From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Resilient Despite Challenges: Production Stable, Eyes on UK Trade Shifts

Ukraine’s steel market demonstrates resilience amidst global trade concerns. Activity levels at key steel plants have remained relatively stable, while the potential impact of UK trade policies warrants close monitoring. Observed activity levels do not reflect any direct impact from news regarding proposed UK steel policy changes, suggesting that the effects are not yet impacting immediate production.

Recent developments in the UK steel market, particularly the proposed import caps, may indirectly affect Ukraine. The “UK may impose country-specific caps on three steel product categories“ news suggests potential shifts in import dynamics. This measure, if implemented, could divert steel originally intended for the UK market, potentially increasing supply in other regions and impacting global pricing. However, no direct relationship could be established between that news article and changes in observed activity levels at Ukrainian steel plants. Concerns raised by UK Steel in “UK Steel: TRA’s quota cap recommendation falls short” regarding the expiry of safeguard measures and potential US tariff impacts further underscore the need for Ukrainian steel producers and buyers to closely monitor global trade flows. The call for lower electricity prices in the UK, highlighted in “British industry calls for lower electricity prices,” “UK Steel, 7Steel call for reduced electricity prices” (multiple dates), and “UK industry calls for lower electricity prices to sustain investments and net zero transition efforts” reveals the competitive pressures within the global steel industry, an issue that is likely to be monitored carefully by steel industry insiders in Ukraine. No direct connection could be established between observed activity levels and those news articles.

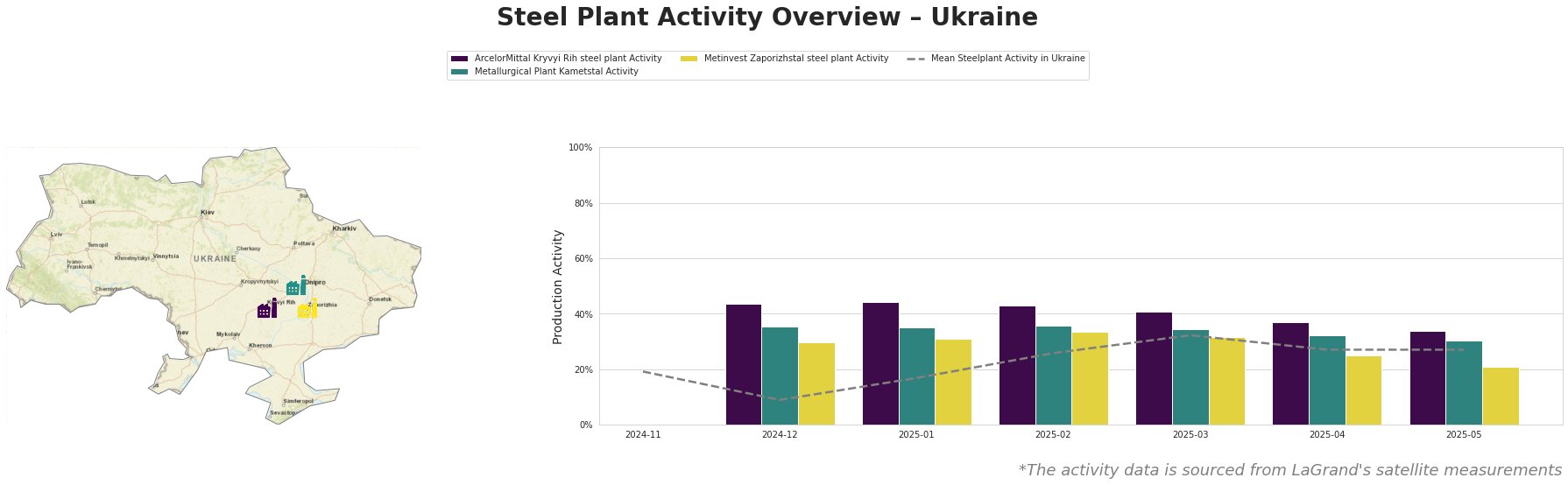

Overall, average Ukrainian steel plant activity saw a dip in December 2024 to 9.0, before steadily increasing to a peak of 32.0 in March 2025. Since then, activity has stabilized at 27.0 for the months of April and May 2025.

ArcelorMittal Kryvyi Rih, an integrated steel plant with a crude steel capacity of 8000 ttpa, primarily utilizing BOF technology and producing semi-finished and finished rolled products, has exhibited relatively stable activity. Starting from a high of 44.0 in December 2024 and January 2025, the plant saw a gradual decrease to 34.0 by May 2025, still exceeding the national average. No direct links can be established between this change and any of the provided news articles.

Metallurgical Plant Kametstal, another integrated BF-BOF plant with a crude steel capacity of 4200 ttpa focusing on semi-finished and finished rolled products for the energy and transport sectors, showed a similar pattern. Activity decreased from 35.0 in December 2024/January 2025 to 30.0 in May 2025, remaining slightly above the national average. No direct connection could be established between this decrease and any of the provided news articles.

Metinvest Zaporizhstal, an integrated BF-OHF plant producing finished rolled products for automotive and other sectors with a crude steel capacity of 4100 ttpa, demonstrated a more pronounced decline in activity. From a high of 34.0 in February 2025, activity decreased to 21.0 in May 2025, falling below the national average. No direct link can be established between this reduction and any of the provided news articles.

Given the potential for increased steel supply in global markets due to the UK’s proposed import caps (“UK may impose country-specific caps on three steel product categories”), Ukrainian steel buyers should closely monitor price fluctuations and consider negotiating forward contracts to secure favorable rates. Furthermore, the UK’s call for lowered electricity prices “British industry calls for lower electricity prices,” “UK Steel, 7Steel call for reduced electricity prices” (multiple dates), and “UK industry calls for lower electricity prices to sustain investments and net zero transition efforts” signals heightened competition; steel buyers should diversify their supply sources to mitigate risks associated with potential shifts in regional competitiveness. Market analysts should carefully examine the impact of the UK’s proposed measures on global steel trade flows to anticipate potential disruptions and price volatility.