From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Trade Actions and Activity Shifts at Siegen Plant Signal Evolving European Steel Landscape

In Europe, recent trade actions impacting Ukraine coincide with activity changes at certain steel plants, signaling a potentially shifting steel landscape. “Ukraine extends duties on coated steel from Russia and China for another 5 years” and “Ukraine reconsiders duties on Chinese seamless pipes” highlight Ukraine’s efforts to protect domestic producers, while “Ukraine can keep protection from dumping from China – the review continues” indicates ongoing concerns about unfair competition. These developments do not have a clear direct impact on the EU steel mills, but influence the Ukrainian steel markets.

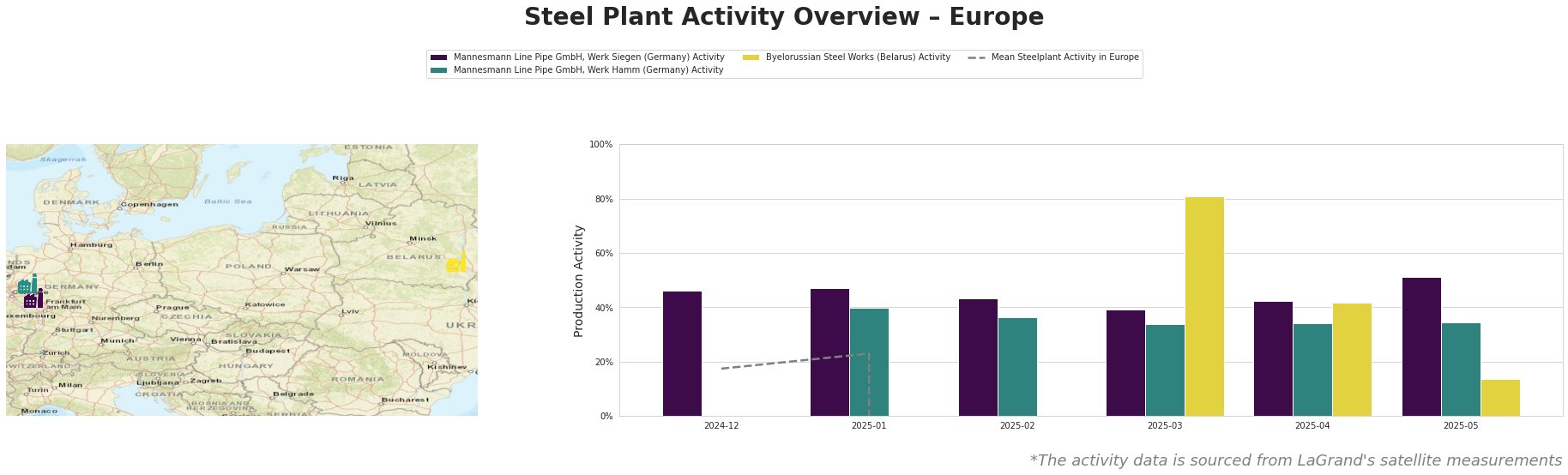

The data presents corrupted, uninterpretable values for ‘Mean Steelplant Activity in Europe’ from February 2025 onwards, rendering it unusable for meaningful comparison. Mannesmann Line Pipe GmbH, Werk Siegen (Germany) exhibited a fluctuating activity pattern, decreasing from 47% in January to 39% in March, before increasing to 51% in May. Mannesmann Line Pipe GmbH, Werk Hamm (Germany) showed a steady activity level between 34% and 40%. The Byelorussian Steel Works (Belarus) experienced a sharp decline in activity, from 81% in March to 14% in May.

Mannesmann Line Pipe GmbH, Werk Siegen, located in Nordrhein-Westfalen, Germany, utilizes EAF technology to produce pipes. Activity at the Siegen plant decreased from 47% in January 2025 to 39% in March 2025, followed by an increase to 51% in May 2025. There is no explicitly identifiable connection between these activity fluctuations and the trade-related news articles concerning Ukraine.

Mannesmann Line Pipe GmbH, Werk Hamm, also in Nordrhein-Westfalen, Germany, produces pipes using EAF technology. The plant’s activity remained relatively stable, fluctuating between 34% and 40% throughout the observed period. As with the Siegen plant, no direct connection can be established between its activity levels and the provided news articles about Ukrainian trade measures.

Byelorussian Steel Works, located in the Gomel Region of Belarus, possesses a crude steel capacity of 3000 tonnes and utilizes EAF technology. Its product portfolio includes semi-finished and finished rolled products such as billets, seamless pipes, and rebar. The plant experienced a significant activity decrease from 81% in March 2025 to 14% in May 2025. Due to a lack of explicit connections to the provided news regarding Ukraine, it is impossible to state a direct connection.

The observed decrease in activity at Byelorussian Steel Works from March to May 2025, paired with Ukraine’s extension of duties on steel from Russia and China, suggests that steel buyers should proactively secure alternative supply sources for seamless pipes and other steel products to mitigate potential supply disruptions and price increases. While a direct impact of the Ukrainian trade actions on these mills is not identifiable, the observed activity decrease in Belarus paired with new duties imposed by Ukraine, should prompt steel buyers to closely monitor the market for potential supply chain effects. Steel buyers should focus on suppliers within the EU or other regions not subject to the extended Ukrainian duties.