From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Exports Surge Amidst Pig Iron Decline: European Market Impact

Europe’s steel market is experiencing a complex dynamic, influenced by shifting export patterns from Ukraine. The activity levels in European steel plants reflect the response to these changes. “Ukraine increased exports of flat products to 554 thousand tons in January-April,” indicating a growing supply of flat steel in the European market. Simultaneously, “Ukraine reduced pig iron exports by 60% m/m in April,” signaling potential constraints in pig iron availability. The following analysis links these trends to observed steel plant activities.

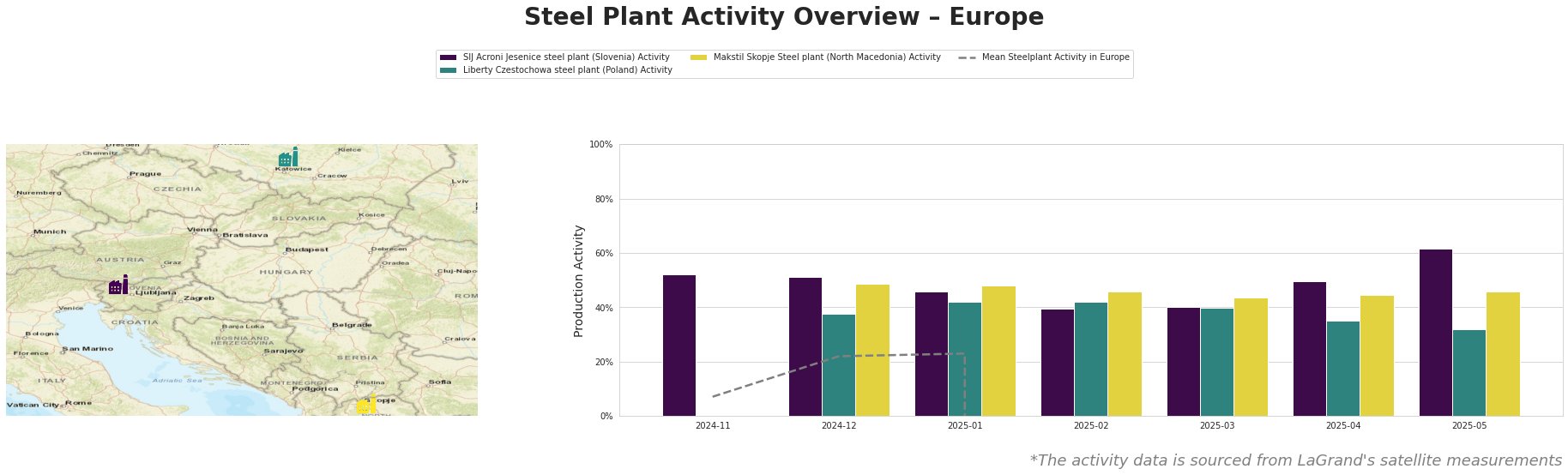

The mean steel plant activity in Europe shows large negative values, which are likely caused by errors in data collection or processing and should be treated as invalid.

SIJ Acroni Jesenice steel plant: This Slovenian plant, relying on EAF technology and producing flat rolled steel products, has consistently operated at high activity levels. From November 2024 (52.0%) to May 2025 (62.0%) it has even increased its capacity utilization. This increase may be related to increased scrap metal exports out of Ukraine, as noted in the news article “Ukraine increased scrap metal exports by 45% in 4 months,” allowing the plant to source cheaper materials.

Liberty Czestochowa steel plant: This Polish plant, also operating EAF, has shown fluctuating activity. From December 2024 (38.0%) to May 2025 (32.0%) its activity has decreased to a certain extend. The observed decrease in activity at Liberty Czestochowa could be connected to the surge in Ukrainian flat steel exports, as reported in “Ukraine increased exports of flat products to 554 thousand tons in January-April”. Poland being a key consumer of flat steel, may have switched to cheaper Ukrainian products.

Makstil Skopje Steel plant: The Makstil Skopje steel plant in North Macedonia, which produces semi-finished products using EAF technology, shows fairly stable activity levels, ranging from 43% to 49% over the observed period. No direct connection to any of the provided news articles could be established.

Evaluated Market Implications:

The increased flat steel exports from Ukraine, as highlighted in “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine’s flat steel exports up 4.1 percent in Jan-Apr,” combined with the reduction in Ukrainian pig iron exports (“Ukraine reduced pig iron exports by 60% m/m in April”), create a complex situation. EAF-based plants in Europe appear to be adjusting to these shifting supply dynamics. Specifically, the increased activity at SIJ Acroni Jesenice steel plant is correlated with the growing availability of Ukrainian scrap metal, while the slight decrease in activity at Liberty Czestochowa could be attributed to competitive pressures from Ukrainian flat steel in the Polish market.

Procurement Actions:

- For flat steel buyers: Given the increased supply of Ukrainian flat steel in the European market, especially in Poland, consider diversifying your supplier base to include Ukrainian producers to potentially leverage cost advantages. Closely monitor quality certifications and delivery timelines from these sources.

- For pig iron buyers: The significant drop in Ukrainian pig iron exports suggests potential price increases and supply constraints. Secure alternative pig iron sources or explore substitutes like DRI (Direct Reduced Iron) to mitigate risks. Consider longer-term supply contracts to stabilize pricing in the face of Ukrainian export volatility.

- For analysts: The shift in Ukrainian steel exports demonstrates the need for continuous monitoring of geopolitical and economic factors impacting raw material flows and finished steel product availability. Tracking of scrap metal prices and flat steel pricing in key consumer markets such as Poland is essential to identify emerging trends and potential market disruptions.