From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Resilience Despite Challenges, Scrap Supply Concerns Emerge

The Ukrainian steel market demonstrates continued activity despite ongoing regional challenges. According to “UK Steel warns of scrap shortages as domestic EAF capacity expands, calls for stronger scrap supply chain” and related articles, the UK steel industry faces scrap supply chain issues that, while not directly impacting Ukrainian plants, highlight potential vulnerabilities for regions relying on EAF technology and scrap imports. While the article “Steel producers and metal recyclers unite to strengthen UK’s industrial supply chain” suggests positive developments in circular steel economies, the Ukrainian market must remain vigilant. No direct link between these articles and Ukrainian plant activities can be established based on the data provided.

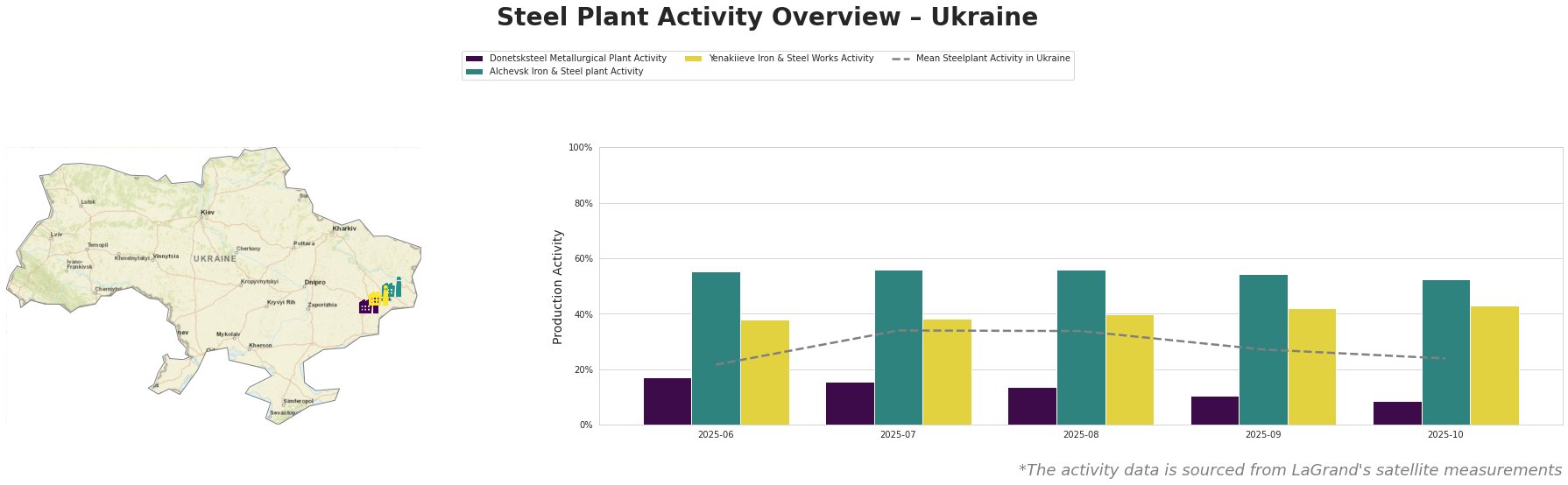

Overall, Ukrainian steel plant activity shows a fluctuating but generally stable trend. The mean activity started at 22.0% in June, peaked at 34.0% in July and August, and then gradually decreased to 24.0% by October.

Donetsksteel Metallurgical Plant: This plant, with a 1500 ttpa iron production capacity and operating via the integrated (BF) route, exhibited the lowest activity levels compared to other plants and the Ukrainian mean. Its activity consistently declined from 17.0% in June to a low of 9.0% in October. This decline does not have any immediately evident connection to the UK-focused articles about scrap shortages.

Alchevsk Iron & Steel plant: This plant, with a 5472 ttpa crude steel capacity (BOF) and 5320 ttpa iron capacity (BF), consistently showed the highest activity levels, ranging from 52.0% to 56.0%. While a slight decrease from 56.0% in July and August to 52.0% in October is observed, the plant maintains a significantly higher activity level compared to the Ukrainian mean. There is no indication this trend relates to the UK scrap market.

Yenakiieve Iron & Steel Works: This plant, with a 3300 ttpa crude steel capacity (BOF) and 2600 ttpa iron capacity (BF), showed a slight upward trend in activity, increasing from 38.0% in June and July to 43.0% in October. This is counter to the overall mean decline in Ukraine, but the cause of this trend cannot be linked to the provided articles about the UK scrap market.

The provided news articles focus on the UK scrap metal supply chain and its implications for domestic steel production using EAF technology. While Alchevsk and Yenakiieve rely primarily on BOF (Basic Oxygen Furnace) technology, meaning they rely less on scrap compared to EAF. Donetsksteel employs both BF and EAF technology, but due to very low recent activity a correlation can not be established. Given these conditions, the reported UK scrap market situation does not appear to directly impact these Ukrainian steel plants, but market analysts should be aware of the general trend towards scrap reliance and circular steel production highlighted in “Circular Steel Sub-Committee releases UK steel recycling report” and “British steelmakers call for strengthening of scrap supply chain in the country“.

Evaluated Market Implications:

Based on the activity data, the Alchevsk Iron & Steel plant seems to be a more reliable supplier than Donetsksteel Metallurgical Plant due to consistently higher activity levels.

Recommended Procurement Actions:

- Steel Buyers: Diversify your sources, giving preference to Alchevsk Iron & Steel plant. Closely monitor Donetsksteel Metallurgical Plant’s activity for any potential recovery; however, do not rely on it in the short term.

- Market Analysts: Continue to monitor the impact of the scrap supply on global steel markets, including Ukraine, even if direct effects are not immediately apparent. Scrutinize activity reports on Donetsksteel.