consistently showed activity below the mean, with a declining trend from 30.0% in May to 21.0% in October. The significant drop in the overall mean activity in October, despite the increasing production from Guangdong Jinshenglan Metallurgical Technology Co., Ltd. and Baosteel Desheng Stainless Steel Co., Ltd., indicates a potential supply issue from other, unlisted plants in Asia.

Guangdong Jinshenglan Metallurgical Technology Co., Ltd., an electric arc furnace (EAF) based steel plant with a capacity of 1.2 million tonnes producing special steel, has shown continuous production increases, reaching 88% in October, despite the overall market slowdown. This suggests that this plant may be capitalizing on favorable market conditions, potentially linked to demand for its specific products. No direct link to the named news articles can be established.

Baosteel Desheng Stainless Steel Co., Ltd., an integrated steel plant with a 3.41 million tonne capacity focused on stainless steel, shows consistent increases in activity, reaching 48% in October. The facility leverages basic oxygen furnace (BOF) technology and has ResponsibleSteel certification, positioning it favorably in environmentally conscious markets. No direct connection to the news articles can be established.

Daido Steel Chita plant, with a 1.5 million tonne EAF capacity, shows a consistent downward trend in production, hitting a low of 21% in October. While it produces various products including stainless steel and tool steel, its decreasing activity doesn’t align directly with the positive sentiments expressed in the news articles regarding the US-China trade deal, suggesting localized factors may be impacting production.

The potential resolution of the US-China trade dispute, highlighted in “US, China Tee Up Sweeping Trade Deal For Trump, Xi To Finish,” initially suggested a positive outlook for steel demand. However, the significant drop in the mean steel plant activity in Asia in October, especially considering the production increase of Guangdong Jinshenglan Metallurgical Technology Co., Ltd and Baosteel Desheng Stainless Steel Co., Ltd, indicates supply disruptions from other plants. The news article “Zölle und Tiktok: Offenbar Annäherung zwischen China und den USA“ indicates that China could be lifting soybean boycotts. The decrease in plant activity shows that other factors could be influencing production.

Recommended Procurement Actions:

- Steel Buyers: Given the drop in mean production activity in Asia, diversify steel sourcing to mitigate potential supply disruptions and price volatility. Focus on regions and plants unaffected by the slowdown. Closely monitor the long-term implications of the US-China trade deal, because the recent decrease in activity could influence trade dynamics.

- Market Analysts: Investigate the specific reasons for the October activity drop in other Asian steel plants to determine the impact on regional supply chains. Assess whether the US-China trade deal’s positive sentiment translates into tangible production increases across the broader Asian steel market in the coming months.