From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Sentiment: Critical Risks and Downward Trends in Activity

The steel market in Ukraine is facing severe challenges, driven by external pressures and declining activity at major steel plants. Recent findings from Tata Steel warns government as UK steel sector faces critical risk and UK has eight weeks to save its steel industry: Tata indicate rising competition from low-priced Chinese imports, prompting urgent calls for governmental intervention to safeguard the steel industry. These calls correlate with notable declines in operational activity at Ukrainian steel plants, particularly Metinvest Zaporizhstal and Metallurgical Plant Kametstal.

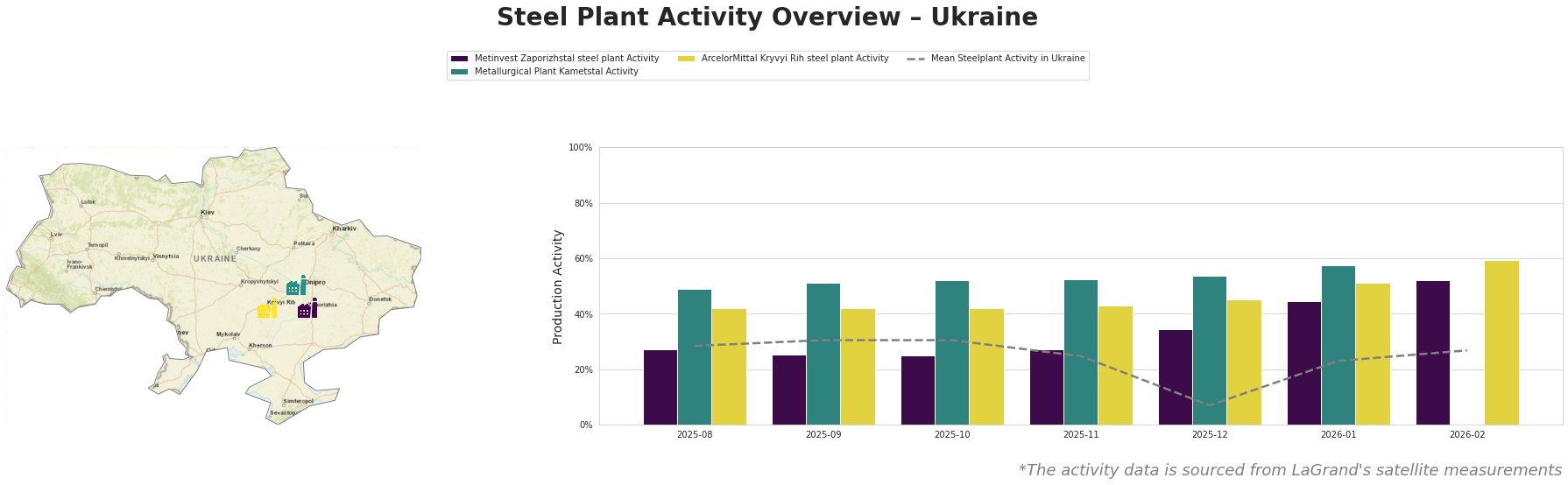

The activity data shows a notable drop in overall steel production, particularly in December 2025, when mean activity fell to 7.0%, signaling reduced operational capabilities and possibly exacerbated by factors mentioned in Tata Steel reports on different market conditions in Europe and Britain. The Metinvest Zaporizhstal plant’s activity increased to 52.0% by February 2026, but this follows a severe drop to 34.0% in December. In comparison, Metallurgical Plant Kametstal’s activity peaked at 58.0% in January, highlighting significant fluctuations without a clear link to recent developments.

Metinvest Zaporizhstal operates an integrated facility with a capacity of 4,100 TTPA, focusing on finished rolled products for sectors such as automotive. Despite experiencing an activity surge to 52.0% in February 2026, its earlier performance at 34.0% may suggest ongoing struggles, likely influenced by ISTA blames lack of investment for Tata UK issues, although no explicit linkage to the drop can be established.

Metallurgical Plant Kametstal, with a comparable crude steel capacity of 4,200 TTPA, reached 58.0% in January but faced a stark decline in subsequent months without observable recovery trends. The UK has eight weeks to save its steel industry: Tata article underscores competing pressures that could extend to Ukrainian suppliers, as rising imports further suppress local output.

ArcelorMittal Kryvyi Rih, the largest facility, showed a strong operational performance with activity rising to 59.0% in February, consistent with observed demand fluctuations. Nonetheless, given the market context, ongoing geopolitical uncertainties may limit its long-term viability.

The implications for the market indicate potential supply disruptions, especially from Metinvest and Kametstal, which might struggle to maintain stable production levels under increasing international competition. Procurement strategies for steel buyers should consider diversifying sources and actively monitoring changes stemming from geopolitical conditions affecting supply chains.

In conclusion, it is crucial for steel buyers and analysts to act swiftly to evaluate their supply chains, ensure that inventory levels are optimized against the backdrop of potential disruptions, and remain agile to changes in import regulations following the looming expiry of protective measures mentioned in multiple news reports.