From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Strong Production Levels Amidst European Decarbonization Efforts

Ukraine’s steel sector shows robust production levels. While improvements in the UK’s steel production are not anticipated to have an immediate impact on the Ukrainian market, the long-term global shift towards greener steelmaking methods might influence investment and export opportunities in Ukraine. The news articles “Tata Steel UK orders electrification package for Port Talbot from ABB” (Published: 2025-07-30T15:20:21Z, 2025-07-30T22:00:00Z, and 2025-07-30T22:00:00Z) highlight decarbonization trends in the UK but do not directly correlate with any changes observed in Ukrainian plant activity levels.

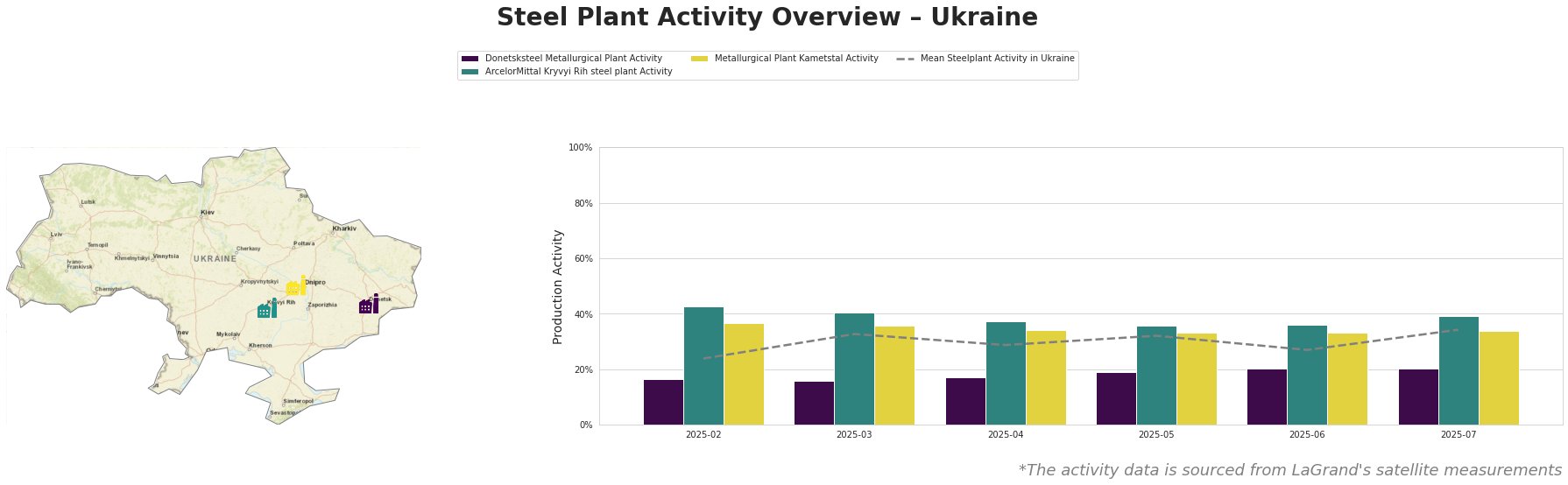

Overall, the mean steel plant activity in Ukraine has fluctuated, showing a general upward trend from 24% in February to 34% in July. Donetsksteel Metallurgical Plant consistently demonstrates the lowest activity levels among the three plants, peaking at only 20% in June and July. ArcelorMittal Kryvyi Rih shows the highest activity, starting at 43% in February, dipping to 36% in May, and climbing back to 39% in July. Metallurgical Plant Kametstal shows consistent activity levels compared to the other plants, with no major variations. No direct link between the UK news articles and activity levels at these Ukrainian plants can be established based on the provided information.

Donetsksteel Metallurgical Plant, located in Donetsk, primarily produces pig iron using integrated (BF) processes with a BF capacity of 1500 tonnes. It has a workforce of 3600. Activity levels have remained consistently low, ranging between 16% and 20% during the observed period, and have remained below the average Ukrainian steel plant activity level. There is no clear correlation between these activity levels and the news of Tata Steel’s electrification efforts in Port Talbot, UK.

ArcelorMittal Kryvyi Rih, situated in Dnipropetrovsk, is a large integrated steel plant (BF) with a crude steel capacity of 8000 tonnes, with 6500 tonnes from BOF and 1500 tonnes from OHF. It possesses a BF capacity of 11450 tonnes, a sinter capacity of 13331 tonnes, and a coking capacity of 2400 tonnes. The plant employs 19700 workers and produces semi-finished and finished rolled products. Activity at ArcelorMittal Kryvyi Rih has been above the Ukrainian average for most of the observed period, starting at 43% in February and ending at 39% in July, following a slight dip in between. There’s no evident impact from the news about Tata Steel UK’s decarbonization project on ArcelorMittal’s operations in Kryvyi Rih.

Metallurgical Plant Kametstal, also in Dnipropetrovsk, operates with integrated (BF) processes and produces semi-finished and finished rolled products, including billets, wire rods, and rails. It has a crude steel capacity of 4200 tonnes and a BF capacity of 4350 tonnes. The plant’s activity levels have been relatively stable, ranging from 33% to 37%, and generally around the average Ukrainian steel plant activity. No connection between the plant’s activity and the news regarding Tata Steel’s UK operations is discernible.

Given the stable to positive production trends in Ukraine and the absence of immediate disruption signals, steel buyers should:

- Maintain existing procurement strategies: Current supply chains from ArcelorMittal Kryvyi Rih and Metallurgical Plant Kametstal appear stable, warranting no immediate changes.

- Monitor long-term decarbonization trends: While the UK’s electrification project (“Tata Steel UK orders electrification package for Port Talbot from ABB”) doesn’t directly impact Ukraine now, track global shifts towards EAF technology for potential future investment and export strategy adjustments.

- Carefully monitor Donetsksteel: This plant is producing at consistently lower levels than competitors in the region and should not be considered a reliable source for procurement without further investigation and risk mitigation.