From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Surge: Long Product Exports Rise Amidst Increased Imports

Ukraine’s steel sector shows a mixed but overall positive trend. “Ukraine increase exports of long products by 26% y/y in January-April” indicates a strong export performance in long steel products. Concurrently, “Ukraine increased imports of long products by 81.1% y/y in January-April” reveals a substantial increase in import volumes, potentially pointing to domestic demand exceeding local production. It is important to note that while the news articles suggest export and import volumes are up, no direct relationship can be established between the increased long product exports and imports reported and the changes observed in steel plant activity levels.

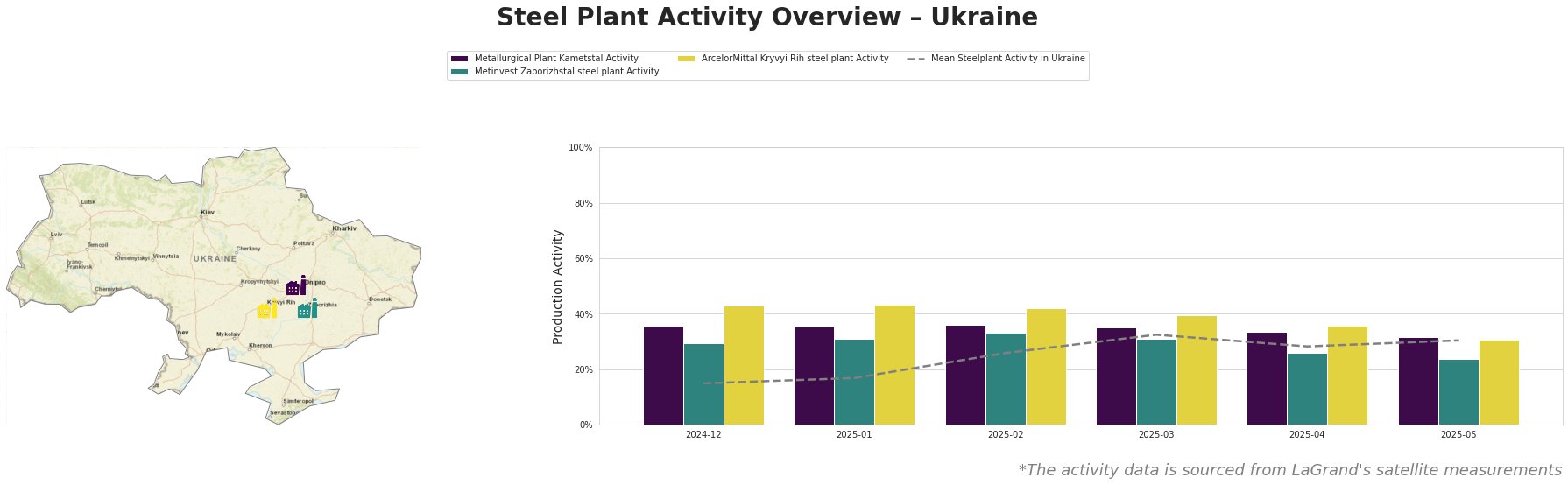

The average steel plant activity in Ukraine increased significantly from 15.0% at the end of 2024 to 30.0% in May 2025, peaking at 32.0% in March 2025, followed by a slight decrease in April. Metallurgical Plant Kametstal showed relatively stable activity, fluctuating between 32.0% and 36.0%. Metinvest Zaporizhstal steel plant activity decreased from 30.0% to 24.0% over the same period, showing the lowest values compared to other plants. ArcelorMittal Kryvyi Rih steel plant also experienced a decrease, from 43.0% to 31.0%. No direct correlation can be established between observed plant activity changes and “Ukraine increased exports of ferrous scrap by 95% year-on-year“.

Metallurgical Plant Kametstal, located in Dnipropetrovsk, primarily uses basic oxygen furnace (BOF) technology with a crude steel capacity of 4.2 million tonnes per annum (TTPA). The plant mainly produces semi-finished and finished rolled products, including wire rods and rails. Activity at Kametstal remained relatively stable, ranging between 32% and 36% from December 2024 to May 2025. No direct link between this trend and the rise in long product exports reported in “Ukraine increase exports of long products by 26% y/y in January-April” can be established.

Metinvest Zaporizhstal, situated in Zaporizhzhia, has a crude steel capacity of 4.1 million TTPA, relying on open-hearth furnace (OHF) technology. Its main products include hot-rolled coils and sheets, catering to the automotive and steel packaging sectors. The plant’s activity decreased from 30% in December 2024 to 24% in May 2025, consistently below the average activity level of observed steel plants in Ukraine. Despite the overall increase in imports reported in “Ukraine increased imports of long products by 81.1% y/y in January-April”, no specific reason can be assigned to the drop in activity.

ArcelorMittal Kryvyi Rih, also in Dnipropetrovsk, is the largest of the three, with a crude steel capacity of 8 million TTPA, using both BOF and OHF processes. It produces a wide range of products, from billets and rebar to sinter and coke, serving the building and infrastructure sectors. The plant’s activity decreased from 43% in December 2024 to 31% in May 2025. The decline may indicate shifting domestic market dynamics; however, no direct connection can be made to the increase in imports documented in “Ukraine increased imports of long products by 81.1% y/y in January-April”.

The increase in long product imports, as reported in “Ukraine increased imports of long products by 81.1% y/y in January-April”, coupled with the decreased activity at Metinvest Zaporizhstal steel plant and ArcelorMittal Kryvyi Rih steel plant, suggests that domestic production might not be fully meeting local demand. Therefore, steel buyers should:

1. Diversify sourcing: Given Turkey’s dominance in Ukrainian long product imports, explore alternative suppliers in other regions to mitigate risks associated with over-reliance on a single source.

2. Monitor import trends: closely track import data to anticipate potential price fluctuations and adjust procurement strategies accordingly. Focus should be on the long product imports, which according to “Ukraine increased imports of long products by 81.1% y/y in January-April” increased substantially.