From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Sector Faces Uncertainty Amidst Peace Talk Hesitation: Activity Declines Signal Risk

The Ukrainian steel market faces continued uncertainty as peace talks stall, influencing production. Observed declines in steel plant activity coincide with ongoing diplomatic efforts discussed in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war” and “‘We’ll see what happens’: Trump ends week of Ukraine-Russia talks on a more tentative note“, though a direct causal link is not explicitly evident. These articles indicate that the success of diplomatic efforts remains uncertain, potentially impacting the steel industry.

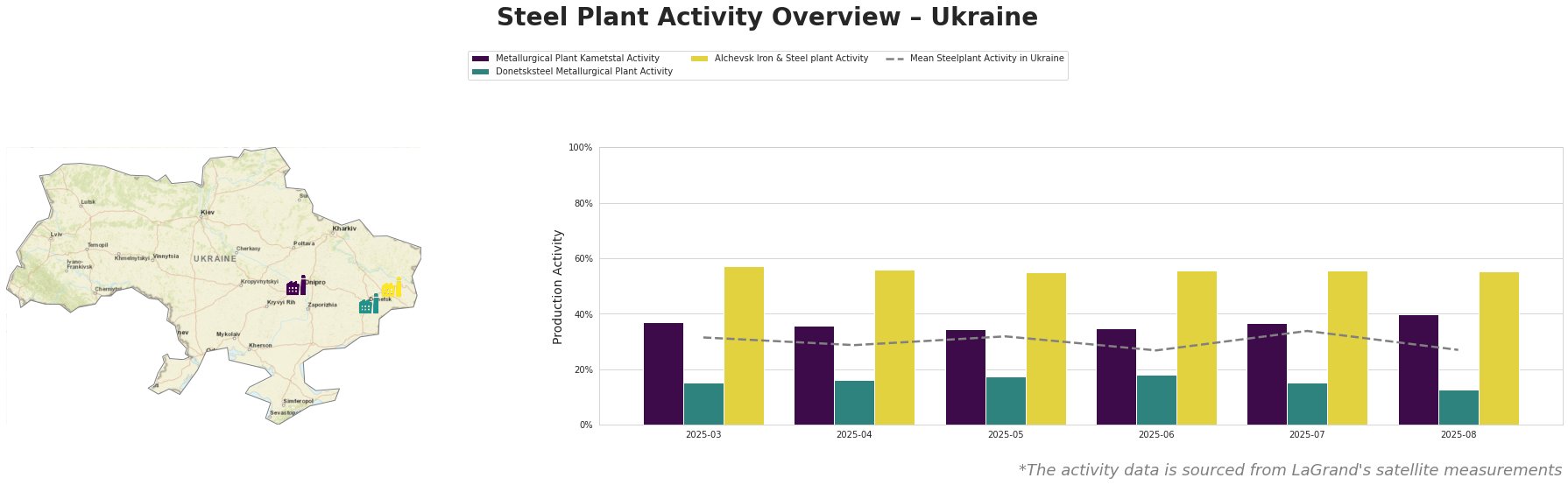

Overall, the mean steel plant activity in Ukraine has fluctuated, ending at 27.0% in August, lower than the 34.0% observed in July. Metallurgical Plant Kametstal shows an increase to 40.0% in August, a high for the observed period. Donetsksteel Metallurgical Plant activity has consistently remained low, with a decrease to 13.0% in August representing the lowest activity level among the monitored plants. Alchevsk Iron & Steel plant activity shows stability around 55-57% with a slight decrease to 55% in August.

Metallurgical Plant Kametstal, located in Dnipropetrovsk, is an integrated steel plant with a crude steel capacity of 4.2 million tonnes per annum (ttpa) using BOF technology. It produces semi-finished and finished rolled products such as square billets, wire rods, and rails, primarily for the energy and transport sectors. Activity at Kametstal increased to 40.0% in August, bucking the overall downward trend. No direct connection to the news articles could be established.

Donetsksteel Metallurgical Plant, located in the contested Donetsk region, has a pig iron capacity of 1.5 million ttpa. While officially an integrated plant utilizing BF technology, its BOF and OHF facilities are either dismantled or mothballed, indicating severely limited or no crude steel production. The plant’s activity continued to be low at 13.0% in August. The low activity levels align with potential disruptions and challenges in the Donetsk region, possibly associated with the conflict mentioned in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war“, though a definitive connection cannot be established.

Alchevsk Iron & Steel plant, located in Luhansk, has a crude steel capacity of 5.472 million ttpa using BOF technology. It produces semi-finished products like slabs and square billets, along with structural shapes. Activity at Alchevsk remained relatively stable at 55.0% in August. Despite its location in a conflict zone, the plant maintains a comparatively higher level of operation. No direct links to the provided news articles are evident.

Evaluated Market Implications:

Given the uncertainty surrounding peace talks as highlighted in “‘We’ll see what happens’: Trump ends week of Ukraine-Russia talks on a more tentative note,” and the observed decline in mean Ukrainian steel plant activity, steel buyers should anticipate potential supply disruptions, particularly from regions closer to the conflict zone. Specifically, the low and declining activity at Donetsksteel Metallurgical Plant poses a risk to pig iron supplies.

Recommended Procurement Actions:

- Diversify Pig Iron Sources: Steel buyers reliant on pig iron should actively seek alternative suppliers outside of the Donetsk region to mitigate potential shortages due to Donetsksteel’s low activity.

- Monitor Kametstal’s Output: Closely track the output of Metallurgical Plant Kametstal, as it is currently operating at higher activity levels. The stability of supply from Kametstal is crucial, and buyers should engage in frequent communication with them.

- Evaluate Price Fluctuations: As “Gold Wavers as Traders Look to Jackson Hole and Ukraine Talks” suggests, geopolitical tensions can influence commodity prices. Be prepared for potential price fluctuations in steel and related raw materials due to the ongoing uncertainty.