From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Market Poised for Growth: Zaporizhstal Drives Output, Prices Mixed

Ukraine’s steel sector demonstrates a positive outlook, fueled by rising production at key mills even as domestic prices for certain steel products fluctuate. Recent activity at major steel plants correlates with increased output figures, suggesting sustained recovery. “Ukraine’s Zaporizhstal records 9.6% rise in crude steel output in Jan-Sept 2025” directly supports the observation of increased activity at the Metinvest Zaporizhstal steel plant. “Zaporizhсoke increased production to 670,000 tons in January-September” also indicates higher activity in the steel production chain, although no direct relation to satellite data can be established.

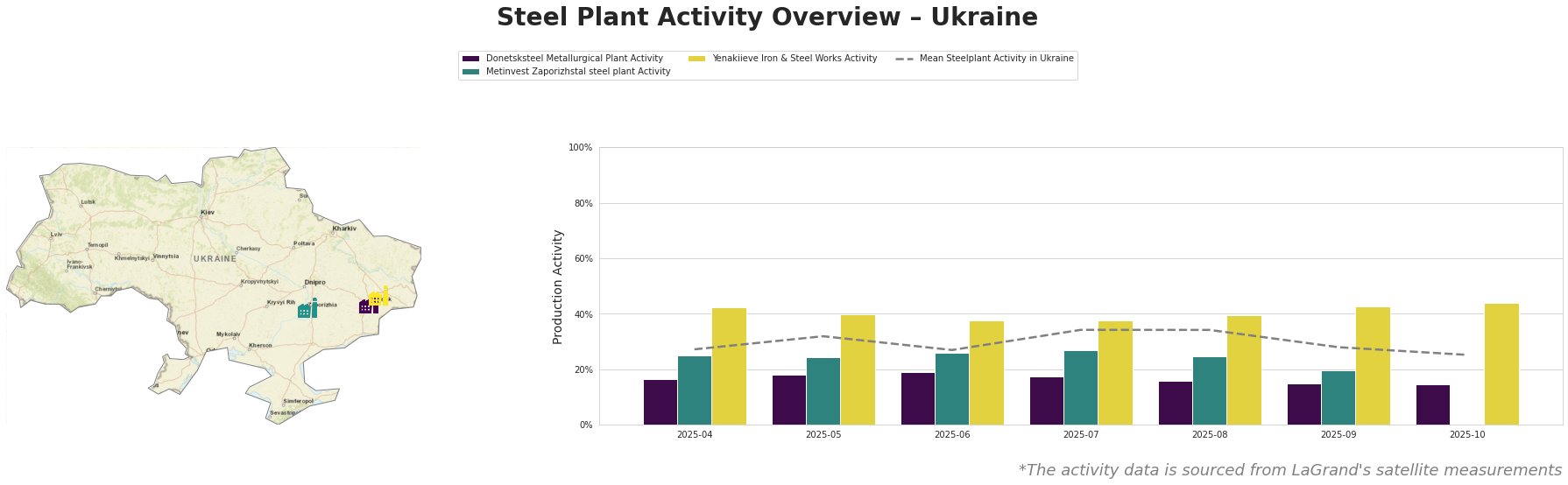

The mean steel plant activity in Ukraine shows fluctuations, peaking at 34% in July and August 2025 before declining to 25% in October. Donetsksteel Metallurgical Plant activity remained consistently low, ranging from 15% to 19%. Metinvest Zaporizhstal steel plant’s activity fluctuated, peaking at 27% in July before falling to 20% in September, aligning with reported production increases in the first nine months. Yenakiieve Iron & Steel Works showed higher activity levels than other plants, reaching 44% in October, though no direct news link can be established.

Donetsksteel Metallurgical Plant, primarily focused on pig iron production via integrated BF processes, exhibits consistently low activity levels (15%-19%) over the observed period. This sustained low activity does not directly correlate with any of the provided news articles; however, the plant’s BF-EAF configuration suggests reliance on external power and raw material sources, making it vulnerable to regional disruptions.

Metinvest Zaporizhstal steel plant, a major Ukrainian producer of finished rolled steel, including hot-rolled coil and sheets, demonstrated fluctuating activity levels throughout the period. The peak activity of 27% in July aligns with the broader production increase reported in “Ukraine’s Zaporizhstal records 9.6% rise in crude steel output in Jan-Sept 2025,” lending credibility to the satellite-observed activity data. The plant’s integrated BF-OHF process underscores its significance in the Ukrainian steel supply chain. The rise in prices for hot-rolled sheets, mentioned in “Prices for channel bars and hot-rolled sheets have risen the most in Ukraine since the beginning of the year,” could be partially attributed to the plant’s key role in their production and the increased demand.

Yenakiieve Iron & Steel Works, producing semi-finished and finished rolled products such as rebar and channels, shows the highest activity levels compared to other plants. Activity increased to 43% in September and further to 44% in October. While no direct news explicitly explains this increase, the plant’s product portfolio aligns with the construction sector, which, as noted in “Prices for channel bars and hot-rolled sheets have risen the most in Ukraine since the beginning of the year,” experienced fluctuating prices due to shifting demand.

The reported rise in hot-rolled sheet prices, coupled with increased production at Zaporizhstal, suggests potential supply pressures in this specific product segment. The stable domestic prices in September, contrasted with the increase for channel bars and hot-rolled sheets as described in “Prices for channel bars and hot-rolled sheets have risen the most in Ukraine since the beginning of the year” highlight the need for steel buyers to carefully monitor inventory levels and secure supply contracts, particularly for hot-rolled sheets. Given the fluctuating prices and the increase in metal traders’ inventories, steel buyers should negotiate pricing with suppliers while closely tracking demand in the construction sector. Procurement professionals should diversify their supplier base, prioritizing mills like Metinvest Zaporizhstal with demonstrated production capacity to mitigate potential disruptions in the hot-rolled sheet market.