From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Sector Shows Mixed Signals: Pig Iron Gains Offset Rolled Steel and Steel Production Declines

Ukraine’s steel sector presents a complex picture, with pig iron production increasing while steel and rolled steel output decreases, according to the news articles “Ukraine produced 3.62 million tons of rolled steel in January-July” and “steel production in Ukraine dropped by 7 in 7 months%“. Metinvest’s decreased production volume as reported in “Metinvest” reduced steel output by 13%” does not appear to show any direct relation to the observed satellite activity data, because mean steel plant activity remained stable at 38% between July and August 2025.

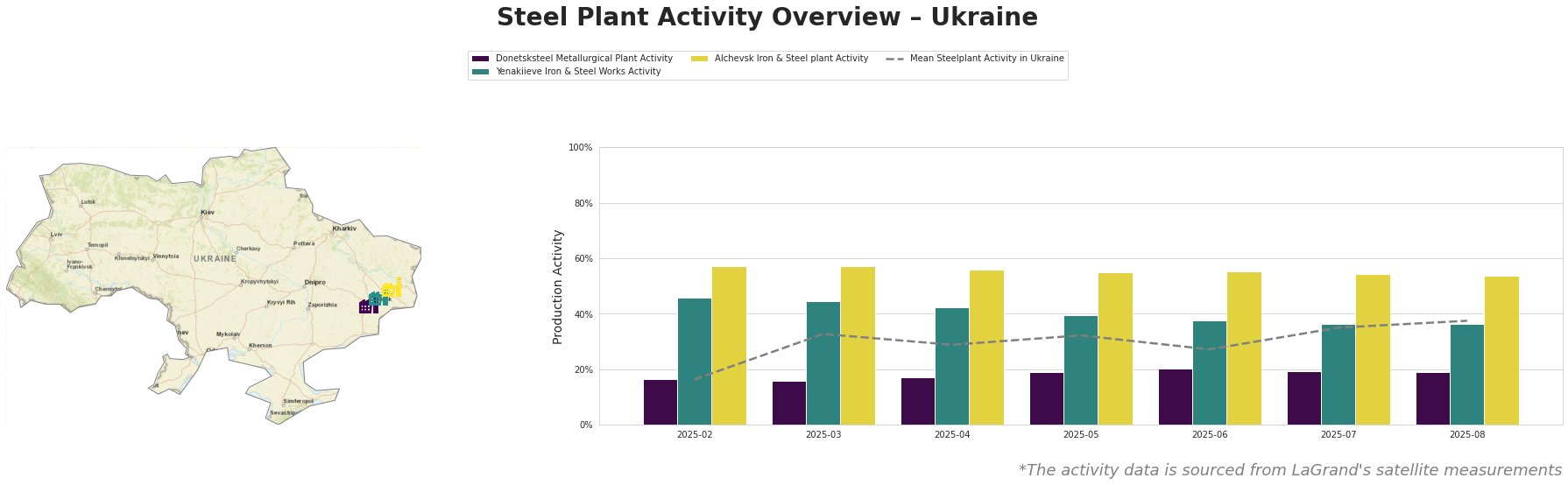

Monthly aggregated activities in % (0% = lowest ever measured, 100% = all time high):

Overall, the mean steel plant activity in Ukraine has been trending upwards since February 2025, reaching 38% in August 2025. Donetsksteel Metallurgical Plant activity remained relatively stable at around 16-20% throughout the observed period. Yenakiieve Iron & Steel Works saw a decline in activity from 46% in February to 36% in August 2025. Alchevsk Iron & Steel plant also experienced a gradual decrease, from 57% in February to 54% in August 2025. Both Yenakiieve and Alchevsk plants consistently operated above the mean Ukrainian steel plant activity level.

Donetsksteel Metallurgical Plant, located in Donetsk, primarily produces pig iron using integrated (BF) processes. Its capacity includes a BF with 1500 ttpa Iron production. The satellite data shows relatively stable, low-level activity at around 16-20% throughout the observed months. There is no apparent link between this stable activity and the news articles.

Yenakiieve Iron & Steel Works, also located in Donetsk, is an integrated (BF) steel plant with a crude steel capacity of 3300 ttpa (BOF) and iron production capacity of 2600 ttpa. It produces semi-finished and finished rolled products, including rebar and structural shapes. Activity has decreased steadily from 46% in February to 36% in August 2025. Despite the production decline reported in the news articles, the satellite data shows an almost consistent slow decline. There is no apparent direct link between the magnitude of production decreases reported in the news articles and the satellite-observed slow decline.

Alchevsk Iron & Steel plant, located in Luhansk, is an integrated (BF) steel plant with a crude steel capacity of 5472 ttpa (BOF) and iron production capacity of 5320 ttpa. Its product portfolio includes slabs, square billets, and structural shapes. The plant’s activity has gradually decreased from 57% in February to 54% in August 2025. There is no apparent link between this plant’s activity trend and the news articles.

The news articles indicate a complex steel market. While pig iron production shows growth, steel and rolled steel production are decreasing. Metinvest’s reduced output, combined with satellite observations, suggests possible localized supply constraints, particularly in the regions served by Yenakiieve Iron & Steel Works.

Procurement Recommendation: Steel buyers should diversify their sourcing strategies to mitigate potential supply disruptions, focusing on regions and producers less affected by the observed declines in production and activity. Given the reported increase in pig iron production, explore opportunities to leverage this availability in steelmaking processes, where feasible. While the news articles mention challenging market conditions in 2025 and potential export declines, carefully monitor price trends and consider forward purchasing to secure favorable rates, especially for rolled steel products where production is declining.