From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Surge: Consumption Rises Amidst Production Shifts – August 2025

Ukraine’s steel market displays a complex picture of increased domestic consumption juxtaposed with shifting production and export dynamics. According to “Consumption of metal products in Ukraine in January–July increased to 2.3 million t,” domestic steel consumption surged, while “Exports of Ukrainian semi-finished carbon steel products decreased by 36%” indicates a notable decline in semi-finished product exports. These shifts do not yet correlate directly with observed activity changes at specific plants based on available data.

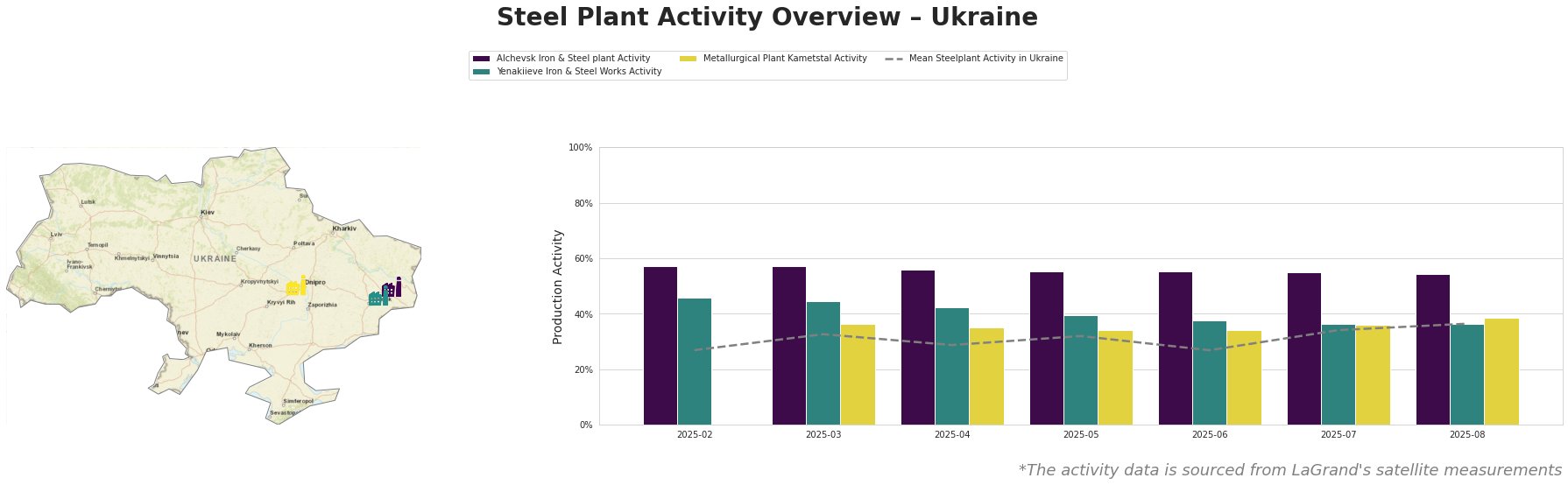

Measured Activity Overview

The average steel plant activity in Ukraine has shown volatility, reaching a high of 36% in August 2025. Alchevsk Iron & Steel plant demonstrates the highest activity levels compared to other plants, remaining consistently above the national average. Activity at Yenakiieve Iron & Steel Works and Metallurgical Plant Kametstal are below average. Metallurgical Plant Kametstal demonstrated a low of 34% activity level in May and June.

Alchevsk Iron & Steel plant

Alchevsk Iron & Steel plant, located in Luhansk, has a crude steel capacity of 5472 thousand tons per annum (ttpa) utilizing BOF technology and an iron capacity of 5320 ttpa using BF. It primarily produces semi-finished products like slabs and square billets, as well as finished rolled structural shapes. Satellite data shows a slight decrease in activity, from 57% in February-March 2025 to 54% in August 2025. While Turkey increased billet imports from Ukraine, as mentioned in “Turkey increased imports of billets from Ukraine by 70.6% year-on-year during January–June,” the plant’s output trend suggests that Alchevsk’s capacity is not directly scaling with that increased demand. No direct connection between the slight decrease in activity and news events can be established based on the provided data.

Yenakiieve Iron & Steel Works

Yenakiieve Iron & Steel Works, situated in Donetsk, has a crude steel production capacity of 3300 ttpa, employing BOF technology, alongside an iron production capacity of 2600 ttpa through BF. Its product range includes semi-finished goods (square billets) and finished rolled products such as rebar, wire rods, channels, angles, and beams. The plant’s activity has steadily declined from 46% in February 2025 to 36% in August 2025. The decline could relate to the overall decrease in semi-finished product exports as outlined in “Exports of Ukrainian semi-finished carbon steel products decreased by 36%,” however, a direct causal link cannot be confirmed based on the provided data alone.

Metallurgical Plant Kametstal

Metallurgical Plant Kametstal, located in Dnipropetrovsk, boasts a crude steel production capacity of 4200 ttpa via BOF and an iron capacity of 4350 ttpa using BF technology. Its product portfolio includes semi-finished goods and a variety of finished rolled products like wire rods, rails, and pipes, serving the energy and transport sectors. Activity at Kametstal has seen a minor increase from 36% in March and July to 38% in August. No direct connection between this increase and the news articles can be established.

Evaluated Market Implications

The increase in steel consumption reported in “Consumption of metal products in Ukraine in January–July increased to 2.3 million t,” coupled with the decrease in exports reported in “Exports of Ukrainian semi-finished carbon steel products decreased by 36%,” implies a greater domestic need that cannot fully be met by local production. This is further complicated by variable plant activity levels, particularly the decline at Yenakiieve Iron & Steel Works.

Recommended Procurement Actions:

- Steel buyers should prioritize securing long-term contracts with Metallurgical Plant Kametstal to leverage its slightly increased production and focus on finished rolled products if those are required.

- Steel analysts should closely monitor activity levels at Alchevsk Iron & Steel plant, given its historically high activity, to understand the potential for billet supply adjustments. Given their high output, a decrease in output from Alchevsk could impact the Turkey billet market reported in “Turkey increased imports of billets from Ukraine by 70.6% year-on-year during January–June“