From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Pig Iron Exports Rise Amidst Production Declines; Activity Shifts Analyzed

Ukraine’s steel sector faces mixed signals, with increased pig iron exports contrasting with overall production decreases. According to “Ukraine reduced rolled steel production by 11.8% y/y in May,” rolled steel output is down. This aligns with observed activity level declines across several plants based on satellite monitoring. However, “Ukraine rose to the top 10 net pig iron exporters, consumption increased by 21%” reveals growth in pig iron exports despite some production dips, indicating a possible shift in product focus. The article “Production in the metallurgical market has fallen in Ukraine” confirms a broader downturn in May, impacting cast iron, steel, and rolled metal.

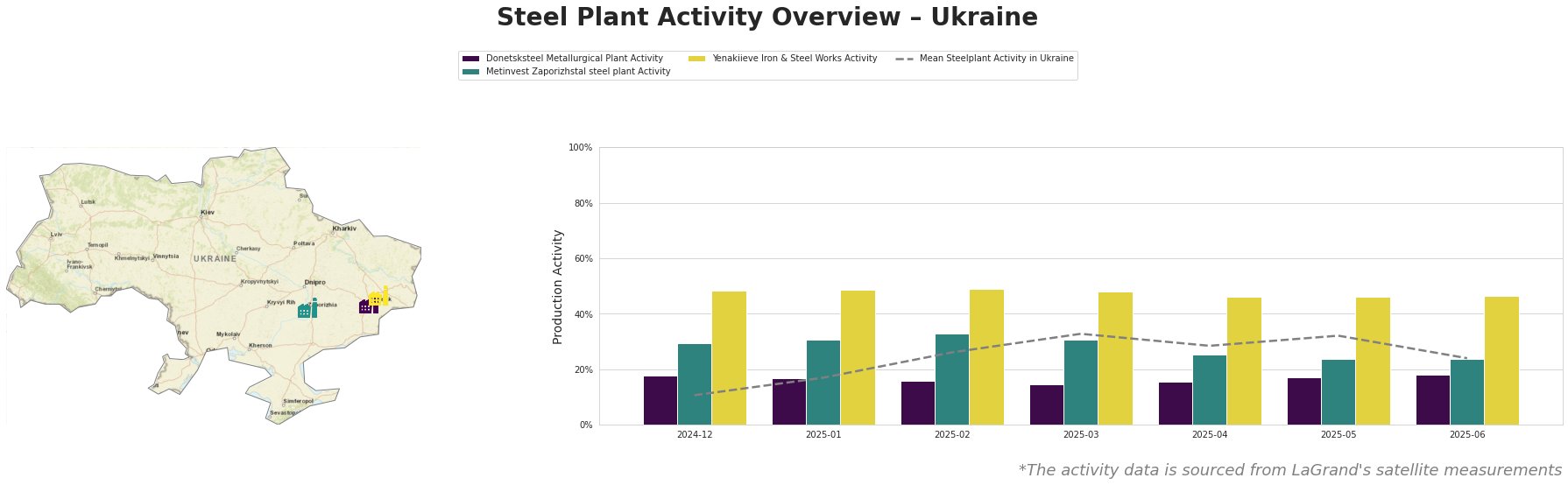

The mean steel plant activity in Ukraine peaked in March 2025 at 33% and has since declined to 24% by June 2025. Donetsksteel Metallurgical Plant activity remained relatively stable, fluctuating between 15% and 18%. Metinvest Zaporizhstal steel plant saw its highest activity in February 2025 at 33% but decreased to 24% by June 2025. Yenakiieve Iron & Steel Works consistently showed higher activity levels compared to other plants, remaining steady at around 46-49%. The overall decline in mean activity, consistent with the reported production decreases in “Ukraine reduced rolled steel production by 11.8% y/y in May” and “Production in the metallurgical market has fallen in Ukraine“, points to a potentially sustained downturn.

Donetsksteel Metallurgical Plant, located in Donetsk and primarily focused on pig iron production using integrated BF and EAF processes, maintained a relatively stable activity level between 15% and 18% throughout the observed period. This stability does not directly contradict the news articles on overall production decline, but it also doesn’t show a strong positive correlation.

Metinvest Zaporizhstal steel plant, based in Zaporizhzhia and known for its finished rolled products such as hot-rolled coil and sheets, experienced a notable decrease in activity from a peak of 33% in February 2025 to 24% in June 2025. This decline potentially mirrors the reduced rolled steel production reported in “Ukraine reduced rolled steel production by 11.8% y/y in May“, suggesting that the plant might be contributing to the overall downturn in rolled steel output.

Yenakiieve Iron & Steel Works, also located in Donetsk and producing semi-finished and finished rolled products like billets and rebar, consistently operated at higher activity levels (46-49%) than the other plants. This sustained activity is notable, but no news article directly explains this trend given the overall context of production decreases.

The reported increase in pig iron exports in “Ukraine rose to the top 10 net pig iron exporters, consumption increased by 21%,” combined with the observed steady activity at Donetsksteel (focused on pig iron), may indicate a strategic shift towards pig iron production for export. However, the overall decline in steel and rolled steel production, as highlighted by “Ukraine reduced rolled steel production by 11.8% y/y in May” and the activity drop at Metinvest Zaporizhstal, signals potential supply constraints for finished steel products.

Evaluated Market Implications:

- Potential Supply Disruptions: The combination of decreased rolled steel production, as reported in “Ukraine reduced rolled steel production by 11.8% y/y in May“, and the activity decline at Metinvest Zaporizhstal (a key producer of finished rolled products), suggests possible disruptions in the supply of hot-rolled coil, cold-rolled sheets, and other finished steel products.

-

Recommended Procurement Actions:

- Steel Buyers: Prioritize securing contracts with suppliers outside of Ukraine for finished steel products, particularly hot-rolled and cold-rolled sheets, to mitigate potential supply shortages. Actively monitor the activity levels of Metinvest Zaporizhstal for further declines, which could exacerbate supply issues.

- Market Analysts: Closely analyze the pig iron export data alongside crude steel production figures. The shift towards pig iron exports might indicate a restructuring of the Ukrainian steel industry, potentially impacting the availability of crude steel for domestic processors. Further investigate the long-term implications of this shift on the broader steel market dynamics.