From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Optimism Despite Export Fluctuations: Insights for Procurement

Ukraine’s steel sector presents a mixed but generally positive outlook. Despite the headline “Ukraine’s Steel Exports Drop by 9.9% in January – October 2025“, overall steel production saw a slight increase, with a considerable portion consumed domestically. The rise in long rolled product exports, highlighted in “Ukraine increased its exports of long rolled products by 43.7% y/y in January-October“, does not appear to directly correlate with any specific observed changes in activity levels at the monitored steel plants, where a recent decrease has been observed.

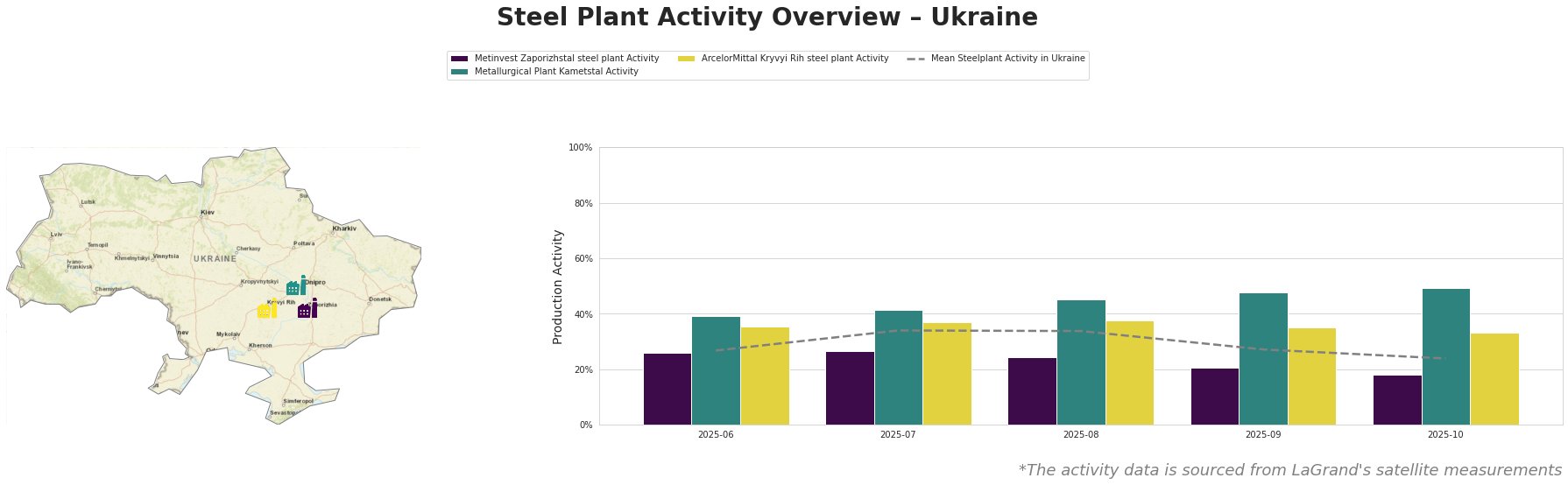

The average activity across all three plants peaked in August at 34% and declined to 24% by October. Metallurgical Plant Kametstal consistently operated above the mean, reaching a high of 49% in October, while Metinvest Zaporizhstal steel plant showed the lowest activity and a continuous decline, reaching 18% in October. ArcelorMittal Kryvyi Rih steel plant maintained relatively stable activity, fluctuating between 33% and 38%. No direct connection could be established between the observed overall decline in activity and the news articles.

Metinvest Zaporizhstal, an integrated BF-OHF plant with a crude steel capacity of 4.1 million tons per annum (TTPA), focuses on finished rolled products like hot-rolled coil and cold-rolled sheets. The plant’s activity has decreased steadily, from 26% in June to 18% in October, significantly below the national average. This decline, while concerning, does not have a clear, directly attributable link to the news of export fluctuations.

Metallurgical Plant Kametstal, also an integrated BF-BOF plant but with a capacity of 4.2 million tons of crude steel, produces semi-finished products and finished rolled products like wire rods and rails. Its activity has consistently exceeded the Ukrainian average, reaching 49% in October, making it the most active plant monitored. This positive trend does not seem to directly correlate with the fluctuations in flat or long rolled steel product exports.

ArcelorMittal Kryvyi Rih, Ukraine’s largest steel plant with 8 million tons of crude steel capacity across BF, BOF, and OHF technologies, produces both semi-finished and finished rolled products. Its activity remained relatively stable but slightly below the average, decreasing from 35% in June to 33% in October. There isn’t a directly evident relationship between this stable activity and the increases in long rolled product exports described in “Ukraine increased its exports of long rolled products by 43.7% y/y in January-October”.

The sustained increase in imports of long rolled products, as evidenced by “Ukraine increased imports of long rolled products by 69.5% y/y in January-October“, coupled with the recent decline in overall plant activity, suggests that domestic production may be struggling to meet demand in specific sectors. Considering the increased exports of long rolled products coupled with their increased imports and decreasing activities in key Ukrainian plants: Procurement professionals should diversify suppliers, prioritizing regions outside of Ukraine to mitigate potential shortages while securing supply chains against potential disruptions. Analyze inventory levels and consumption rates to establish a safety stock.