From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Exports Surge: Flat & Long Products Lead European Market Growth

Europe’s steel market is showing positive momentum driven by increasing Ukrainian exports. The surge is particularly noticeable in flat and long steel products, as indicated by the news articles “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine increase exports of long products by 26% y/y in January-April“. While these articles highlight export increases, a direct correlation to satellite-observed plant activity in the provided dataset cannot be directly established.

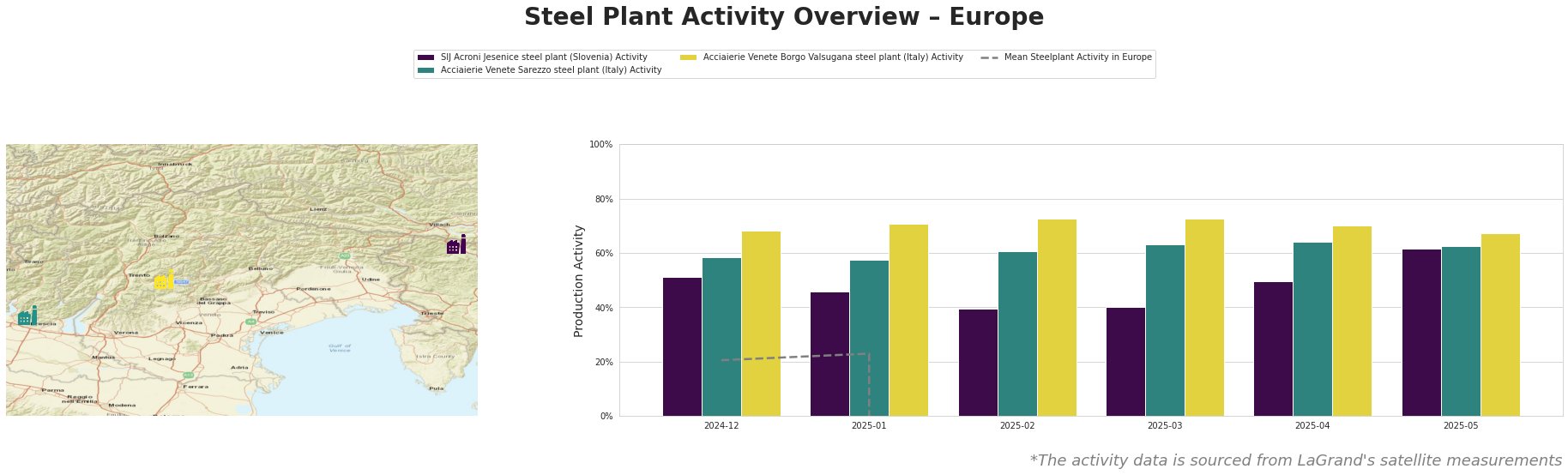

Monthly aggregated activities in % (0% = lowest ever measured, 100% = all time high).

The table reveals significant irregularities in the “Mean Steelplant Activity in Europe” data. The negative values from February 2025 onward render the mean values unusable for meaningful analysis, and therefore no statements about deviations from the mean can be formulated.

The SIJ Acroni Jesenice steel plant in Slovenia, with a 726 thousand ton EAF-based crude steel capacity, focuses on flat rolled steel products. Its activity level shows a fluctuating trend, starting at 51% in December 2024, dropping to 39% by February 2025, and then rising to 62% by May 2025. While Ukraine’s increased flat product exports, as stated in “Ukraine increased exports of flat products to 554 thousand tons in January-April,” might indirectly impact demand for SIJ Acroni’s products, no direct correlation can be established based on the provided information.

The Acciaierie Venete Sarezzo steel plant in Italy, equipped with a 95-tonne EAF and a 540 thousand ton crude steel capacity, produces bars and wire rod. Its activity remained relatively stable, fluctuating between 58% and 64% from December 2024 to May 2025. As “Ukraine increase exports of long products by 26% y/y in January-April” states, Poland and Italy are key consumers. However, there is no direct link to increases or decreases in observed activity, despite Italy being a key export destination for Ukrainian long products.

The Acciaierie Venete Borgo Valsugana steel plant, similar to Sarezzo with a 90-tonne EAF and 600 thousand ton capacity, also produces long products. Its activity remained high, ranging from 67% to 73% during the observed period. Just as in the case of Acciaierie Venete Sarezzo, it is not possible to establish direct connections between this plant’s activity and increased exports of long products from Ukraine to Italy.

Several news articles point to potentially competing market forces: “Ukraine increased scrap metal exports by 45% in 4 months“, “Ukraine increased exports of ferrous scrap by 95% year-on-year“. This activity could put upward pressure on steel prices and input costs for EAF plants, while an import surge of long products into Ukraine is described in “Ukraine increased imports of long products by 81.1% y/y in January-April“.

Given the surge in Ukrainian exports and the potential for domestic market instability due to increased scrap exports coupled with increased imports, steel buyers should:

- Monitor Ukrainian export policies closely. The Ministry of Economy is considering export restrictions on scrap metal, as reported in “Ukraine increased scrap metal exports by 45% in 4 months“. Any implemented quotas could impact scrap availability and pricing in the region.

- Diversify sourcing for long products. With Ukraine increasing imports of long products, particularly from Turkey as highlighted in “Ukraine increased imports of long products by 81.1% y/y in January-April“, European buyers should evaluate Turkish suppliers as alternative sources, acknowledging potential supply chain shifts.

- Closely observe the impact of the high cost and stability of the electricity supply remain significant challenges on steel production costs, as indicated in “Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April“, possibly impacting production costs.