From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel: Zaporizhstal Ramps Up Output Amidst Overall Production Concerns

Ukraine’s steel sector presents a mixed outlook, with some mills increasing production while others face challenges. News articles such as “Ukraine’s Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025” highlight positive developments at specific plants. However, conflicting data regarding overall output and concerns raised in “Ukraine produced 3.62 million tons of rolled steel in January-July” and “Metinvest” reduced steel output by 13%” suggest potential volatility. Direct links between these articles and the satellite observed plant activities are not explicitly established, and must be considered carefully when making decisions.

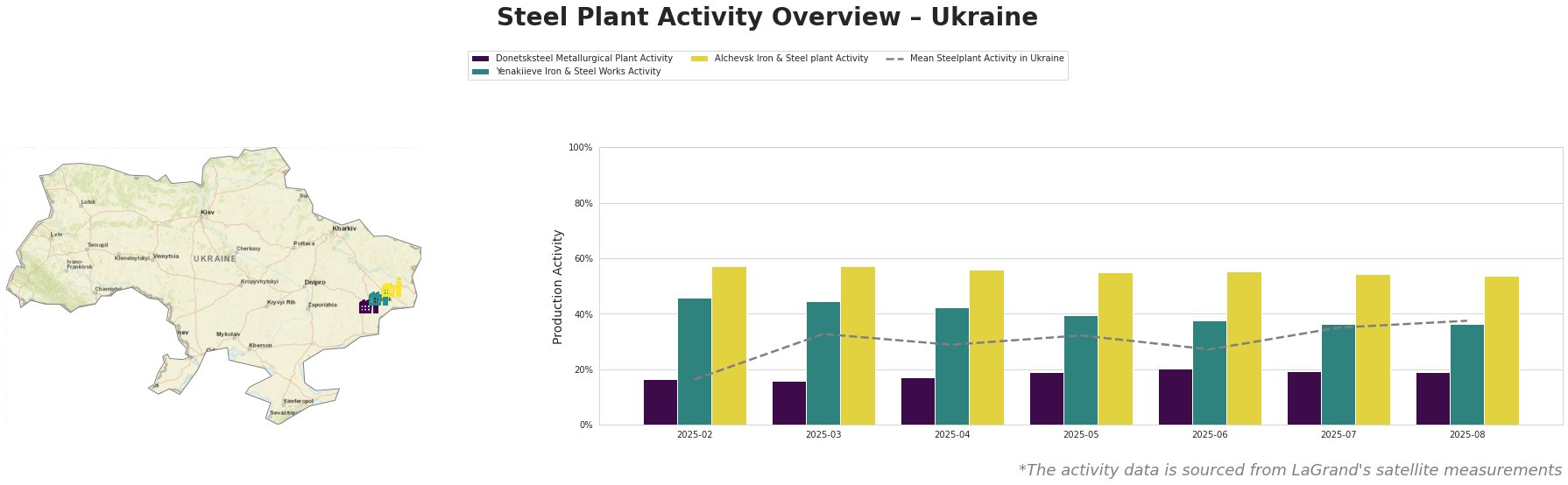

The mean steel plant activity in Ukraine has shown an upward trend, rising from 16.0% in February to 38.0% in August. Donetsksteel Metallurgical Plant consistently demonstrates activity levels significantly below the national average, remaining stable at around 16-20%. Yenakiieve Iron & Steel Works shows considerably higher activity than Donetsksteel, but experiences a steady decline from 46% in February to 36% in August. Alchevsk Iron & Steel plant maintains the highest activity level of the observed plants, with a gradual decrease from 57% in February to 54% in August. No direct connection can be established between these activity level changes and the news articles provided.

Donetsksteel Metallurgical Plant, located in the Donetsk region, primarily produces pig iron using integrated (BF) processes. The plant is equipped with blast furnaces and an EAF, though the EAF is reportedly mothballed. Satellite data reveals its activity remains consistently low (around 16-20%), far below the national average. There is no explicit link in the provided news to explain these low activity levels at Donetsksteel.

Yenakiieve Iron & Steel Works, also in the Donetsk region, is an integrated steel plant with a crude steel capacity of 3.3 million tons, focusing on semi-finished and finished rolled products like rebar and wire rods. The satellite-observed activity at Yenakiieve has declined steadily from 46% in February to 36% in August. While the news article “Metinvest” reduced steel output by 13%” reports an overall decrease in Metinvest’s steel production, Yenakiieve’s specific contribution to this decline and its relationship to the satellite data is not explicitly stated.

Alchevsk Iron & Steel plant, situated in the Luhansk region, is an integrated steel plant with a significant crude steel capacity of 5.472 million tons, producing slabs, square billets, and structural shapes. Alchevsk consistently shows the highest activity of all observed plants, though it has experienced a gradual decrease from 57% in February to 54% in August. No direct connection can be established between this moderate decline and the provided news articles.

Given the reported overall decline in rolled steel production (“Ukraine produced 3.62 million tons of rolled steel in January-July”) alongside the decrease in activity at Yenakiieve and Alchevsk, potential supply disruptions for rebar, wire rods, slabs, square billets, and structural shapes could occur. However, the reported increase in Zaporizhstal’s production (“Ukraine’s Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025”) may partially offset these disruptions. Steel buyers should closely monitor inventory levels and consider diversifying their supplier base to mitigate potential risks. Given that Metinvest has reduced output overall (“Metinvest” reduced steel output by 13%) analysts are urged to check their specific supply chain exposure to Metinvest plants. Procurement strategies should be prepared to adapt swiftly to fluctuating production levels and regional disruptions.