Understanding Monthly Steel Price Volatility: Insights from 14 Years of Data

Steel prices are highly volatile, and this volatility has a significant impact on procurement strategies and financial decisions. Our latest analysis, using 14 years of steel rebar price data, reveals that monthly steel prices undergo an average change of approximately 6%. This finding underscores the critical need for informed decision-making in the steel market.

How Was the Analysis Conducted?

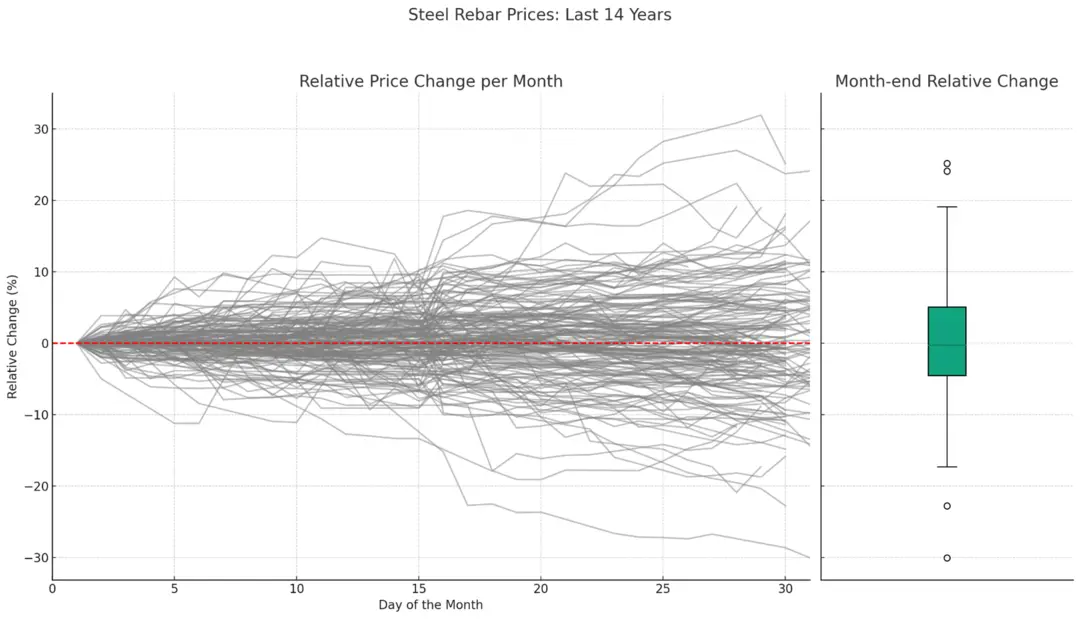

To understand price fluctuations, we segmented 14 years of steel rebar prices into monthly intervals. Each month’s prices were normalized to start at 0%, representing no change. The relative price changes were then tracked throughout the month. By overlaying the data from all months, we visualized the recurring patterns of price movements in the graph above.

- Line Chart Interpretation: The spaghetti-like lines show the relative price changes for individual months. The red dashed line represents no change (0%). The graph illustrates how prices often rise or fall significantly within a month.

- Box Plot Insight: The adjacent box plot summarizes the distribution of month-end price changes. It highlights that while the median price change is slightly below 0%, a typical monthly fluctuation is around +6%. This variability demonstrates how unpredictable monthly price movements can be.

Key Findings

- Average Price Change: Steel prices fluctuate by approximately 6% in a typical month, both upwards and downwards.

- Median Trend: The slight negative median suggests that prices tend to end slightly lower, on average, over long periods.

- Strategic Implications: Without an informed trading or purchasing strategy, buyers often experience neutral or slightly negative outcomes. For instance, locking in prices at the wrong time could result in overpaying by 6% or saving 6% inconsistently.

Why This Analysis Matters

For procurement managers, finance institutions, and steel traders, the stakes are high. Relying on gut feelings or outdated reports to navigate such volatile markets can lead to suboptimal outcomes. The data suggests that:

- Strategic Timing: Knowing when to purchase or settle payments (early vs. late in the month) can significantly impact financial performance.

- Informed Decision-Making: Predictive tools and insights into upcoming price trends are invaluable for positioning effectively in the market.

Conclusion

Steel price volatility is not just a challenge — it’s an opportunity for those equipped with the right data and tools. Our analysis underscores the importance of anticipating price changes to maximize profits or reduce costs. Whether you’re a procurement manager or a financial institution, leveraging monthly price trends can transform uncertainty into strategic advantage.