From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Update: Activity Trends and Implications Amid EU Regulations and Calls for Support

Recent observations from the Ukrainian steel sector reflect a marked decline in activity amid evolving regulatory pressures and domestic challenges. In particular, the articles titled “BCSA calls for UK government support for steel“ and “CBAM could cost UK industry £800 million annually as EU rules out exemption“ highlight that, while focused on the UK, underscore broader implications affecting the regional steel supply landscape.

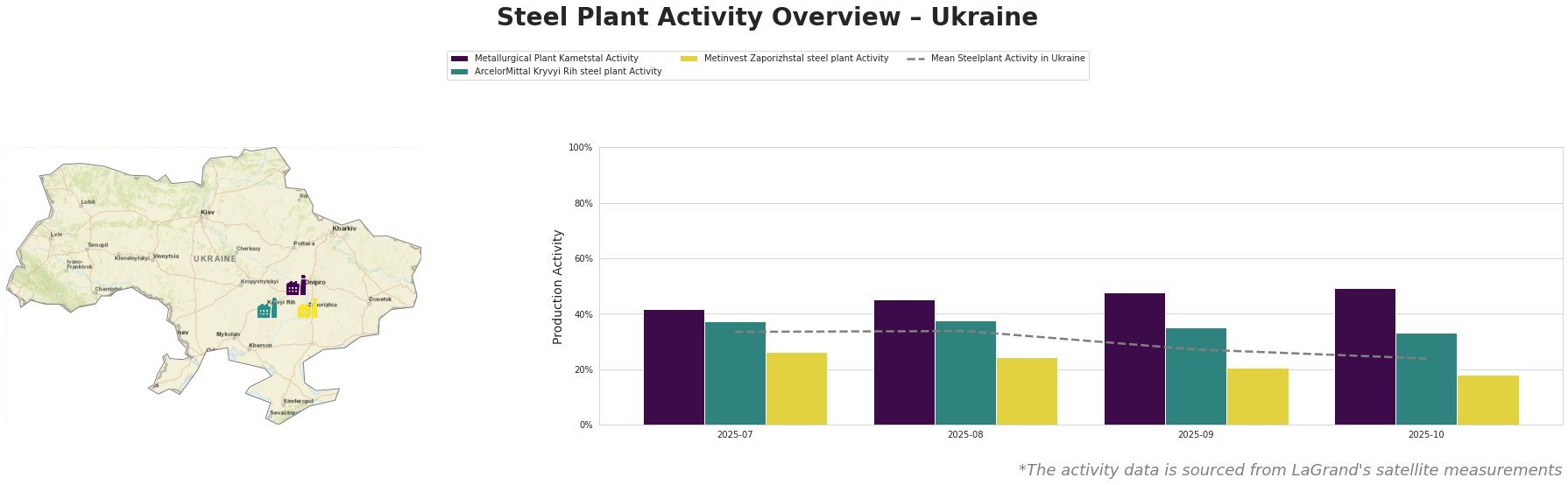

Between July and October 2025, the mean activity level at Ukrainian steel plants has fallen from 34% to 24%. The Metallurgical Plant Kametstal demonstrated relatively higher resilience, peaking at 49% in October, whereas Metinvest Zaporizhstal saw a significant decline, ending at 18% in the same month. These fluctuations indicate heightened operational challenges that warrant close attention from steel buyers.

Recent Activity Trends

Activity at Kametstal, primarily using a BOF integrated process with a crude steel output capacity of 4.2 million tonnes, remained above both the mean and other plants, indicating strong potential for procurement from this source for stable supply chains. Conversely, Metinvest Zaporizhstal’s activity dwindled by 13 percentage points over the observed period, aligning with broader market challenges noted in the BCSA’s calls for government intervention regarding energy costs and labor competitiveness.

ArcelorMittal Kryvyi Rih has maintained activity levels around 33%, reflecting operational steadiness compared to Zaporizhstal, although the plant’s capacity and production capability suggest these levels must be reassessed in light of potential supply chain disruptions.

Evaluated Market Implications

Given the observed downturn in plant activities, particularly for Metinvest Zaporizhstal, steel buyers should prepare for possible supply disruptions in the coming months, particularly from plants facing operational difficulties. The recent press on potential financial burdens from CBAM indicates heightened scrutiny on emissions compliance, which may affect pricing strategies and availability.

Procurement professionals are advised to focus on sourcing from Metallurgical Plant Kametstal, taking advantage of their stable operational performance while closely monitoring activity patterns and regulatory developments that could present cost increments or operational halts. Immediate contracts could mitigate risks associated with supply volatility highlighted in the news regarding UK’s steel industry, indirectly resonating across regions tied to Ukraine’s production capabilities.