From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Sector Shows Resilience Amidst EU Funding Debates: Kametstal Activity Bucking Downtrend

The Ukrainian steel sector demonstrates resilience amidst ongoing EU funding debates for Kyiv, although the lack of consensus may introduce future uncertainties. Recent monthly activity trends, coupled with EU summit discussions, paint a nuanced picture. “EU-Staaten zerstreiten sich über Ukraine-Finanzierung” and “Gipfel in Brüssel: EU-Staaten zerstreiten sich über Ukraine-Finanzierung” highlight the challenges in securing financial aid, potentially impacting long-term stability. While a direct link to immediate plant activity is not explicitly established, the uncertain financial landscape could affect future investment and operational capabilities.

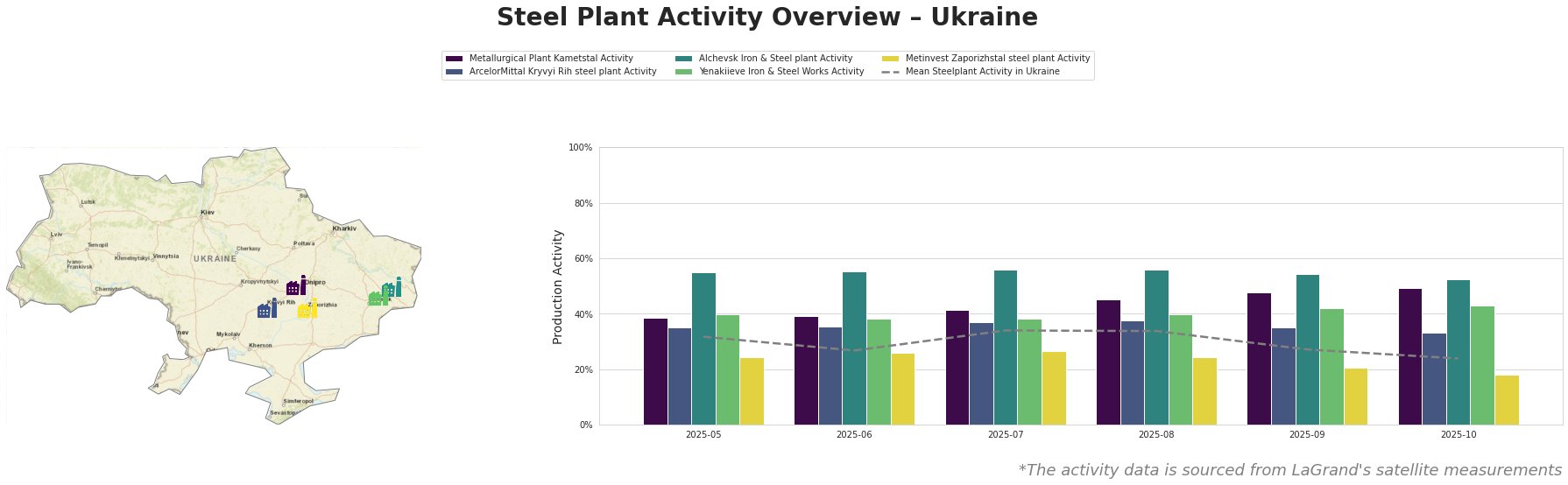

Overall, the mean steel plant activity in Ukraine shows a declining trend from 32% in May to 24% in October. Metallurgical Plant Kametstal bucks this trend, increasing from 39% in May to 49% in October. Alchevsk Iron & Steel plant activity showed relative stability, with a slight decline. Activity at ArcelorMittal Kryvyi Rih, Yenakiieve Iron & Steel Works, and Metinvest Zaporizhstal steel plant declined over the same period.

Metallurgical Plant Kametstal, located in Dnipropetrovsk and primarily utilizing basic oxygen furnace (BOF) technology with a crude steel capacity of 4.2 million tonnes, demonstrates increasing activity. The plant’s activity rose steadily from 39% in May to 49% in October, bucking the overall downtrend in Ukrainian steel production. This increase occurs against the backdrop of EU funding debates as reported in “EU-Staaten zerstreiten sich über Ukraine-Finanzierung,” yet no direct causal link can be established. The plant’s focus on semi-finished and finished rolled products, serving the energy and transport sectors, may contribute to its relative resilience.

ArcelorMittal Kryvyi Rih steel plant, also in Dnipropetrovsk, is a large integrated steel plant with a crude steel capacity of 8 million tonnes, utilizing BOF and open hearth furnace (OHF) technologies. Its activity has decreased slightly from 35% in May to 33% in October, remaining above the mean value. The news articles regarding EU funding discussions (“EU-Staaten zerstreiten sich über Ukraine-Finanzierung”) don’t provide a direct explanation for this decline, but the general uncertainty may be a contributing factor. The plant’s diverse product range, including billets, rebar, and wire rod, caters to the building and infrastructure sectors.

Alchevsk Iron & Steel plant, located in Luhansk, operates with BOF technology and has a crude steel capacity of 5.472 million tonnes. Its activity has remained relatively stable, decreasing from 55% in May to 52% in October. The provided news articles do not offer specific insights into the Alchevsk plant’s operations, and no direct connection can be established.

Yenakiieve Iron & Steel Works, situated in Donetsk, uses BOF technology and has a crude steel capacity of 3.3 million tonnes. The plant’s activity has seen a slight increase from 40% in May to 43% in October. The news articles regarding EU funding discussions (“EU-Staaten zerstreiten sich über Ukraine-Finanzierung”) don’t provide a direct explanation for this increase, and no direct connection can be established.

Metinvest Zaporizhstal steel plant, located in Zaporizhzhia, primarily uses open hearth furnace (OHF) technology with a crude steel capacity of 4.1 million tonnes. Its activity has steadily decreased from 24% in May to 18% in October, consistently remaining below the mean activity for Ukraine. The news articles regarding EU funding discussions (“EU-Staaten zerstreiten sich über Ukraine-Finanzierung”) don’t provide a direct explanation for this decline, and no direct connection can be established. The plant’s focus on finished rolled products, serving the automotive and steel packaging sectors, does not appear to insulate it from the overall downward trend.

Considering the EU’s uncertain funding commitment highlighted in “EU-Staaten zerstreiten sich über Ukraine-Finanzierung,” and the overall downward trend in steel plant activity, steel buyers should:

- Monitor Kametstal closely: Given its increasing activity, explore potential supply opportunities from this plant, but verify its capacity to meet increased demand.

- Assess ArcelorMittal Kryvyi Rih Risks: While currently operating, the slight decrease in activity warrants a supply chain risk assessment. Consider diversifying suppliers for products sourced from this plant to mitigate potential disruptions.

- Stay Informed: Closely follow EU policy developments related to Ukraine’s financial support. Any positive breakthroughs could stabilize the steel sector and impact production strategies.

The lack of consensus on financial aid for Ukraine introduces uncertainty into the steel market, requiring buyers to adopt a proactive risk management approach.