From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Strengthens: Pig Iron Exports Surge Amidst Domestic Consumption Growth

Ukraine’s steel market shows positive signs in the first half of 2025, as evidenced by increased pig iron production and domestic steel consumption. According to “pig iron smelting in Ukraine increased by 6% in the first half of the year“, pig iron production rose, signaling a recovery in this sector. “Consumption of steel products in Ukraine rose to 1.94 million tons in January-June” corroborates this by noting increased domestic steel consumption, which supports the increased production. No direct link between these articles and observed plant activity changes can be established.

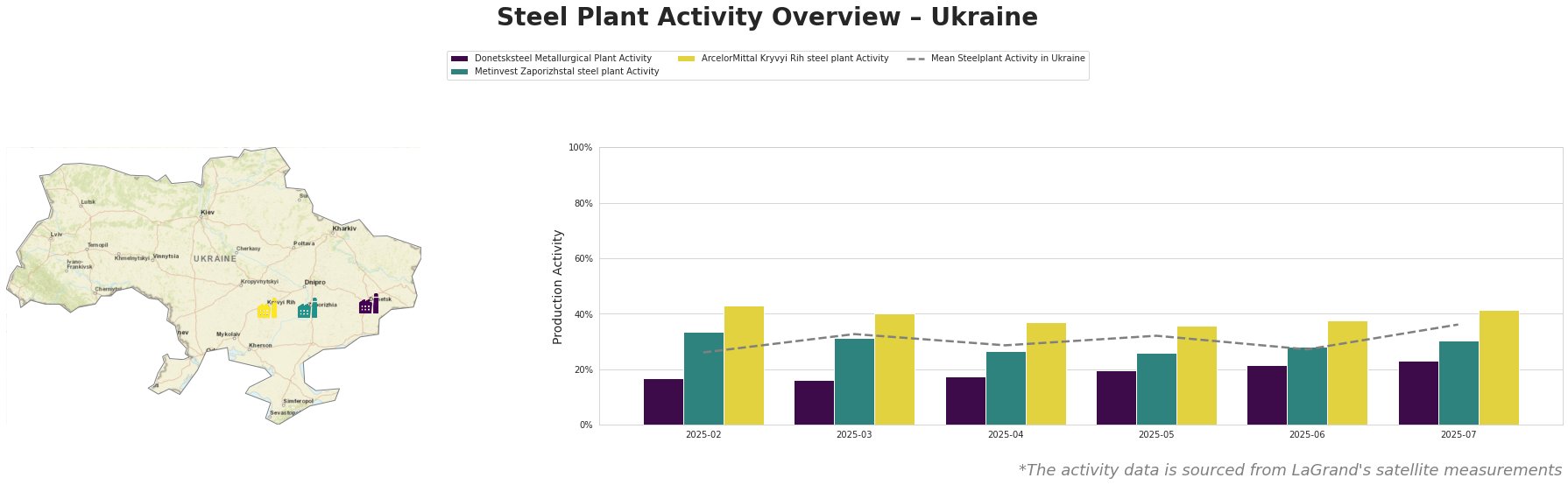

Steel Plant Activity Analysis:

The average steel plant activity in Ukraine shows an upward trend, increasing from 26% in February to 36% in July. Donetsksteel Metallurgical Plant’s activity increased steadily from 17% in February to 23% in July, remaining consistently below the national average. Metinvest Zaporizhstal’s activity fluctuated, reaching a low of 26% in April and May before rising to 30% in July. ArcelorMittal Kryvyi Rih consistently exhibited the highest activity levels, ranging from 36% to 43%, with a notable peak in February.

Steel Plant Name: Donetsksteel Metallurgical Plant

Donetsksteel Metallurgical Plant, located in Donetsk, has a crude steel capacity of 0 and pig iron capacity of 1,500 ttpa utilizing integrated (BF) main process. Satellite observations indicate that plant activity increased from 17% in February to 23% in July, but remains significantly below the national average. This increase in activity does not appear to directly correlate to any of the news articles provided, suggesting localized factors may be influencing production.

Steel Plant Name: Metinvest Zaporizhstal steel plant

Metinvest Zaporizhstal, situated in Zaporizhzhia, has a crude steel capacity of 4,100 ttpa and pig iron capacity of 4,359 ttpa with integrated (BF) process. The plant produces finished rolled products. Plant activity fluctuated between 26% and 33% during the observed period, ending at 30% in July. While “Consumption of steel products in Ukraine rose to 1.94 million tons in January-June” reported higher domestic demand, no direct impact on the satellite-observed activity of this plant could be established.

Steel Plant Name: ArcelorMittal Kryvyi Rih steel plant

ArcelorMittal Kryvyi Rih, located in Dnipropetrovsk, has a crude steel capacity of 8,000 ttpa and iron capacity of 11,450 ttpa using integrated (BF) process, producing semi-finished and finished rolled products. This plant has consistently exhibited the highest activity levels compared to other Ukrainian steel plants. Although the mean plant activity in Ukraine is growing according to “pig iron smelting in Ukraine increased by 6% in the first half of the year“, there is no established connection to ArcelorMittal’s specific growth of activity according to satellite observation.

Evaluated Market Implications:

The article “Ukraine increased pig iron exports by 47.5% y/y in 1H2025” indicates a significant surge in pig iron exports, especially to the United States. While Donetsksteel Metallurgical Plant’s activity is increasing, it remains below the national average. Given this, and the focus on exports, steel buyers should anticipate potential shifts in the availability of pig iron in the domestic market.

Procurement Actions:

- Pig Iron Buyers: Given the surge in pig iron exports reported in “Ukraine increased pig iron exports by 47.5% y/y in 1H2025“, specifically with increased demand from the US, procurement professionals should proactively secure contracts with Ukrainian pig iron producers to mitigate potential supply shortages in the domestic market.

- Market Analysts: Closely monitor the export trends of pig iron, particularly the demand from the United States and Italy, as highlighted in “Ukraine increased pig iron exports by 47.5% y/y in 1H2025“, to assess the impact on domestic steel prices and availability. Also, keep an eye on “Ukraine reduced iron ore exports by 11.9% y/y in 1H2025“, as this can create upstream bottlenecks in the market.