From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Positive Outlook Despite Activity Dip; UK-US Trade Deal Impact Looms

Ukraine’s steel sector shows a generally positive outlook, although recent satellite data reveals a decline in plant activity. The potential impact of the UK-US trade deal, as outlined in “UK industry welcomes US-UK trade deal canceling 25% import tariff on steel and aluminum,” could affect global steel pricing and indirectly influence the Ukrainian market, as “Will the UK’s exemption lead to a “dilution” of US steel tariffs?” suggests a possible reduction in US steel prices due to the agreement. However, no direct link can be currently established between this news and the observed plant activity changes.

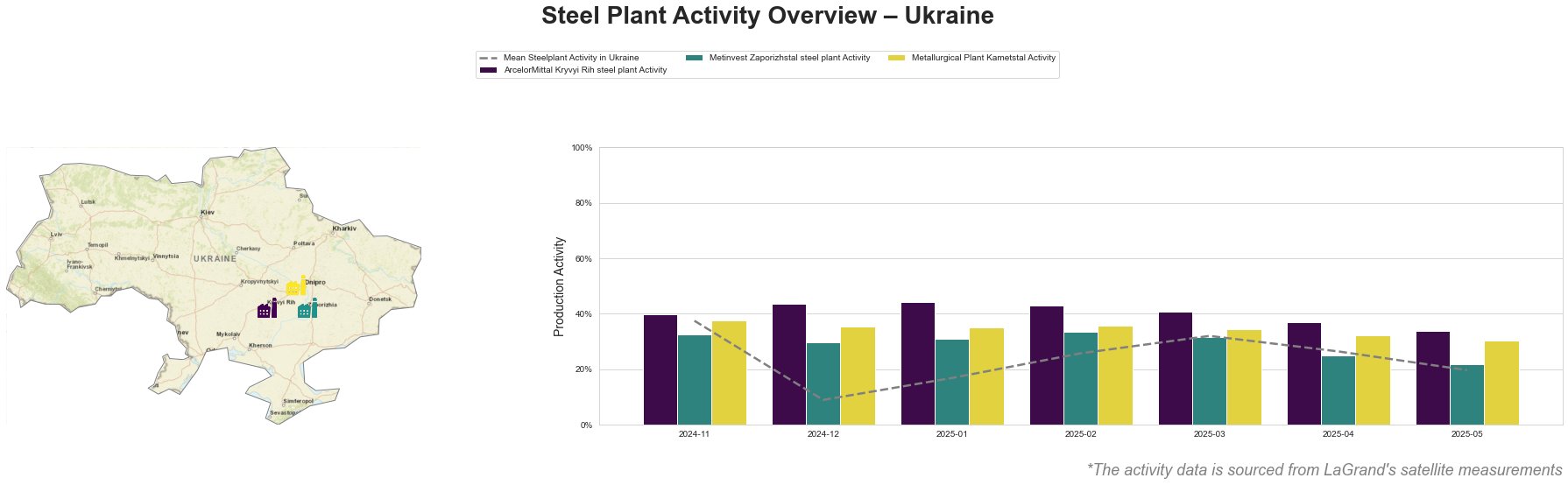

Overall, steel plant activity in Ukraine has declined, reaching 20.0% in May 2025, down from a peak of 38.0% in November 2024. The mean activity across all plants has shown a decrease since March 2025.

ArcelorMittal Kryvyi Rih, an integrated plant with a crude steel capacity of 8,000 ttpa, primarily uses the BOF process. The plant’s activity saw a significant decline from 44.0% in January 2025 to 34.0% in May 2025. No direct connection can be established between this decline and the news articles provided.

Metinvest Zaporizhstal, focused on finished rolled products with a crude steel capacity of 4,100 ttpa using primarily OHF, showed a similar downward trend. Activity dropped from 34.0% in February 2025 to 22.0% in May 2025. This decline cannot be directly linked to the provided news articles.

Metallurgical Plant Kametstal, an integrated plant with a 4,200 ttpa crude steel capacity via BOF, experienced a drop in activity from 36.0% in February 2025 to 30.0% in May 2025. No direct link can be established between this decline and the provided news articles.

The UK-US trade agreement discussed in “UK industry welcomes US-UK trade deal canceling 25% import tariff on steel and aluminum” and “Will the UK’s exemption lead to a “dilution” of US steel tariffs?” may lead to a reduction of US steel prices, potentially impacting global price dynamics. Steel buyers should closely monitor US steel pricing trends and consider negotiating contracts with clauses that allow for price adjustments based on global market fluctuations. Given the recent drop in activity levels in Ukraine, although unrelated to the news, procurement professionals should assess their supply chain resilience, diversify suppliers, and explore inventory options to mitigate potential risks due to production fluctuations.