From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Mixed Signals Despite Global Stainless Surge: Activity Analysis Reveals Procurement Insights

Ukraine’s steel sector presents a nuanced picture, with both challenges and opportunities for buyers. While global stainless steel production is on the rise, as indicated in “Global stainless steel production increased by 6.2% y/y in Q1“, Ukraine’s steel production experienced a decline. Specifically, “Steel production in Ukraine fell by 14% in May – Worldsteel” reports a 13.8% year-over-year decrease in May 2025. The satellite data showing steel plant activity levels, combined with these news reports, give important insights.

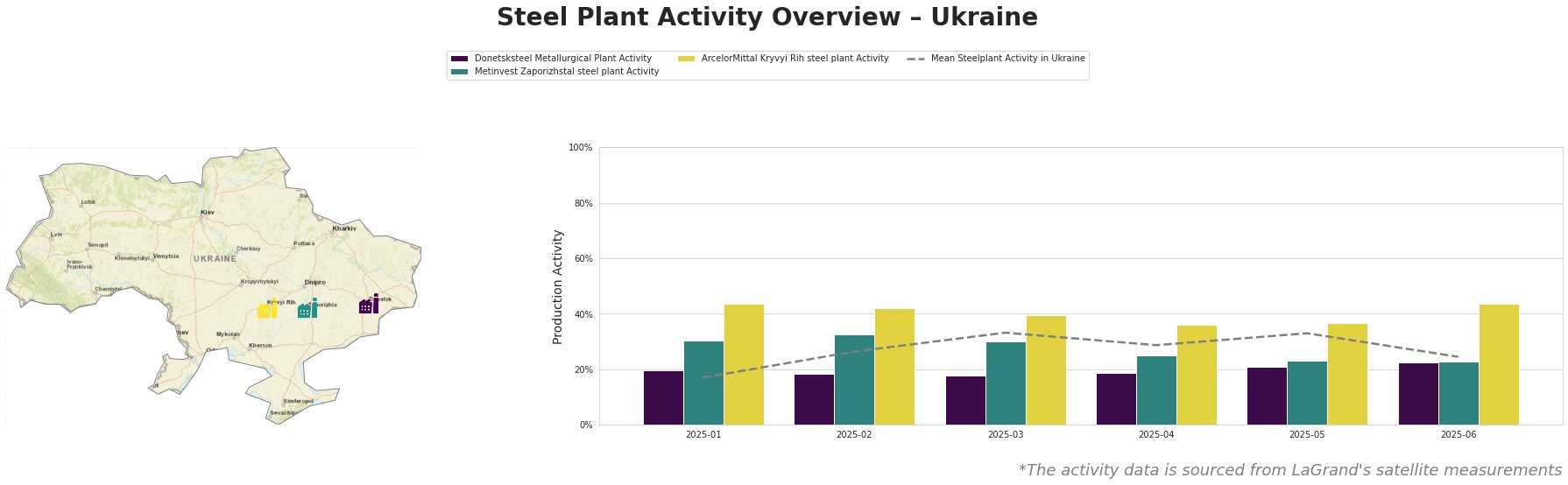

The satellite data shows that overall steel plant activity in Ukraine reached a peak in March and May at 33%, with a drop to 24% in June.

Donetsksteel Metallurgical Plant, an integrated BF producer specializing in pig iron, has consistently operated below the Ukrainian average. Its activity level has seen only a slight increase, reaching 22% in June, which does not directly align with either of the news articles about changes in overall production.

Metinvest Zaporizhstal, another integrated BF producer focused on finished rolled products, including hot-rolled coil and sheets, has also generally operated below the national average. Its activity has decreased from 32% in February to 23% in both May and June. A small recovery, not a major decline. This does not explicitly relate to the reported overall decline in Ukrainian steel production in May.

ArcelorMittal Kryvyi Rih, a major integrated BF producer with a diverse product range including billets, rebar, and wire rod, consistently shows the highest activity levels among the observed plants. Its activity fluctuated, reaching a high of 44% in January and June, with a low of 36% in April. While “Steel production in Ukraine fell by 14% in May – Worldsteel” indicates a general decline, ArcelorMittal Kryvyi Rih’s observed activity doesn’t show such decline.

Evaluated Market Implications:

The decrease in Ukrainian steel production reported in “Steel production in Ukraine fell by 14% in May – Worldsteel” warrants caution. Although the satellite data suggests that this may disproportionately impact certain producers more than others, procurement professionals should anticipate potential supply disruptions, particularly for products sourced from plants like Metinvest Zaporizhstal, where activity has dipped to below-average levels.

Given the global rise in stainless steel production reported in “Global stainless steel production increased by 6.2% y/y in Q1“, and the specific activity levels observed at each plant, procurement recommendations are as follows:

1. For buyers of products from Metinvest Zaporizhstal: Actively explore alternative suppliers or negotiate contracts with built-in flexibility to account for potential supply chain disruptions.

2. For buyers of products from ArcelorMittal Kryvyi Rih: While this plant is still the most active, closely monitor their output, because any dip at this plant would mean big impact on total Ukrainian output.

3. For buyers dependent on Ukrainian steel: Increase inventory levels to mitigate risks associated with production fluctuations. Prioritize building relationships with multiple suppliers to ensure supply chain resilience.