From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Production Mixed; Ferrexpo Ramps Up Concentrate Output Amid Export Challenges; HKM Activity Surges

Ukraine’s steel sector presents a mixed landscape despite increases in overall production. According to “Ukraine produced 4.8 million tons of rolled steel in January-September“, rolled steel production saw a slight increase, while steel production decreased. This contrasts with “Ferrexpo increased output by 0.9% y/y in January-September,” which highlights a strategic shift towards high-grade iron ore concentrate, yet faces logistical and financial headwinds. While these articles outline production trends, no direct relationship to observed steel plant activity outside of Ukraine could be established.

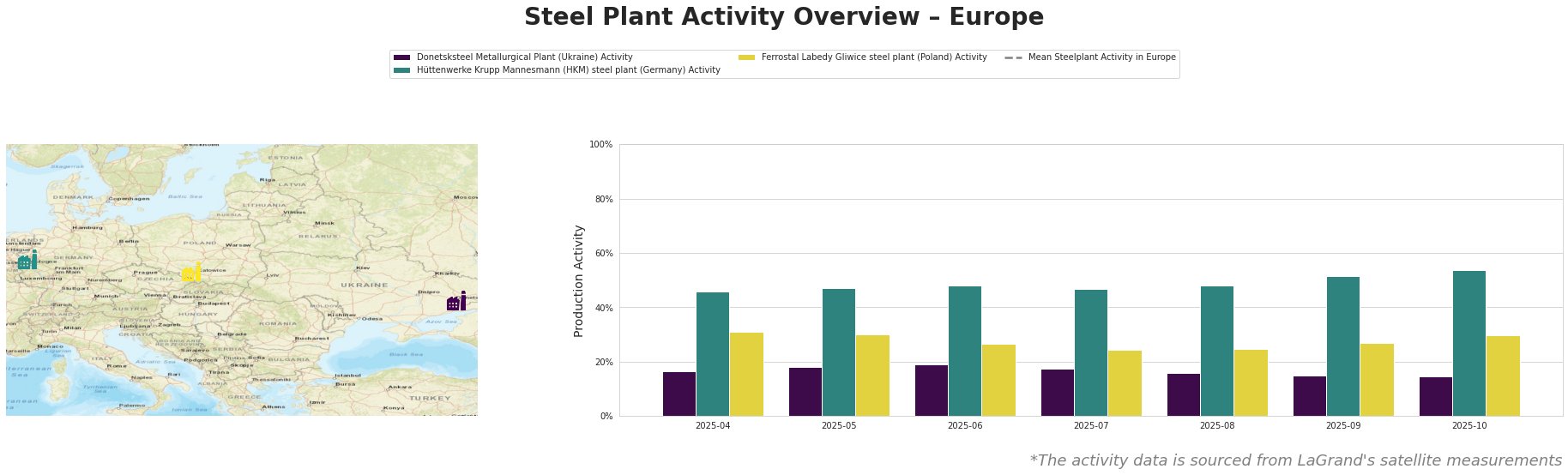

Here’s a breakdown of observed plant activity:

The mean steel plant activity in Europe fluctuated significantly. Donetsksteel Metallurgical Plant activity has remained relatively stable and low, ranging from 15% to 19%. Hüttenwerke Krupp Mannesmann (HKM) steel plant has shown a consistently increasing trend, rising to 54% in October, significantly above the European mean, indicating robust production. Ferrostal Labedy Gliwice steel plant has shown a generally decreasing trend, with a slight increase in October, remaining below the European mean.

Donetsksteel Metallurgical Plant, an integrated steel plant with a BF capacity of 1500 tons producing pig iron, shows consistently low activity (around 16%) throughout the observed period. Given that “Ukraine reduced iron ore exports by 4.4% y/y in January-September,” and the plant’s location in Ukraine, the low activity levels might be partially explained by export difficulties and regional instability as mentioned in “Ferrexpo increased output by 0.9% y/y in January-September,” citing infrastructure attacks.

Hüttenwerke Krupp Mannesmann (HKM) steel plant, a major integrated BF-BOF producer in Germany with 6000 tons of crude steel capacity, exhibits a strong upward trend in activity, reaching 54% in October. No direct connection to the Ukrainian news articles can be established.

Ferrostal Labedy Gliwice steel plant, a smaller electric arc furnace (EAF) based producer in Poland with 500 tons of crude steel capacity, demonstrates relatively stable but low activity levels (24-31%). No direct link to the named news articles regarding Ukraine could be established.

The news article “Prices for channel bars and hot-rolled sheets have risen the most in Ukraine since the beginning of the year” coupled with observations of Donetsksteel’s consistent low operation suggests limited production capacity and the potential for further price increases in Ukrainian steel products, with no direct implications for European steel production. The rising activity at HKM, a major European producer, could alleviate supply pressures but should be monitored for potential bottlenecks due to increased demand. Given the rising activity at HKM, buyers should attempt to lock in contracts now to avoid further potential price increases, particularly in slabs, round bars and other HKM core products.