From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Mixed Signals: Pig Iron Exports Dip Amidst Rising Flat Steel Production

Ukraine’s steel market presents a complex picture. While crude steel and rolled steel production saw slight increases in the first four months of 2025, as reported in “Ukraine reports 8.1 percent rise in pig iron output for Jan-Apr“, pig iron exports experienced a significant decline in April, detailed in “Ukraine reduced pig iron exports by 60% m/m in April“. This shift is reflected in the satellite-observed activity levels, showing variations across different steel plants, though a direct relationship could not be definitively established.

Observed Activity Overview:

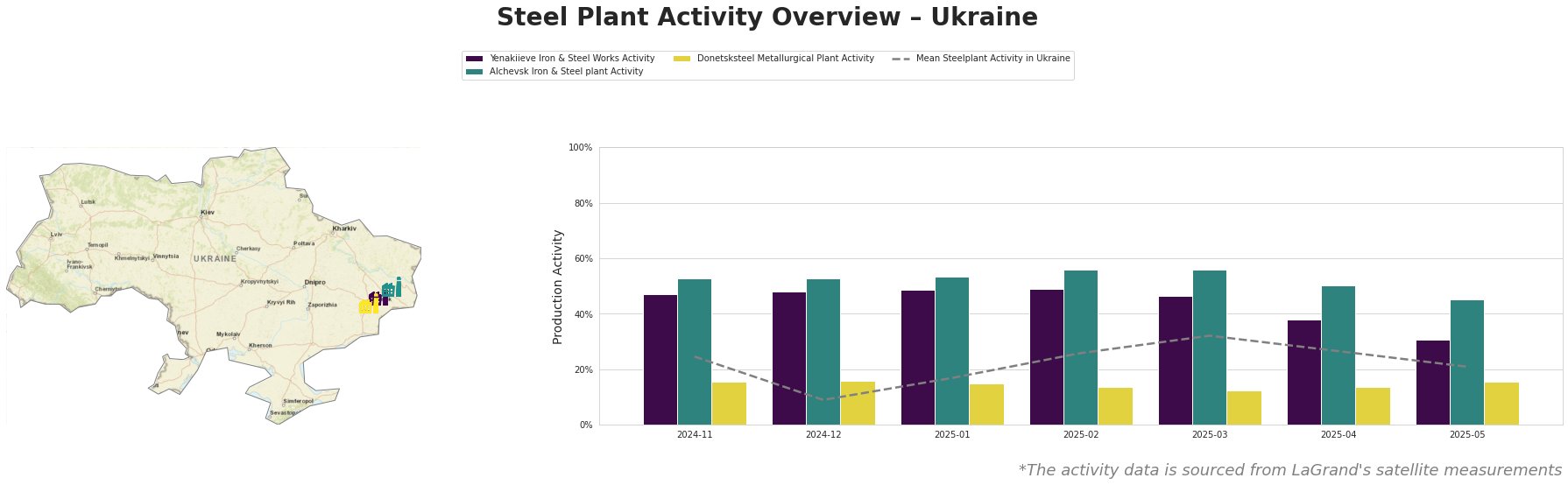

The mean steel plant activity in Ukraine peaked in March 2025 at 32.0%, before declining to 21.0% by the end of May. Yenakiieve Iron & Steel Works and Alchevsk Iron & Steel plant consistently operated above the mean activity level. Alchevsk Iron & Steel plant recorded the highest activity level at 56.0% in February and March, whereas Donetsksteel Metallurgical Plant remained significantly below the mean across all months. The recent decline in the average steel plant activity is in line with the pig iron export reduction reported in “Ukraine reduced pig iron exports by 60% m/m in April,” though no direct causal link can be explicitly established.

Yenakiieve Iron & Steel Works, located in Donetsk, has a crude steel capacity of 3.3 million tons using BOF technology, focusing on semi-finished and finished rolled products. The plant’s activity level decreased from 49.0% in February 2025 to 31.0% in May, reflecting a notable downtrend. This decline may contribute to the overall decrease in pig iron exports detailed in “Ukraine reduced pig iron exports by 60% m/m in April” given that Yenakiieve produces semi-finished products, however, a direct connection cannot be stated.

Alchevsk Iron & Steel plant, situated in Luhansk, boasts a larger crude steel capacity of 5.472 million tons, also utilizing BOF technology and focusing on semi-finished and finished rolled products. The plant’s activity has decreased from a high of 56.0% in February-March 2025 to 45% in May, mirroring the broader market trend. No direct link can be made between the activity reduction and available reports.

Donetsksteel Metallurgical Plant, also in Donetsk, has a pig iron capacity of 1.5 million tons, utilizing BF technology. This plant’s activity remained consistently low, fluctuating between 12.0% and 16.0%, indicating limited production output. This could be aligned with the reduction of pig iron production and exports described in “Ukraine reduced pig iron exports by 60% m/m in April” and “Ukraine reports 8.1 percent rise in pig iron output for Jan-Apr“.

Evaluated Market Implications:

Reduced pig iron exports, as highlighted in “Ukraine reduced pig iron exports by 60% m/m in April“, coupled with the decline in activity at Yenakiieve Iron & Steel Works and Alchevsk Iron & Steel plant, could potentially lead to supply disruptions in semi-finished steel products.

Procurement Action Recommendation:

For steel buyers, it is advisable to diversify pig iron and semi-finished steel sourcing to mitigate risks associated with potential supply constraints, especially considering the significant drop in Ukrainian pig iron exports to the US as per “Ukraine reduced pig iron exports by 60% m/m in April“. Focus on regions not heavily reliant on Ukrainian exports. Given the increase in flat steel exports reported in “Ukraine’s flat steel exports up 4.1 percent in Jan-Apr“, buyers requiring flat steel should monitor the situation, however, as it could suggest some supply stability for this product category.