From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Mixed Signals: Flat Steel Exports Rise Amidst Semi-Finished Decline

Ukraine’s steel sector presents a nuanced picture. Flat steel exports increased, while semi-finished exports declined, as reported in “Ukraine’s flat steel exports up 6.1 percent in Jan-May 2025” and “Ukraine reduced semi-finished products’ exports by 34% y/y in January-May“. These export shifts coincide with satellite observations showing fluctuating, but overall resilient activity at key steel plants, though a direct causal relationship cannot be definitively established.

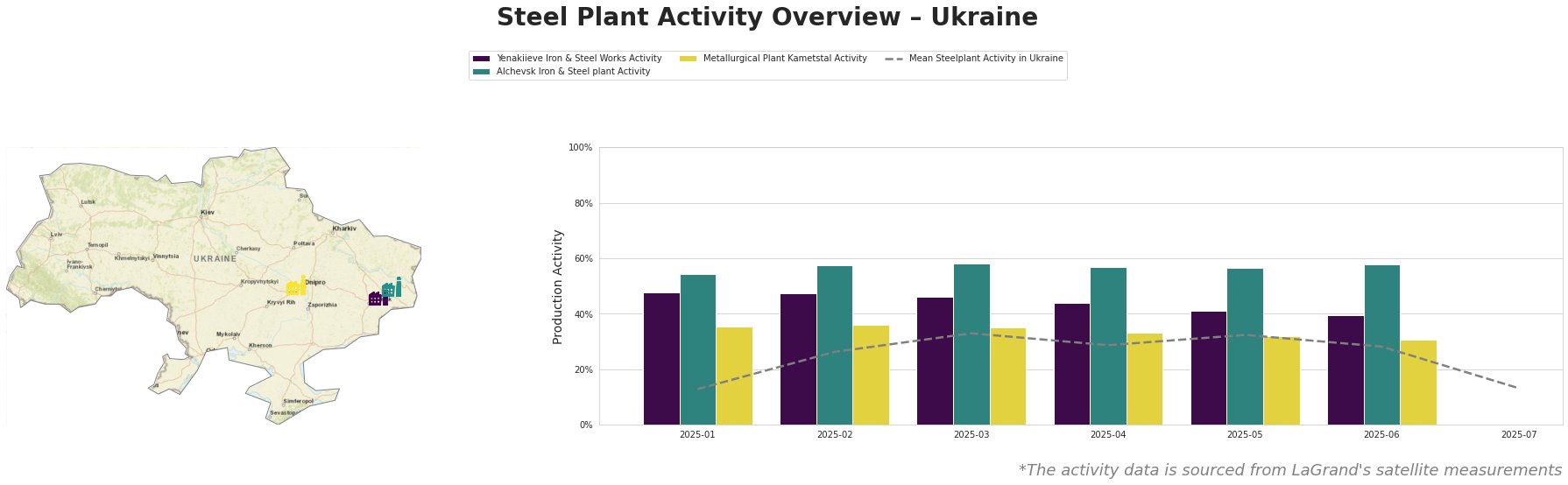

Measured Activity Overview

Plant activity across the observed steelworks in Ukraine peaked in March 2025, with an average activity level of 33%. Since then, there’s been a general decline in activity levels, with the lowest recorded for July 2025 (13%). Yenakiieve Iron & Steel Works showed the most substantial decline, dropping from 48% in January to 40% in June. In contrast, Alchevsk Iron & Steel Plant maintained a relatively stable activity level, hovering around 57-58% throughout the observed period, consistently exceeding the Ukrainian average. Metallurgical Plant Kametstal exhibited a gradual decrease from 36% in January to 31% in June, consistently remaining below the average activity level. These observed activity changes do not have a directly attributable connection to any of the provided news articles.

Yenakiieve Iron & Steel Works

Yenakiieve Iron & Steel Works, located in the Donetsk region, is an integrated steel plant with a crude steel capacity of 3.3 million tons per annum (ttpa) using basic oxygen furnace (BOF) technology. The plant produces semi-finished and finished rolled products, including square billets, rebar, wire rods, channels, angles, and beams. Satellite data reveals a consistent decline in activity from 48% in January 2025 to 40% in June 2025. This decline could potentially impact the availability of their specific product range, however no direct link with any news article can be established. This plant holds a ResponsibleSteel Certification.

Alchevsk Iron & Steel plant

Alchevsk Iron & Steel plant, situated in the Luhansk region, is an integrated BF-BOF steel plant with a crude steel capacity of 5.472 million tons. The plant produces slabs, square billets and structual shapes. Alchevsk demonstrates relative stability, holding ResponsibleSteel Certification. The plant’s steady activity levels, observed via satellite, do not show any immediate correlation with the trade trends described in “Ukraine reduced semi-finished products’ exports by 34% y/y in January-May“, despite producing semi-finished goods.

Metallurgical Plant Kametstal

Metallurgical Plant Kametstal, located in the Dnipropetrovsk region, is an integrated steel plant with a crude steel capacity of 4.2 million tons per annum. Utilizing BOF technology, the plant produces square billets, wire rods, rails, pipes, grinding balls, circles, and shaped profiles, serving the energy and transport sectors. The plant demonstrates a declining activity from 36% in January 2025 to 31% in June 2025. The plant is certified with ISO14001:2019 and ResponsibleSteel Certification. Similar to Yenakiieve, no direct relationship can be established with the news articles based on the observed activity trends.

Evaluated Market Implications

The increase in flat steel exports, highlighted in “Ukraine’s flat steel exports up 6.1 percent in Jan-May 2025” and “Ukraine increased flat rolled products’ exports by 6.1% y/y in January-May“, coupled with increased flat steel imports “Ukraine increased imports of flat rolled steel by 17.2% y/y in January-May” and “Imports of flat rolled products to Ukraine have increased, with Turkey, Poland and Slovakia as supply leaders.” suggests a shifting domestic market. Procurement professionals sourcing flat steel should:

- Diversify Import Sources: Given the increase in flat steel imports and Turkey’s dominant role as a supplier (mentioned in “Imports of flat rolled products to Ukraine have increased, with Turkey, Poland and Slovakia as supply leaders.“), steel buyers should consider diversifying their import sources to mitigate potential supply chain risks from over-reliance on a single country.

- Monitor Price Fluctuations: Despite increased export volumes of flat rolled steel, revenue decreased by 4.9% year-on-year, as stated in “Ukraine increased flat rolled products’ exports by 6.1% y/y in January-May“. Procurement teams should closely monitor price fluctuations and potentially negotiate contracts that account for these dynamics to maintain cost-effectiveness.

Procurement professionals should consider the product specifics of each plant, and the overall shifts in the market towards increased Flat Steel exports while Semi-Finished exports are decreasing.