From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Production Mixed: Zaporizhstal Ramps Up Amidst Coke Import Reliance

Ukraine’s steel sector shows a mixed performance, with increasing production at Zaporizhstal offset by reliance on coke imports. According to “Ukraine’s Zaporizhstal crude steel output up in Jan-June 2025“, Zaporizhstal significantly increased its output in June 2025. This increased output may be related to the increased coke imports reported in “Ukraine imported 297,700 tons of metallurgical coke in January-May,” highlighting Ukraine’s dependence on external coke supplies.

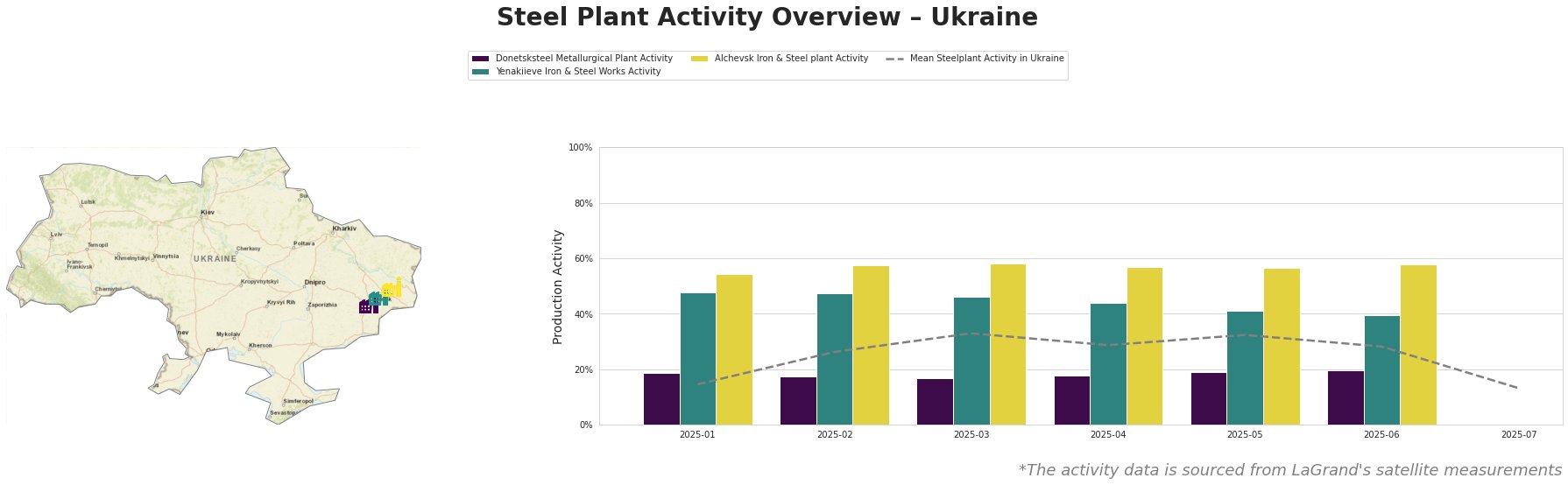

The mean steel plant activity in Ukraine peaked in March 2025 at 33.0% and then generally decreased through June 2025. In July 2025 there was a significant drop to 13.0%.

Donetsksteel Metallurgical Plant’s activity has remained relatively stable and below the national average, ranging from 17.0% to 20.0% throughout the observed period. Yenakiieve Iron & Steel Works shows a gradual decline in activity from 48.0% in January 2025 to 40.0% in June 2025, consistently above the national average. Alchevsk Iron & Steel plant consistently shows the highest activity levels, remaining stable near 57-58% throughout the observed period, significantly above the national average. The drastic drop in average activity in July 2025 cannot be directly tied to specific news events affecting individual plants based on the provided information.

Donetsksteel Metallurgical Plant

Donetsksteel Metallurgical Plant, located in Donetsk, primarily produces pig iron using integrated blast furnace (BF) technology, with a BF capacity of 1500 ttpa. The plant’s activity remained consistently below the national average. From January to June 2025, its activity fluctuated narrowly between 17% and 20%. There is no immediate indication from the provided news articles that explains this behavior.

Yenakiieve Iron & Steel Works

Yenakiieve Iron & Steel Works, also located in Donetsk, is an integrated steel plant with a crude steel capacity of 3300 ttpa, primarily utilizing BOF technology. Its activity declined steadily from 48.0% in January 2025 to 40.0% in June 2025. There is no direct evidence in the provided news articles to connect to the observed change in activity.

Alchevsk Iron & Steel Plant

Alchevsk Iron & Steel plant, situated in Luhansk, is an integrated plant with a crude steel capacity of 5472 ttpa, relying on BF and BOF technologies. The plant maintained a high and stable activity level, consistently around 57-58% between January and June 2025. No direct connection to the provided news can be established.

Evaluated Market Implications:

The news article “Ukraine imported 297,700 tons of metallurgical coke in January-May” highlights an increased reliance on coke imports, mainly from Poland, to sustain steel production. This dependence makes Ukrainian steelmakers vulnerable to supply chain disruptions and price fluctuations in the coke market. The shutdown of the Pokrovsk Coal Group and decreased domestic coking coal production further exacerbate this reliance. The increased Zaporizhstal production reported in “Ukraine’s Zaporizhstal crude steel output up in Jan-June 2025” despite the overall reliance on coke imports suggests potential vulnerabilities.

- Procurement Action: Steel buyers should closely monitor coke prices and import volumes, particularly from Poland. Diversifying coke suppliers and securing long-term contracts are recommended to mitigate risks associated with potential supply disruptions or price increases. Furthermore, analyzing alternative ironmaking technologies requiring less coke could be a strategic advantage, even if there is no immediate action to be taken.