From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Exports Surge Amidst Increased Imports, Impacting European Plant Activity

Europe’s steel market is seeing increased Ukrainian exports, particularly in flat and long products, as highlighted by the news articles “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine increase exports of long products by 26% y/y in January-April“. Increased imports from Turkey into Ukraine, as reported in “Ukraine increased imports of long products by 81.1% y/y in January-April“, may also exert some impact on European steel markets. Satellite data analysis reveals activity fluctuations at key European steel plants, though direct correlations to these specific Ukrainian export trends are not immediately evident.

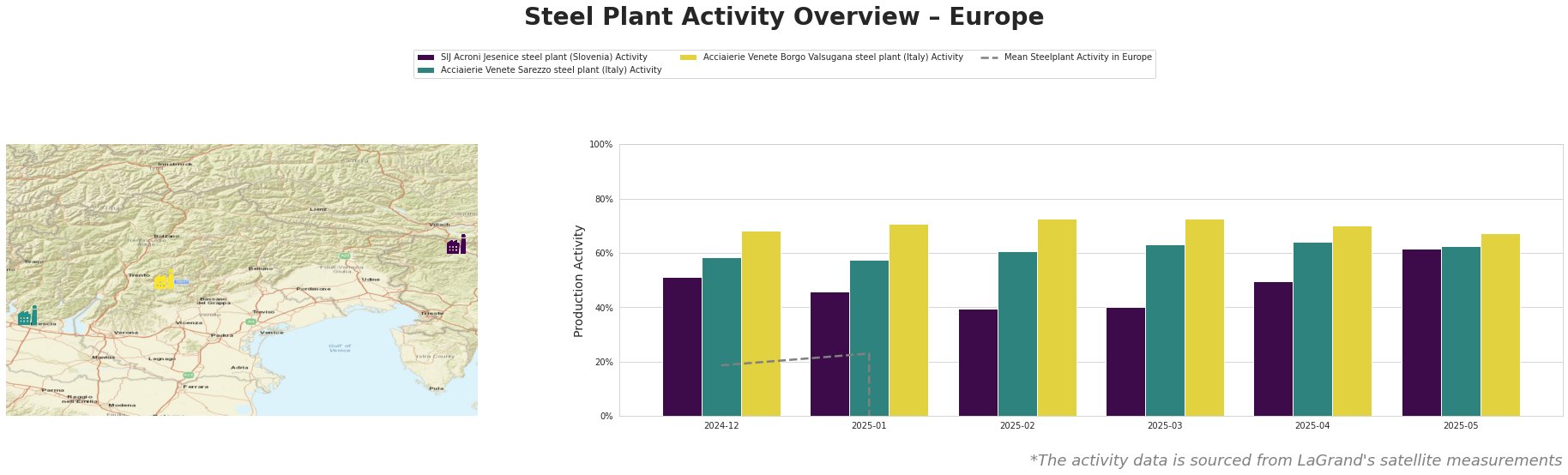

Observed activity levels exhibit substantial volatility and negative values, with some data entries invalid and potentially corrupt (negative values). Therefore, interpreting the “Mean Steelplant Activity in Europe” in absolute terms is impossible. Among the three plants, Acciaierie Venete Borgo Valsugana consistently shows the highest activity. SIJ Acroni Jesenice experienced a notable increase in activity in May, reaching 62.0, compared to earlier months. The Acciaierie Venete Sarezzo plant shows a more stable trend compared to the other two.

SIJ Acroni Jesenice steel plant: This Slovenian plant, with a crude steel capacity of 726 thousand tons produced via EAF technology, focuses on flat rolled steel products. The plant has shown a recent increase in activity, from 40 in March 2025 to 62 in May 2025. No direct link can be established between this increased activity and the news articles on Ukrainian exports.

Acciaierie Venete Sarezzo steel plant: Located in Italy, this EAF-based plant produces 540 thousand tons of crude steel annually, specializing in bars and wire rod for various sectors. Its activity level has remained relatively stable, fluctuating between 58 and 64 between January 2025 and May 2025. No direct connection can be established between this activity and the Ukrainian export data.

Acciaierie Venete Borgo Valsugana steel plant: Another Italian EAF-based facility, producing 600 thousand tons of crude steel per year, focuses on similar products to the Sarezzo plant. The plant consistently exhibited high-activity levels, peaking at 73 in February and March 2025 and settling at 67 in May 2025. The increased pig iron exports from Ukraine to Italy, as noted in “Pig iron exports from Ukraine increased by 37% in 4 months“, may indirectly influence demand, but no direct correlation with activity levels can be asserted based on the provided data.

Given the increase in Ukrainian steel exports, particularly flat and long products, European steel buyers should:

- Monitor price fluctuations: The increased supply from Ukraine, as indicated in “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine increase exports of long products by 26% y/y in January-April“, could put downward pressure on European steel prices, specifically in Poland, Bulgaria and Italy given they are the main importers of Ukrainian steel.. Procurement teams should closely track price movements and adjust purchasing strategies accordingly to capitalize on potential cost savings.

- Assess supply chain risks: The surge in Ukrainian ferrous scrap exports, highlighted in “Ukraine increased exports of ferrous scrap by 95% year-on-year“, combined with the concurrent increase in long product imports into Ukraine (“**Ukraine increased imports of long products by 81.1% y/y in January-April**”), may indicate a tightening of scrap availability in certain European regions, given the EU’s aim to reduce scrap exports. Buyers should evaluate their reliance on scrap-based steel production and consider diversifying supply sources or explore alternative steelmaking routes to mitigate potential disruptions.