From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Surges: Ferroalloy Exports Skyrocket, Flat & Long Products Follow

Ukraine’s steel sector is showing strong signs of recovery, driven by increased exports across multiple product categories. The surge in activity aligns with several key developments reported in recent news, including “Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April” and “Ukraine increased exports of flat products to 554 thousand tons in January-April“. However, a clear relationship to specific plant activity fluctuations based on satellite data is not always evident.

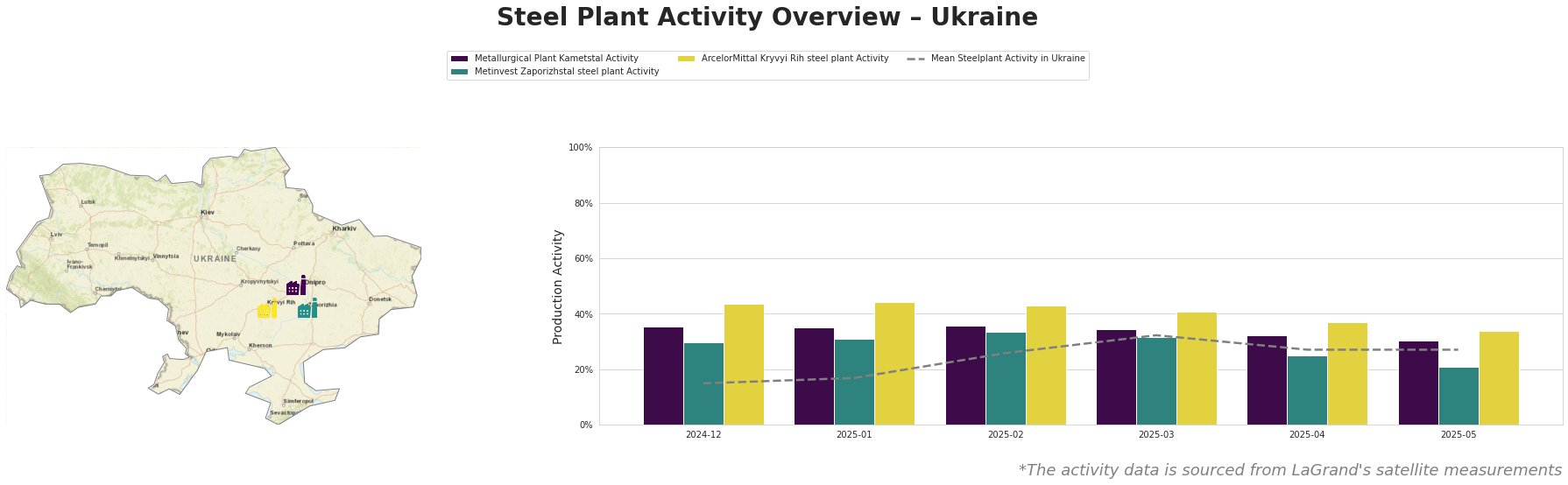

Overall, the mean steel plant activity in Ukraine rose significantly from 15% at the end of 2024 to a peak of 32% in March 2025, before stabilizing at 27% for April and May.

Metallurgical Plant Kametstal, an integrated BF-BOF steel plant with a crude steel capacity of 4.2 million tons per annum, maintained a relatively stable activity level. Starting at 35% in December 2024 and January 2025, it saw a slight increase to 36% in February 2025, followed by a minor decline to 30% by May 2025. While this plant is a significant producer of semi-finished and finished rolled products, including rails used in transport, no direct correlation between its activity levels and the reported export increases in long products in “Ukraine increase exports of long products by 26% y/y in January-April” could be established based on the data provided.

Metinvest Zaporizhstal steel plant, another integrated BF-OHF steel plant with a crude steel capacity of 4.1 million tons, experienced a more pronounced decline in activity. From a starting point of 30% in December 2024, activity gradually increased to 34% by February 2025 before decreasing to 21% in May 2025. As this plant focuses on finished rolled products such as hot-rolled coil and sheets used in automotive and steel packaging, the decline may reflect adjustments based on reduced revenue figures outlined in “Ukraine increased exports of flat products to 554 thousand tons in January-April“, which also notes a 7.7% year-on-year decrease in revenue from flat product exports.

ArcelorMittal Kryvyi Rih steel plant, the largest plant assessed, with a crude steel capacity of 8 million tons using integrated BF-BOF-OHF production, showed a steady decrease in activity from 44% in December 2024/January 2025 to 34% in May 2025. This decline occurred despite broader positive export trends. The plant produces semi-finished and finished rolled products, including rebar and wire rod for building and infrastructure. However, a specific link between its production and the increases in export volumes of long products detailed in “Ukraine increase exports of long products by 26% y/y in January-April” cannot be explicitly substantiated.

The increase in scrap metal exports, as highlighted in “Ukraine increased exports of ferrous scrap by 95% year-on-year” and “Ukraine increased scrap metal exports by 45% in 4 months“, has potential implications. This rise could lead to increased input costs for electric arc furnace (EAF) steelmakers globally, although its direct impact on the three observed BF/BOF-dominated Ukrainian plants is less immediate. The proposed export restrictions by the Ministry of Economy, outlined in the same articles, if implemented, could impact scrap availability and pricing dynamics. Conversely, imports of long steel products surged, as reported in “Ukraine increased imports of long products by 81.1% y/y in January-April“, primarily from Turkey. This suggests increased demand within Ukraine that domestic producers haven’t fully met.

Steel buyers should carefully monitor the evolving scrap export policies in Ukraine, especially if relying on EAF steel production. Given the increasing scrap exports and domestic demand, buyers should consider diversifying their supply sources and securing long-term contracts to mitigate potential price volatility and supply disruptions.

Furthermore, given the reported increase in long product exports, steel buyers should proactively engage with Ukrainian producers, such as Metallurgical Plant Kametstal, to ensure availability and secure favorable pricing. Buyers needing flat products should closely watch production trends at Metinvest Zaporizhstal steel plant and consider alternative suppliers, potentially from Turkey, if further declines in plant activity are observed.