From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Resilience Amidst EU Trade Consultations and UK-US Tariff Deal

Ukraine’s steel sector demonstrates overall positive market sentiment, driven by improving activity levels, with future uncertainties around EU import guarantees. While “UK, US near final deal to eliminate steel tariffs following quota breakthrough” is expected to positively influence global steel trade, direct impact on Ukrainian steel plants isn’t immediately observable in current activity data. Simultaneously, the “EU begins consultations on future steel import guarantees“, signaling potential shifts in trade policy that might affect Ukraine’s access to European markets, warranting careful monitoring despite no direct observed plant activity changes at this time.

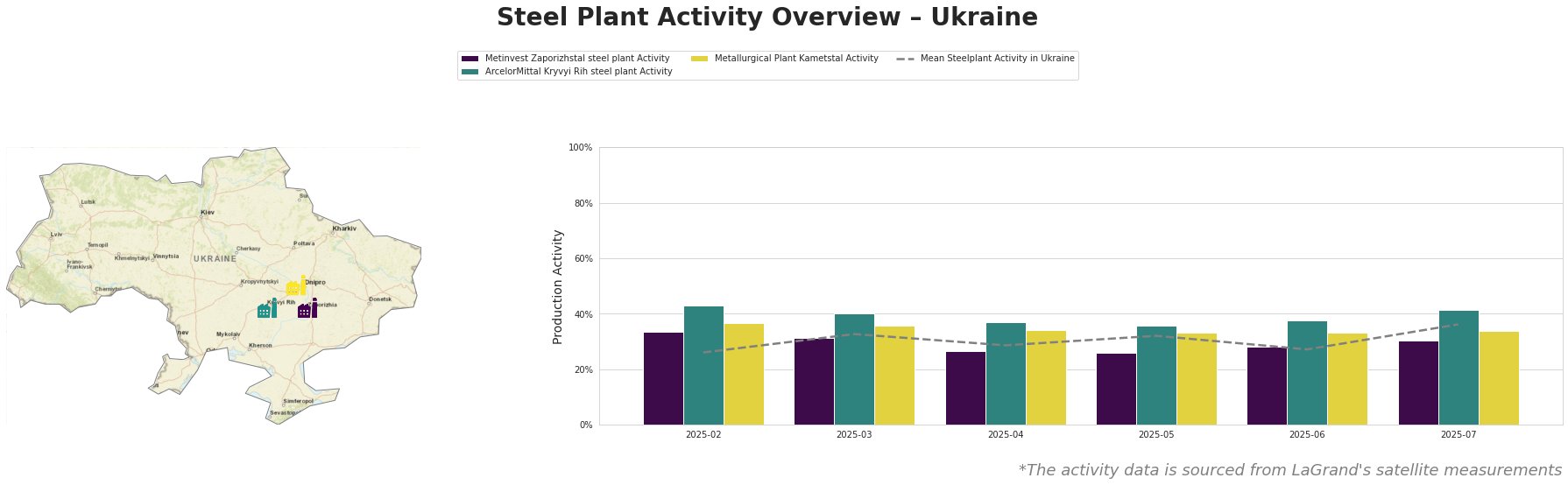

Monthly Steel Plant Activity in Ukraine

The mean steel plant activity in Ukraine has shown a general upward trend, rising from 26% in February to 36% in July, indicating a recovery. ArcelorMittal Kryvyi Rih consistently exhibits higher activity levels than the mean, peaking at 43% in February, while Metinvest Zaporizhstal generally operates below average.

Plant Information

Metinvest Zaporizhstal, an integrated BF-OHF steel plant with a crude steel capacity of 4.1 million tonnes per annum (TTPA), specializing in finished rolled products like hot-rolled coil, showed a decrease in activity from 33% in February to 26% in April and May, followed by a recovery to 30% in July. This fluctuation doesn’t directly correlate with any of the provided news articles.

ArcelorMittal Kryvyi Rih, a major integrated BF-BOF-OHF steel plant with a crude steel capacity of 8 million TTPA, produces semi-finished and finished rolled products, including rebar and wire rod. The plant consistently shows activity levels above the Ukrainian average, with activity rising to 41% in July. No direct link to the provided news could be established.

Metallurgical Plant Kametstal, an integrated BF-BOF plant with a crude steel capacity of 4.2 million TTPA, focusing on semi-finished and finished rolled products such as square billets and wire rods, showed relatively stable activity levels between 33% and 37% from February through July. There’s no apparent correlation between its activity and any of the provided news pieces.

Evaluated Market Implications

While the “UK, US near final deal to eliminate steel tariffs following quota breakthrough” improves overall market sentiment, the “EU begins consultations on future steel import guarantees” introduces uncertainty regarding long-term export opportunities for Ukrainian steelmakers.

-

Potential Supply Disruptions: No immediate supply disruptions are indicated by the plant activity data.

-

Recommended Procurement Actions:

- For steel buyers focusing on EU markets: Closely monitor the outcomes of the “EU begins consultations on future steel import guarantees.” Consider diversifying supply sources outside the EU if stricter import regulations are implemented.

- For steel buyers sourcing specific products from Metinvest Zaporizhstal: Closely monitor its output, as it is the only one of the selected plants with a decrease in activity. Prepare for possible spot shortages and higher prices in the short term.