From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Market Surges: Exports Up Across Multiple Product Categories Amidst Scrap Export Concerns

Ukraine’s steel sector demonstrates robust growth in exports, as highlighted in the following news: “Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April,” “Ukraine increased exports of flat products to 554 thousand tons in January-April,” “Pig iron exports from Ukraine increased by 37% in 4 months,” and “Ukraine increase exports of long products by 26% y/y in January-April.” These export increases occur alongside surging ferrous scrap exports, detailed in “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increased exports of ferrous scrap by 95% year-on-year,” raising concerns about domestic supply and prompting proposed export restrictions. Satellite data shows fluctuations in plant activity, but no direct correlation to these overall export trends can be explicitly established from the news provided.

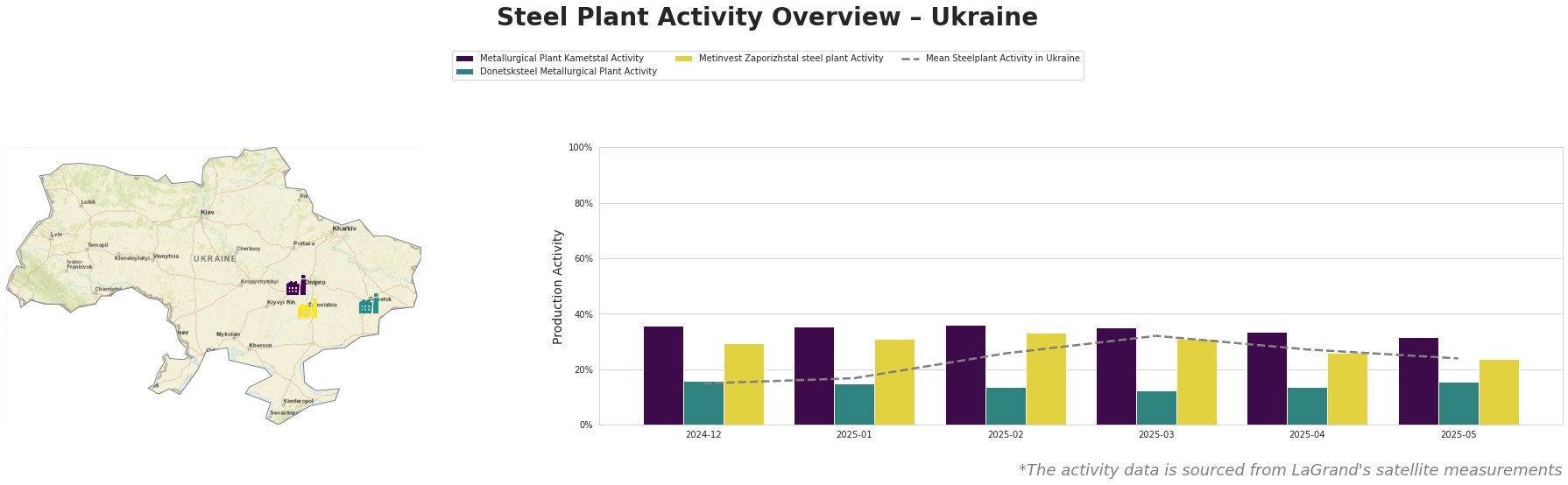

Overall, the mean steel plant activity in Ukraine increased steadily from December 2024 (15%) to March 2025 (32%) before declining to 24% by May 2025.

Metallurgical Plant Kametstal, an integrated BF-BOF producer in Dnipropetrovsk with a crude steel capacity of 4.2 million tonnes, showed a stable activity level around 35-36% between December 2024 and February 2025, then a slow decline to 32% by May 2025. This decline does not directly correlate with any specific news article provided, although the general rise in exports may suggest capacity constraints. Kametstal produces semi-finished and finished rolled products, including square billets, wire rods, and rails, primarily for the energy and transport sectors.

Donetsksteel Metallurgical Plant, located in Donetsk, has a blast furnace with a capacity of 1.5 million tonnes of iron. Its activity fluctuated slightly, with a drop to 12% in March 2025. Activity increased to 16% in May 2025. This plant focuses on pig iron production, with equipment including dismantled or mothballed BOF and EAF. No direct link between the plant’s activity and the news articles can be established.

Metinvest Zaporizhstal steel plant in Zaporizhzhia, another integrated BF-OHF producer with a crude steel capacity of 4.1 million tonnes, mirrored the overall trend, peaking at 33% activity in February 2025 and declining to 24% by May 2025. Its product range includes hot-rolled and cold-rolled sheets and coils for the automotive, steel packaging, and transport industries. The observed activity trends cannot be directly correlated to specific news items about increased exports.

Evaluated Market Implications:

The significant increase in scrap metal exports, as reported in “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increased exports of ferrous scrap by 95% year-on-year“, coupled with proposed export restrictions and licensing regimes, could lead to increased price volatility for steel buyers reliant on EAF steel production within Ukraine. While the activity levels of integrated steel plants like Kametstal and Zaporizhstal do not show an immediate production decline, the potential tightening of scrap supply, and the concurrent rise in long product imports “Ukraine increased imports of long products by 81.1% y/y in January-April“, signals a possible shift in the market.

Recommended Procurement Actions:

- Monitor Scrap Export Policy Changes: Steel buyers should closely track any policy changes regarding scrap metal exports and their potential impact on domestic steel prices, especially those reliant on electric arc furnace (EAF) steel production.

- Diversify Sourcing for Long Products: Given the increase in long product imports, buyers should evaluate and diversify their sourcing options, particularly considering suppliers from Turkey and China, as mentioned in “Ukraine increased imports of long products by 81.1% y/y in January-April.”

- Negotiate Contracts with Pig Iron Suppliers: The rise in pig iron exports, as detailed in “Pig iron exports from Ukraine increased by 37% in 4 months,” primarily to the USA and Italy, suggests strong demand. Buyers should negotiate contracts with pig iron suppliers to secure supply and hedge against potential price increases, especially if scrap availability tightens.