From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Surges: EU-UK Deal Boosts Production Despite Recent Dip

Ukraine’s steel market shows a positive outlook, driven by the UK and EU’s strengthened trade relations. The activity changes observed at key steel plants like Yenakiieve Iron & Steel Works, Metinvest Zaporizhstal, and ArcelorMittal Kryvyi Rih, while exhibiting short-term volatility, do not yet reflect the long-term impact of agreements described in “UK Steel welcomes linking with EU carbon markets” and “UK and EU reach new deal to set out post-Brexit relations“. Despite these agreements, a direct and immediate causal relationship between the deals and satellite-observed activity changes cannot be conclusively established at this time.

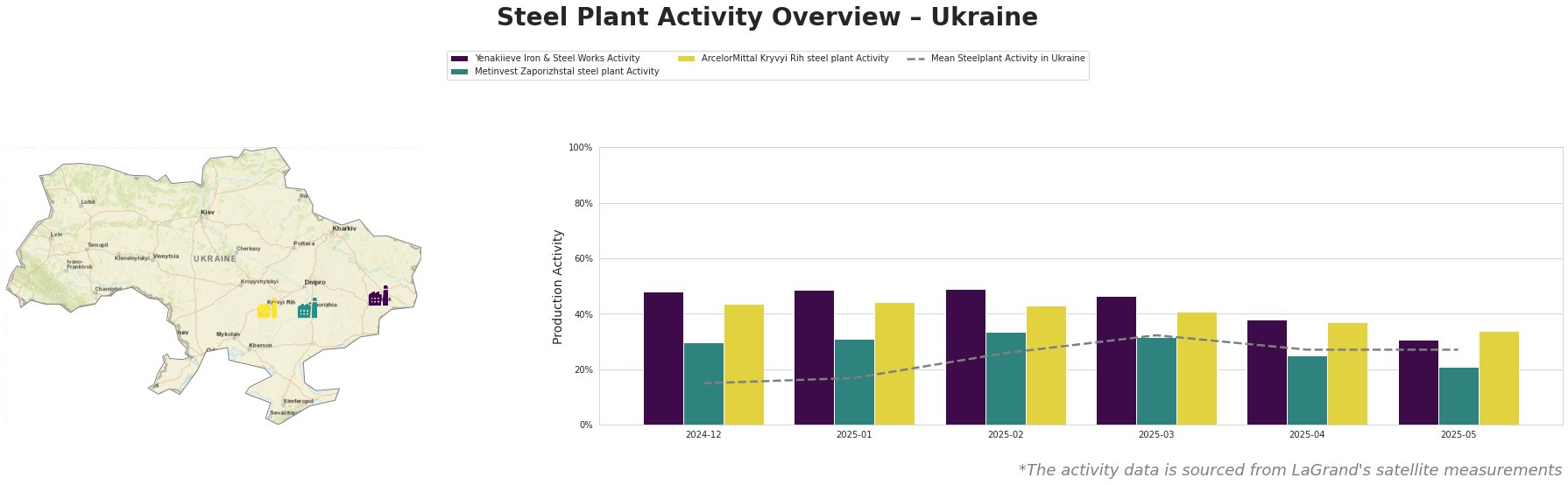

Here’s a summary of monthly steel plant activity:

From December 2024 to March 2025, the mean steel plant activity in Ukraine increased significantly from 15% to 32%. However, activity decreased to 27% in both April and May 2025. Yenakiieve Iron & Steel Works consistently operated above the Ukrainian mean until April 2025. Activity at Metinvest Zaporizhstal and ArcelorMittal Kryvyi Rih has consistently been around the Ukrainian mean, dropping below the average in April and May 2025.

Yenakiieve Iron & Steel Works

Yenakiieve Iron & Steel Works, located in Donetsk, features a 3,300 TTPA crude steel capacity based on BOF technology and relies on integrated BF production. It produces semi-finished and finished rolled products like square billets, rebar, angles, and beams. Its activity decreased from a high of 49% between January and February to 31% in May 2025. This drop is significant and falls below the national average. The news articles do not directly address production changes at this specific plant, so no immediate connection can be made between the EU-UK deal and the observed production figures.

Metinvest Zaporizhstal steel plant

Metinvest Zaporizhstal, based in Zaporizhzhia, boasts a 4,100 TTPA crude steel capacity and uses integrated BF production, with plans for a new 3,200 TTPA BOF. Its product focus lies on finished rolled products like hot-rolled coil and cold-rolled sheets. The plant’s activity mirrored the average Ukrainian activity trend until March 2025. Its activity peaked at 34% in February 2025 but declined significantly to 21% in May 2025, falling below the Ukrainian mean. As with Yenakiieve, there’s no direct, news-supported correlation between plant activities and the EU-UK deals.

ArcelorMittal Kryvyi Rih steel plant

ArcelorMittal Kryvyi Rih, situated in Dnipropetrovsk, has a substantial 8,000 TTPA crude steel capacity, using integrated BF production with both BOF and OHF technologies. Its diverse product portfolio includes semi-finished and finished rolled products, such as billets, rebar, and sections. Activity also decreased, from a high of 44% at the start of the year, to 34% in May 2025, falling below the Ukrainian mean. There is no direct, news-supported correlation between plant activities and the EU-UK deals.

Evaluated Market Implications

While the news surrounding the EU-UK trade deal “UK and EU reach new deal to set out post-Brexit relations“, “EU, UK to ‘work towards’ linking carbon markets“, and “UK Steel welcomes linking with EU carbon markets” points to improved market access and reduced trade friction, particularly concerning steel exports, the recent activity data reveals a potential disconnect. Despite the positive sentiment driven by these agreements, observed plant activity at all three major steel plants in Ukraine has decreased in the last two months. This suggests that the anticipated benefits of the trade agreement may not be immediately realized and could be offset by other factors currently impacting production.

Procurement Recommendations:

- Short-Term Caution: Despite the generally positive outlook, the recent dip in production across major Ukrainian steel plants suggests a need for caution in the short term.

- Monitor Yenakiieve: The significant drop in activity at Yenakiieve Iron & Steel Works warrants careful monitoring. Steel buyers relying on products like rebar, wire rods, and angles from this plant should proactively secure alternative supply options to mitigate potential disruptions.

- Negotiate Contracts: Steel buyers should leverage the news of reduced trade friction and potential tariff savings described in “UK and EU reach new deal to set out post-Brexit relations” to negotiate more favorable contract terms.

- Assess Long-Term Impact: The EU-UK carbon market linking discussed in “EU, UK to ‘work towards’ linking carbon markets” and “UK Steel welcomes linking with EU carbon markets” is anticipated to reduce costs and provide long-term security. However, the actual impact depends on the timeline and implementation of the linking mechanism. Procurement professionals should actively monitor the progress of this initiative and factor potential cost savings into their long-term planning, without making any immediate commitments before further information on the actual implementation is avaliable.