From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Exports Surge Amidst Plant Activity Fluctuations in Europe

Europe’s steel market is experiencing a complex interplay of rising Ukrainian exports and varying plant activity levels. Recent news, including “Ukraine increased exports of flat products to 554 thousand tons in January-April“, “Pig iron exports from Ukraine increased by 37% in 4 months“, and “Ukraine increase exports of long products by 26% y/y in January-April“, highlights a significant increase in Ukrainian steel exports across various product categories. However, satellite-observed activity at selected European steel plants reveals a more nuanced picture, with no immediate correlation identifiable in the provided data to the increased exports from Ukraine.

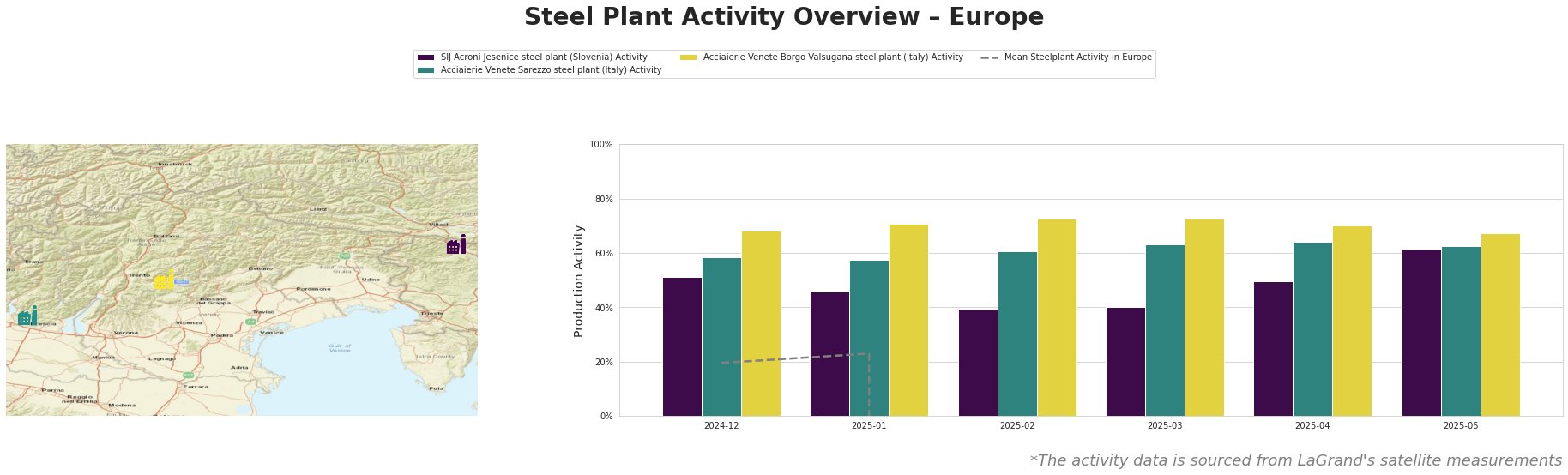

The mean steel plant activity in Europe is showing anomalous negative activity data and hence, is not informative. SIJ Acroni Jesenice steel plant in Slovenia, which uses electric arc furnaces (EAF) to produce 726ktpa of crude steel focused on flat-rolled products, displayed fluctuating activity. Starting at 51% in December 2024, it dipped to 39% by February 2025 but recovered significantly to 62% by May 2025. No direct connection between this increase and the “Ukraine increased exports of flat products to 554 thousand tons in January-April” could be explicitly established, but could indicate a response to increased exports of flat products from Ukraine.

Acciaierie Venete Sarezzo steel plant in Italy, with a 540ktpa EAF capacity producing bars and wire rods, showed relatively stable activity, ranging from 58% to 64% between December 2024 and May 2025. Acciaierie Venete Borgo Valsugana steel plant, also in Italy, producing 600ktpa of bars and wire rods with EAF technology, showed the highest activity levels among the observed plants, consistently above 67%, peaking at 73% in February and March 2025. This stability does not immediately reflect any impact from increased Ukrainian exports of long products as highlighted in “Ukraine increase exports of long products by 26% y/y in January-April“.

Evaluated Market Implications:

The news article “Ukraine increased exports of ferrous scrap by 95% year-on-year” coupled with the information that SIJ Acroni Jesenice uses EAFs could indicate potential raw material shortages.

Procurement Actions:

- Scrap Sourcing: Given the increased ferrous scrap exports from Ukraine and potential export restrictions, steel buyers relying on EAF-based steel production should diversify scrap sourcing strategies, secure long-term contracts with reliable suppliers, and explore alternative raw materials like DRI if feasible. Explicitly monitor scrap price developments in Poland, the primary destination for Ukrainian scrap.

The increased pig iron exports from Ukraine, as reported in “Pig iron exports from Ukraine increased by 37% in 4 months“, primarily to the USA and Italy, suggest an increased supply of this material.

Procurement Actions:

- Pig Iron Procurement: European steel buyers, particularly those with blast furnace operations, should closely monitor pig iron price trends and availability from Ukrainian sources. Evaluate the potential for substituting or supplementing existing pig iron supplies with Ukrainian material, considering transportation costs and quality specifications. Italian steel buyers should evaluate their procurement strategy.

Given the surge in Ukrainian exports of various steel products, as detailed in “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine increase exports of long products by 26% y/y in January-April“, European steel buyers should consider the following:

Procurement Actions:

- Product Diversification: Buyers should evaluate the competitive landscape and identify potential opportunities to source flat and long steel products from Ukrainian suppliers, potentially diversifying their supply base and negotiating favorable pricing terms.

- Negotiation Leverage: Utilize the increased availability of Ukrainian steel to strengthen their negotiating position with existing suppliers. By obtaining quotes from Ukrainian producers, buyers can potentially exert downward pressure on prices and improve contract terms with their current vendors.