From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Production Mixed; Pig Iron Exports Drop, Flat Steel Rises Amidst Fluctuating Plant Activity in Europe

Ukraine’s steel sector presents a mixed outlook, influencing European steel dynamics. Recent increases in pig iron and flat steel production contrast with decreased iron ore and pig iron exports. According to “Ukraine reports 8.1 percent rise in pig iron output for Jan-Apr,” pig iron production increased, while “Ukraine’s flat steel exports up 4.1 percent in Jan-Apr” indicates a rise in flat steel exports, although semi-finished steel exports fell. However, no direct relationship can be established between these news items and observed European plant activity based on the provided data. The satellite data shows large negative shifts in steel plant activities that are attributed to erroneous data (negative activity is not physically possible).

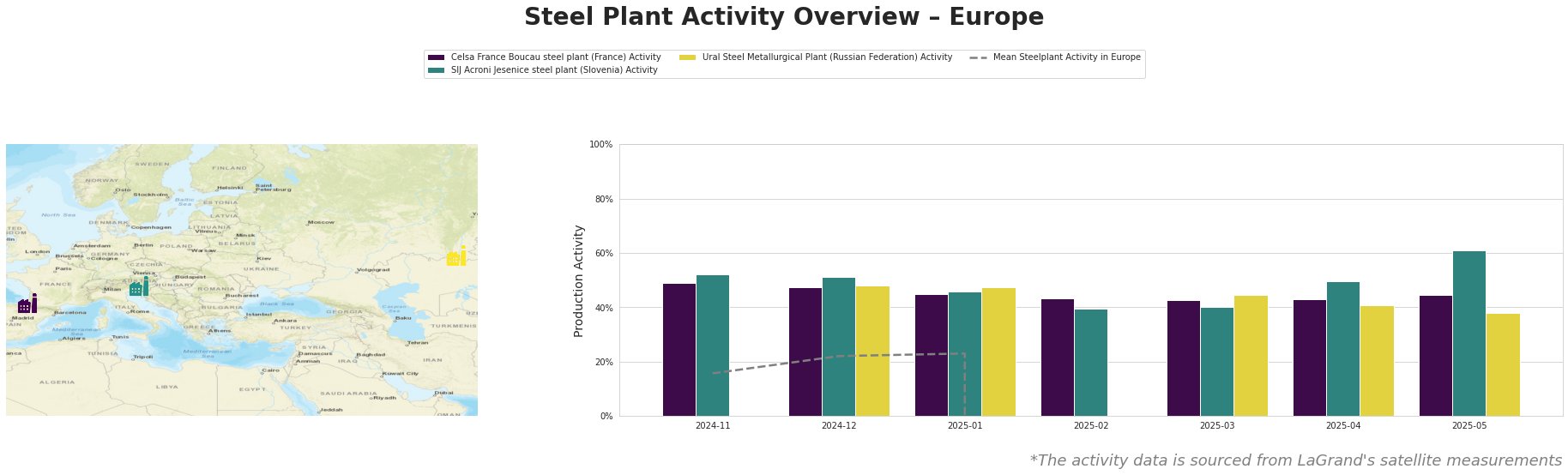

The mean steel plant activity in Europe shows erroneous values from February 2025 onwards, making trend analysis impossible. Celsa France Boucau steel plant activity remained relatively stable from November 2024 to May 2025, hovering around the 43-49% range. SIJ Acroni Jesenice steel plant activity showed more fluctuation, with a low of 39% in February 2025 and a peak of 61% in May 2025. Ural Steel Metallurgical Plant activity gradually declined from 48% in December 2024 to 38% in May 2025.

Celsa France Boucau, an EAF-based plant with a 1.2 million tonne crude steel capacity, primarily produces semi-finished and finished rolled products for the automotive, building, energy, and transport sectors. The plant’s activity remained stable between November 2024 and May 2025. No direct connection can be established between this stable activity and the provided news articles.

SIJ Acroni Jesenice, an EAF-based plant with a 726,000 tonne crude steel capacity, focuses on flat-rolled products for the building and infrastructure and tools and machinery sectors. Its activity increased to 61% in May 2025. No direct connection can be established between this increased activity and the provided news articles.

Ural Steel Metallurgical Plant, with a 2.7 million tonne iron and 1.6 million tonne crude steel capacity, utilizes integrated BF and EAF processes to produce pig iron, billets, and flat products for the building and transport sectors. The plant’s activity gradually declined to 38% in May 2025. No direct connection can be established between this decreased activity and the provided news articles.

The news articles “Ukraine reduced iron ore exports by 10% y/y in January-April,” “Ukraine has reduced iron ore exports by 10 in 4 months%,” and “Ukraine reduced pig iron exports by 60% m/m in April” highlight potential disruptions in the supply of raw materials and pig iron from Ukraine, particularly impacting regions that heavily rely on Ukrainian exports, such as the US, which saw a significant decrease in pig iron imports from Ukraine in April 2025. However, the EU remains the largest market for Ukraine’s steel exports, representing 79.7% of shipments according to “Metallurgists of Ukraine exported 1.23 million tons of rolled metal in 4 months“, mitigating some supply risks within Europe.

Given the decline in Ukrainian pig iron exports and the shift in export destinations as highlighted in “Ukraine reduced pig iron exports by 60% m/m in April“, steel buyers should:

- Diversify Pig Iron Sourcing: Explore alternative pig iron suppliers outside of Ukraine to mitigate risks associated with decreased Ukrainian export volumes.

- Monitor US Pig Iron Prices: Given the significant decrease in US imports of Ukrainian pig iron, monitor pig iron price fluctuations in the US market closely, as this could influence global pricing.

- Evaluate Flat Steel Availability: Given the increase in flat steel exports from Ukraine per “Ukraine’s flat steel exports up 4.1 percent in Jan-Apr,” assess the availability of flat steel from Ukrainian producers and factor this into procurement strategies.