From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Production Mixed: Pig Iron Exports Plunge Amidst Rising Domestic Consumption; EU Market Remains Key

Europe’s steel market faces a complex situation influenced by Ukrainian production dynamics, where “Ukraine reduced pig iron exports by 60% m/m in April” while domestic consumption is rising, as reported in “Consumption of steel products in Ukraine increased to 1.2 million tons in January-April“. These trends might impact material availability in Europe as the EU remains a key export market. These developments follow a period of increasing pig iron and steel production, as noted in “Ukraine reports 8.1 percent rise in pig iron output for Jan-Apr,” however no direct relationship to any observed plant activity can be established based on these articles.

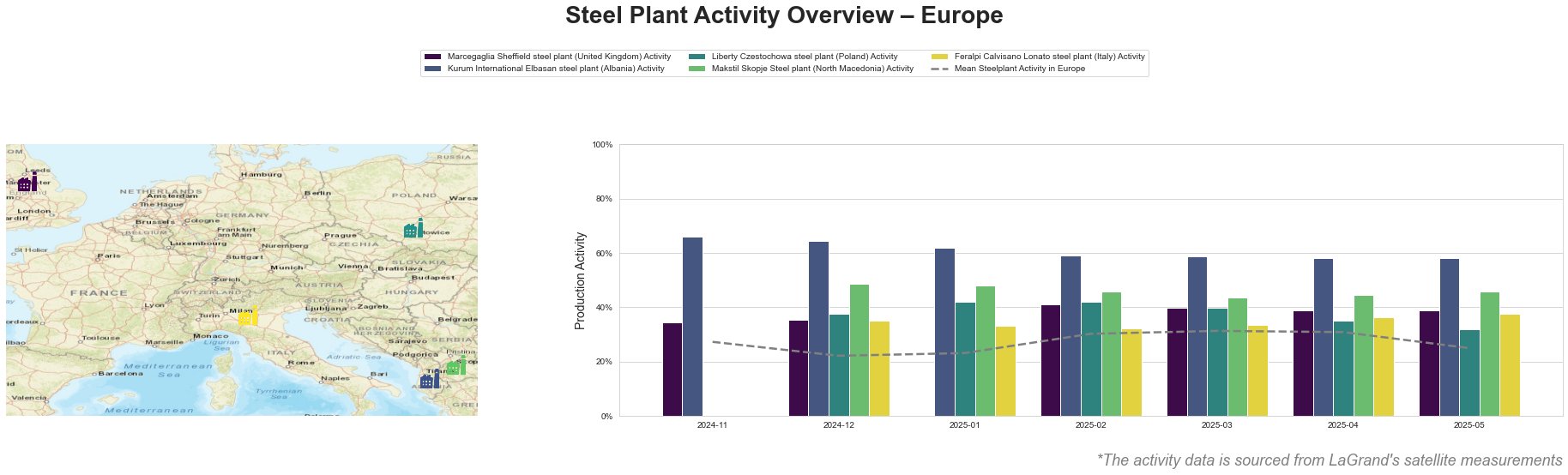

The mean steel plant activity in Europe fluctuated, peaking in March-April 2025 at 31% before dropping to 25% in May 2025. Kurum International Elbasan consistently showed the highest activity levels relative to the mean. Liberty Czestochowa displayed the lowest activity levels in the observed plants.

Marcegaglia Sheffield, a UK-based plant with a 500kt EAF capacity producing crude and semi-finished steel, shows relatively stable activity, fluctuating between 34% and 41%. There’s a slight dip from 41% in February to 39% in May. There are no readily apparent direct links between the observed activity levels at Marcegaglia Sheffield and the Ukrainian steel market news.

Kurum International Elbasan, an Albanian steel plant with a 700kt EAF capacity that also uses integrated BF processes to produce iron and steel billets, exhibited the highest activity levels among the observed plants. It starts at 66% in November 2024, gradually decreasing to 58% by May 2025. There are no readily apparent direct links between the observed activity levels at Kurum International Elbasan and the Ukrainian steel market news.

Liberty Czestochowa, a Polish steel plant with an 840kt EAF capacity focused on plate production, has the lowest activity levels, declining from 38% in December 2024 to 32% in May 2025. There are no readily apparent direct links between the observed activity levels at Liberty Czestochowa and the Ukrainian steel market news.

Makstil Skopje, a North Macedonian steel plant with a 550kt EAF capacity producing slabs, shows a fluctuating activity level, starting at 49% in December 2024, decreasing to 43% in March 2025, and then recovering to 46% in May 2025. There are no readily apparent direct links between the observed activity levels at Makstil Skopje and the Ukrainian steel market news.

Feralpi Calvisano Lonato, an Italian steel plant with a 600kt EAF capacity producing billets, shows a gradual increase in activity from 35% in December 2024 to 38% in May 2025. There are no readily apparent direct links between the observed activity levels at Feralpi Calvisano Lonato and the Ukrainian steel market news.

The “Ukraine reduced pig iron exports by 60% m/m in April” combined with the reported “Consumption of steel products in Ukraine increased to 1.2 million tons in January-April” suggests a potential shift in Ukrainian steel supply dynamics. The decline in pig iron exports, especially to the US as highlighted in the article, coupled with increased domestic demand, may reduce the availability of Ukrainian steel products in the EU market. Considering the EU’s role as the primary export market for Ukrainian steel, as stated in “Ukraine’s flat steel exports up 4.1 percent in Jan-Apr” and “Consumption of steel products in Ukraine increased to 1.2 million tons in January-April”, a supply reduction could put upward pressure on European steel prices.

Procurement Actions:

- Monitor Pig Iron Alternatives: Steel buyers relying on Ukrainian pig iron should actively explore alternative sources, particularly given the 60% month-over-month export decline in April. Focus should be given to regional suppliers and available import options from outside Europe.

- Assess Flat Steel Sourcing: Given “Ukraine’s flat steel exports up 4.1 percent in Jan-Apr”, monitor flat steel prices closely as a potential decline in Ukrainian exports may affect supply and prices. Diversification of flat steel suppliers is advisable to mitigate risks.

- Evaluate Semi-Finished Steel Options: As noted in “Ukrainian steelmakers cut exports of semi-finished products by 25% y/y in January-April“, proactively assess alternative sources for semi-finished products. Particularly, the changes in export destinations (Bulgaria, Turkey, Poland, Egypt) indicate shifts in supply flows that need to be considered.