From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Output Rises: Zaporizhstal Boosts Production Amid Coke Supply Adjustments

Ukraine’s steel sector shows signs of recovery, driven by increased production at key mills despite ongoing logistical challenges. “Ukraine’s Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025” directly correlates with activity data showing positive trends at certain plants, while “Ukraine’s Zaporizhkoks posts higher coke output for July 2025” and “Zaporizhcoke increased production to 513,000 tons in January-July” may indirectly support steel production through improved coke supply. A direct relationship between coke production numbers and observed activity at other specific steel plants, however, cannot be explicitly established with the provided data.

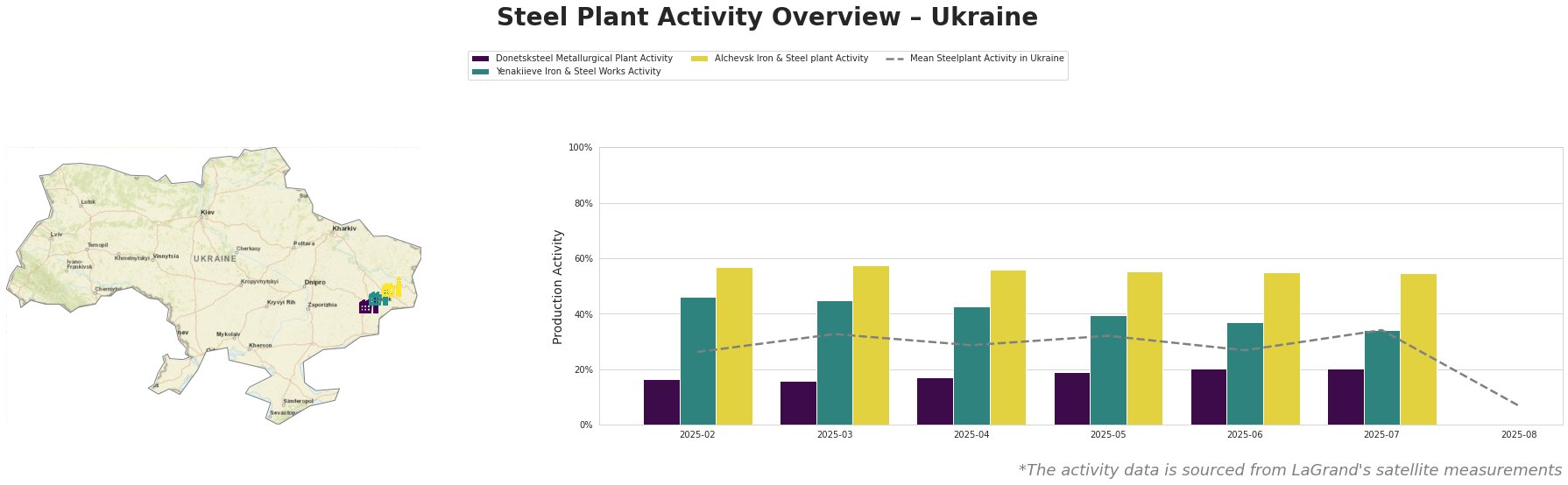

The mean steel plant activity in Ukraine saw fluctuations between February and July 2025, peaking at 34.0 in July before a sharp drop to 7.0 in August. Donetsksteel Metallurgical Plant activity remained relatively stable and low, gradually increasing from 16.0 in February to 20.0 in June and July. Yenakiieve Iron & Steel Works experienced a gradual decline from 46.0 in February to 34.0 in July. Alchevsk Iron & Steel plant maintained a consistently high activity level, hovering around 55-57, before a drastic drop to 0 in August. The overall drop in mean activity in August can be attributed to the lack of readings for multiple plants.

Donetsksteel Metallurgical Plant, an integrated (BF) steel plant focusing on pig iron production, has shown consistently low activity levels, peaking at 20% in June and July 2025, but remained significantly below the Ukrainian average. Given its reliance on BF and limited EAF capacity, no direct connection can be established between its operational status and the reported increases in Zaporizhstal’s crude steel output or Zaporizhkoks’ coke production.

Yenakiieve Iron & Steel Works, an integrated (BF) steel plant producing semi-finished and finished rolled products, experienced a gradual decline in activity from 46% in February to 34% in July 2025. This plant’s production of square billets, rebar, and wire rods positions it as a key supplier to the construction sector. No direct connection can be established between the observed decline and any of the named news articles.

Alchevsk Iron & Steel plant, an integrated (BF) steel plant with a large coking plant (6 batteries), maintained a high, stable activity level around 55-57% until July 2025. The plant produces slabs, square billets and structural shapes. There’s no clear connection between its activity levels and “Ukraine’s Zaporizhkoks posts higher coke output for July 2025,” although its integrated BF process would make it a consumer of coke.

The “Ukraine’s Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025,” coupled with increased coke production (“Ukraine’s Zaporizhkoks posts higher coke output for July 2025” and “Zaporizhcoke increased production to 513,000 tons in January-July”), suggests improved operational capacity within Metinvest’s vertically integrated supply chain. Steel buyers should closely monitor the continued impact of coke availability and pricing on Zaporizhstal’s output. Given the relatively stable, but low activity at Donetsksteel Metallurgical Plant, steel buyers relying on pig iron may want to secure alternative sources to mitigate supply chain risks. The drop in mean steelplant activity in Ukraine coupled with news articles about an increase in steel production, suggest a possible consolidation of steel production in the region. Buyers should evaluate and potentially diversify away from steel plants in regions where steel production is consolidating.