From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine’s Steel Market Poised for Growth Amid Positive Trade Developments

Recent activity within Ukraine’s steel industry indicates a surge in optimism due to favorable trade negotiations, particularly highlighted by the article “UK $6 billion trade deal with Trump includes removal of steel, aluminum tariffs.” This trade agreement aims to ease tariffs, potentially revitalizing not only the US steel sector but also influencing Ukraine’s exports. This optimism aligns with observed improvements in steel plant activity levels as captured by satellite data.

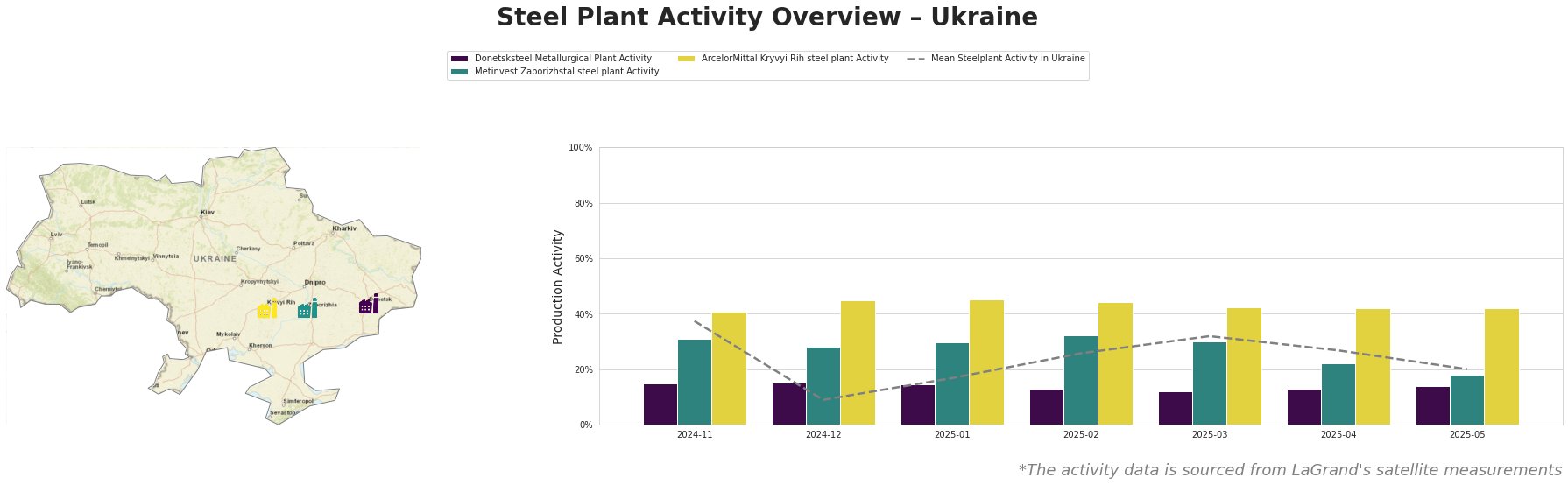

Since November 2024, the average activity level across Ukrainian steel plants has seen fluctuations, with a notable peak on March 31, 2025, at 32%, whereas activity at the Donetsksteel plant trailed significantly, with a low of 12% observed in March. Meanwhile, ArcelorMittal Kryvyi Rih, while stable, peaked at 45% in December 2024, affirming its resilience in the current market landscape. However, despite these trends, no direct links between the activity declines or increases in individual plants were conclusively established with the recent trade agreements.

The Donetsksteel Metallurgical Plant, located in a region facing challenges, exhibited declining activity, bottoming at 12% in March before a slight recovery to 14% in May. Its production primarily involves pig iron, but the plant’s inability to reach higher operational capacities reflects ongoing operational struggles. The trade news provides a glimmer of hope for future improvement, although no direct connection to the recent tariff relief can be made.

Metinvest Zaporizhstal steel plant, active mainly in finished rolled products, saw a moderate decline, reaching 28% in December. This plant’s robust offerings in carbon steel make it a key player, yet its performance remains closely tied to broader market conditions and recent negotiated trade benefits.

ArcelorMittal Kryvyi Rih consistently achieved strong activity, retaining a peak of 45% in December. The plant’s well-equipped infrastructure and diverse product portfolio — ranging from billets to finished rods — position it favorably to capitalize on the improving trade landscape, particularly with competitive US import conditions potentially expanding its reach.

Market implications indicate potential supply disruptions primarily through the Donetsksteel Metallurgical Plant, given its operational challenges. However, the pro-trade policies indicated by recent news provide a valuable opportunity for buyers to secure favorable pricing as tariffs ease.

For steel buyers and market analysts, it is advisable to reconsider procurement strategies with a keen eye on the upcoming trends related to the easing of trade tariffs, particularly in sourcing from ArcelorMittal Kryvyi Rih as it stands out as a reliable supplier amidst improving conditions. Monitoring the operational status of Metinvest Zaporizhstal is also crucial for understanding medium-term price movements and stock availability, corresponding to increased demand driven by potential tariff reductions.