From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Production Shows Mixed Signals Amidst Export Challenges

Ukraine’s steel industry presents a complex picture, with increased rolled steel production reported alongside declining iron ore exports. According to “Ukraine produced 4.8 million tons of rolled steel in January-September,” rolled steel production saw a slight increase, while “Ukraine reduced iron ore exports by 4.4% y/y in January-September” highlights export challenges. Ferrexpo’s increased output, as noted in “Ferrexpo increased output by 0.9% y/y in January-September,” does not appear to be directly correlated to changes in overall plant activity observed via satellite.

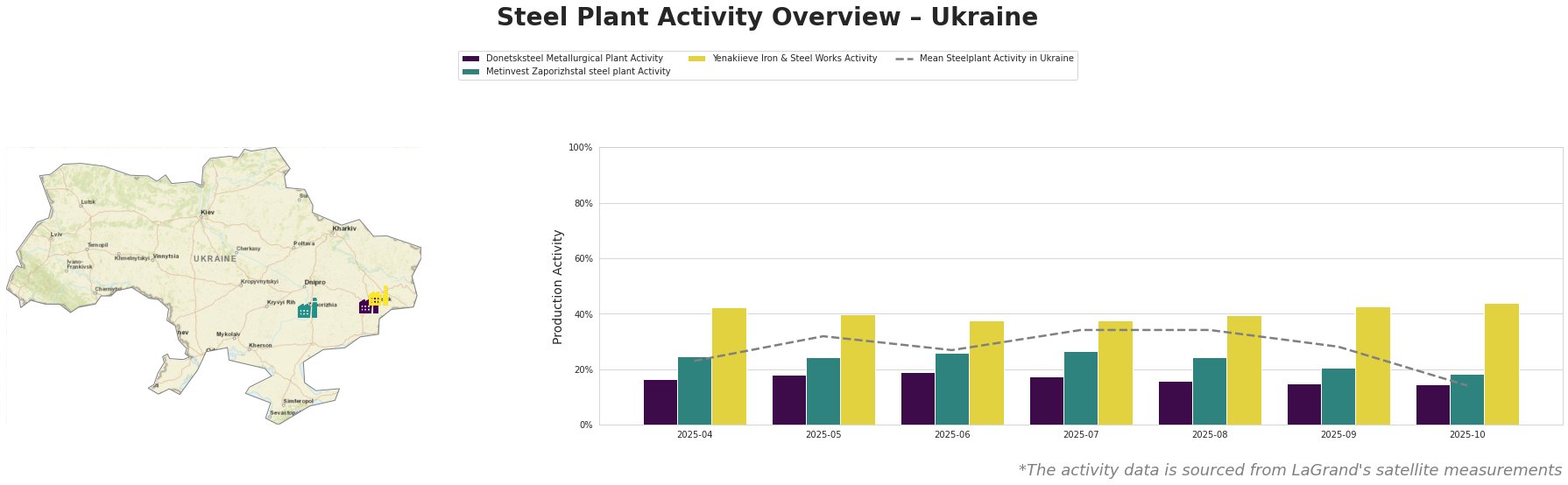

The mean steel plant activity in Ukraine fluctuated throughout the period, peaking in July and August at 34% before experiencing a significant drop to 14% in October. Donetsksteel Metallurgical Plant showed a relatively stable, consistently below-average activity, declining to its lowest point of 15% in September and October. Metinvest Zaporizhstal steel plant activity also decreased over the period, ending at 18% in October. Yenakiieve Iron & Steel Works showed the most consistent activity and ended at its highest level in October at 44%. The sharp drop in average activity across all plants in October does not directly correlate with any information explicitly provided in the referenced news articles.

Donetsksteel Metallurgical Plant

Donetsksteel Metallurgical Plant, an integrated (BF) steel plant located in Donetsk with a BF iron capacity of 1500 ttpa, has shown consistently low activity levels compared to the Ukrainian average. The satellite data indicates a gradual decline in activity throughout the observed period, reaching 15% in September and October. While “Ukraine produced 4.8 million tons of rolled steel in January-September” indicates a general increase in rolled steel production, the sustained low activity at Donetsksteel suggests potential operational constraints specific to this plant, but no direct relationship can be established based on the provided news.

Metinvest Zaporizhstal steel plant

Metinvest Zaporizhstal, a major integrated (BF) steel plant located in Zaporizhzhia, is capable of producing 4100 ttpa of crude steel using older OHF technology. It primarily focuses on finished rolled products for the automotive and packaging sectors. Satellite data shows a decreasing trend in activity from 25% in April to 18% in October. Despite “Ukraine produced 4.8 million tons of rolled steel in January-September” reporting increased rolled steel production, the observed decrease in activity might reflect a strategic shift in production focus or operational adjustments at this specific plant; however, no direct connection to the provided news can be explicitly established.

Yenakiieve Iron & Steel Works

Yenakiieve Iron & Steel Works, an integrated (BF) steel plant in Donetsk with a crude steel capacity of 3300 ttpa, utilizes BOF technology to produce semi-finished and finished rolled products like rebar and channels. The plant’s activity remained relatively stable throughout the observed period, peaking at 44% in October. This suggests a degree of operational resilience. “Ukraine produced 4.8 million tons of rolled steel in January-September” indicated a general increase in rolled steel production in Ukraine and the satellite observations indicate strong individual plant activity, but no direct cause and effect relationship can be explicitly established.

Given the decline in iron ore exports reported in “Ukraine reduced iron ore exports by 4.4% y/y in January-September,” coupled with the observed drop in average steel plant activity in October, steel buyers should:

- Prioritize securing supply contracts with Yenakiieve Iron & Steel Works. Satellite data suggests relative operational stability and output (44% activity in October), making it a potentially reliable source for rebar and channels.

- Closely monitor Metinvest Zaporizhstal’s production. While the plant’s activity has decreased, it’s a key supplier of hot-rolled and cold-rolled sheets for automotive and packaging. Diversifying supply sources for these products is advisable.

- Consider Ferrexpo’s shift towards high-grade concentrate production. “Ferrexpo increased output by 0.9% y/y in January-September” reports this shift; buyers needing high-grade iron ore concentrates should explore Ferrexpo as a potential supplier.