From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Exports Surge Amidst Duty Extensions: European Market Impact

Europe’s steel market is seeing increased activity, partially influenced by rising Ukrainian steel exports and extended import duties. The surge in Ukrainian exports, as detailed in “Ukraine increased exports of flat products to 554 thousand tons in January-April“, “Ukraine increased exports of long products by 26% y/y in January-April“, “Pig iron exports from Ukraine increased by 37% in 4 months“, “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increase exports of ferrous scrap by 95% year-on-year“, could impact European steel supply and pricing. Simultaneously, the article “Ukraine extends duties on coated steel from Russia and China for another 5 years” highlights measures to protect domestic producers, a move that could influence trade flows within Europe. There is no direct explicit evidence linking Ukrainian export volumes to activity levels from satellite imagery.

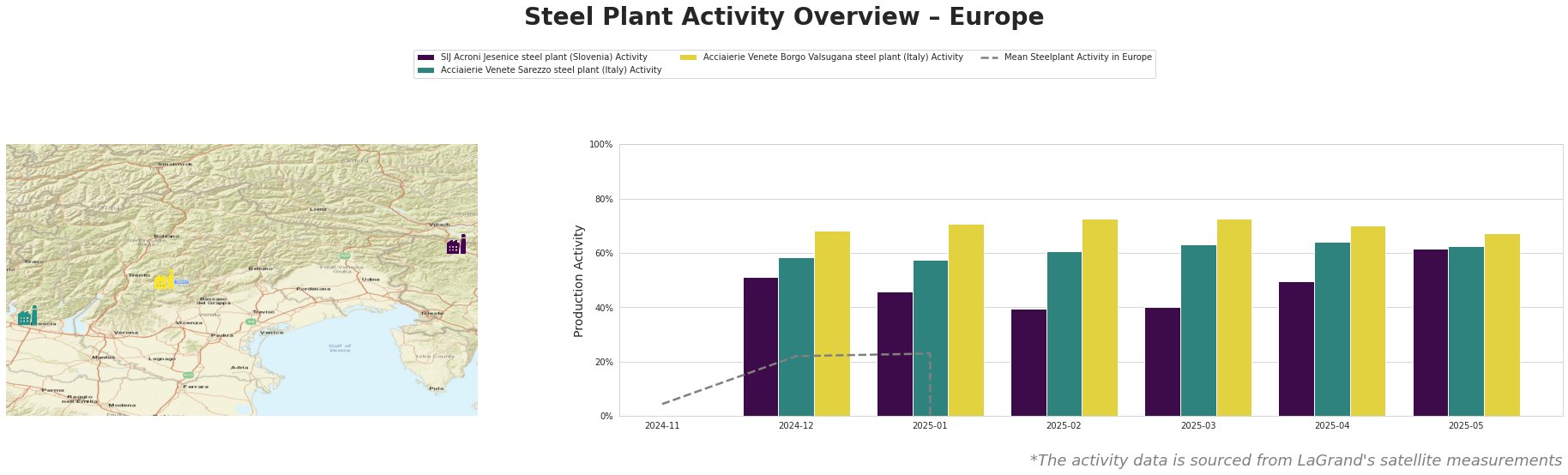

The data reveals irregularities in the “Mean Steelplant Activity in Europe” data, rendering it unusable for overall trend analysis. Individual plant activity, however, shows discernible patterns. SIJ Acroni Jesenice steel plant displays a consistent upward trend from December 2024 (51.0) to May 2025 (62.0), indicating increased production. Acciaierie Venete Sarezzo steel plant shows a relatively stable, high-activity level, fluctuating between 58.0 and 64.0. Acciaierie Venete Borgo Valsugana steel plant maintains the highest activity levels among the observed plants, generally above 67.0. There is no directly established link between these plant-specific activity levels and the Ukrainian news articles provided.

SIJ Acroni Jesenice, a Slovenian steel plant with a 726ktpa EAF-based crude steel capacity, focuses on flat-rolled products. Activity has risen consistently since December 2024, reaching 62.0 in May 2025. The increase might be linked to growing demand, but no direct connection to the provided news articles about Ukraine can be explicitly established. The plant holds a ResponsibleSteel Certification, suggesting a focus on sustainable practices which could influence its market positioning.

Acciaierie Venete Sarezzo, an Italian EAF steel plant with a 540ktpa crude steel capacity, produces bars and wire rod. The plant’s activity has been consistently high, with a slight peak in April 2025 (64.0). The consistent activity levels may indicate stable demand in its end-user sectors such as automotive and building, but there is no explicit link to the news articles about Ukraine. The plant’s ResponsibleSteel Certification suggests a commitment to responsible production.

Acciaierie Venete Borgo Valsugana, another Italian EAF steel plant with a 600ktpa crude steel capacity, also produces bars and wire rod. This plant has consistently shown the highest activity levels, peaking in February and March 2025 (73.0). Like Sarezzo, its products serve the automotive and building sectors. The plant’s high activity could reflect strong regional demand, but again, there’s no direct link to the provided Ukrainian news. It also holds a ResponsibleSteel Certification, reinforcing its commitment to sustainability.

The increase in Ukrainian steel exports, particularly flat and long products, could place downward pressure on European steel prices, potentially affecting the profitability of European producers. However, the extension of duties on coated steel from Russia and China by Ukraine, as mentioned in “Ukraine extends duties on coated steel from Russia and China for another 5 years“, may create opportunities for European producers to fill the supply gap in the Ukrainian market.

Recommended Procurement Actions:

- Monitor Price Fluctuations: Steel buyers should closely monitor price fluctuations in the European market due to the increased supply of Ukrainian steel. Use forward contracts cautiously to hedge against potential price drops, especially for flat and long products.

- Diversify Sourcing: Procurement professionals should diversify their sourcing strategies to include Ukrainian suppliers, especially for flat and long products. Leverage the increased export volumes from Ukraine as reported in “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine increased exports of long products by 26% y/y in January-April” to negotiate more competitive prices.

- Assess Supply Chain Risks: Given the ongoing situation in Ukraine, assess potential supply chain disruptions and develop contingency plans. Consider alternative suppliers from other regions to mitigate risks associated with relying solely on Ukrainian sources.

- Evaluate Quality and Compliance: Verify the quality and compliance of Ukrainian steel products with European standards before committing to large orders. Ensure that Ukrainian suppliers adhere to relevant environmental and safety regulations.

- Engage with Policy Developments: Stay informed about trade policy developments and regulations related to steel imports from Ukraine. The Ministry of Economy’s proposal to limit ferrous scrap exports, as detailed in “Ukraine increased scrap metal exports by 45% in 4 months“, highlights a potentially volatile trade landscape.