From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Long Rolled Exports Surge Amidst Rising Imports; Flat Steel Exports Show Slight Dip

Ukraine’s steel market presents a mixed picture. While “Ukraine increased its exports of long rolled products by 44.4% y/y in January-August“, this growth is coupled with increasing imports, as highlighted by “Ukraine increased imports of long rolled products by 48% y/y in January-August,” primarily from Turkey and China. These developments contrast with a slight decrease in flat steel exports, as reported in “Flat steel exports from Ukraine exceeded 1.1 million tons in January-August,” indicating shifting trade dynamics. The news articles cannot be directly linked to changes in plant activity levels.

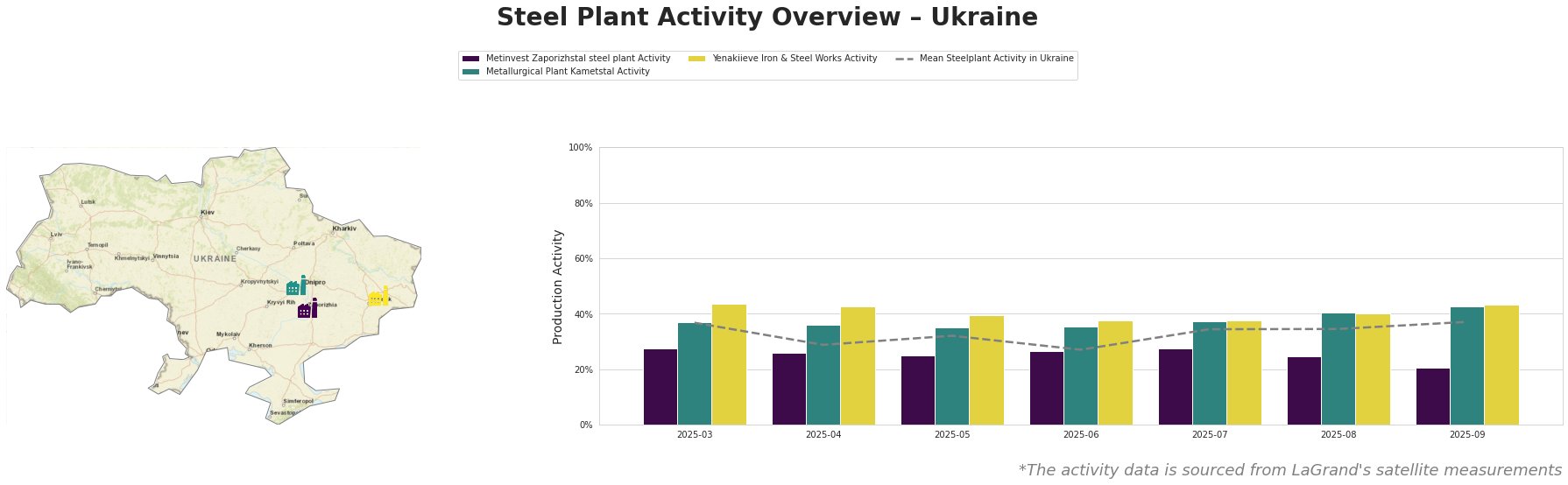

Overall, the mean steel plant activity in Ukraine fluctuated, reaching a low of 27.0% in June and peaking at 37.0% in March and September. Metinvest Zaporizhstal shows consistently lower activity than the mean, dropping significantly to 21.0% in September. Metallurgical Plant Kametstal and Yenakiieve Iron & Steel Works consistently exhibit activity levels above the mean. Kametstal peaks at 43% in September, while Yenakiieve shows stable activity in August and September at 40% and 43% respectively.

Metinvest Zaporizhstal steel plant: This integrated steel plant, with a crude steel capacity of 4.1 million tons per annum (TTPA) via open-hearth furnaces (OHF), focuses on finished rolled products like hot-rolled and cold-rolled sheets. Satellite data indicates that activity at Metinvest Zaporizhstal has remained consistently below the Ukrainian average for the observed period, culminating in a low of 21% in September. While “Flat steel exports from Ukraine exceeded 1.1 million tons in January-August” highlights a 1.5% decrease in flat steel exports, primarily hot-rolled products, the correlation between this export trend and Metinvest Zaporizhstal’s decreasing activity is not directly evident based on the provided information, but the plant focuses on hot-rolled and cold-rolled sheet production.

Metallurgical Plant Kametstal: Kametstal, an integrated plant with a 4.2 million TTPA crude steel capacity produced via BOF, manufactures both semi-finished (square billets) and finished rolled products (wire rods, rails). Satellite observations reveal that Kametstal’s activity has consistently been above the national average. The plant’s activity reached 43% in September, the highest in the observed period. “Ukraine increased its exports of long rolled products by 44.4% y/y in January-August” might suggest increased production at Kametstal to fulfill export demand, particularly given its focus on wire rods and rails; however, no definitive relationship can be explicitly established based on provided information alone.

Yenakiieve Iron & Steel Works: With a crude steel capacity of 3.3 million TTPA using BOF technology, Yenakiieve produces semi-finished (square billets) and finished long rolled products (rebar, wire rods). The plant’s activity, consistently above the Ukrainian average, remained stable at 43% in September. Though “Ukraine increased its exports of long rolled products by 44.4% y/y in January-August” reports a surge in long rolled product exports, and Yenakiieve produces such products, no direct connection to Yenakiieve’s observed plant activity can be definitively established using the provided information.

Given the increase in Turkish steel exports to Ukraine, as reported in “Turkish steel exports to Ukraine grew by 36.1% y/y in January-August“, and the increased Ukrainian imports of long rolled products from Turkey and China (“Ukraine increased imports of long rolled products by 48% y/y in January-August”), Ukrainian steel buyers should:

- Assess supplier risks associated with Metinvest Zaporizhstal: Given the continued lower activity levels at the plant, procurement professionals dependent on hot-rolled or cold-rolled sheets should evaluate and secure alternative supply sources to mitigate potential supply disruptions. The recent drop to 21% activity in September at Metinvest Zaporizhstal highlights the need for proactive risk management.

- Negotiate strategically for long rolled steel: Given the surge in imports, buyers should leverage competitive pricing from Turkish and Chinese suppliers against domestic offers from plants like Kametstal and Yenakiieve to optimize procurement costs. Consider the implications of “Ukraine increased imports of long rolled products by 48% y/y in January-August” when negotiating with local suppliers.

These recommendations are explicitly based on observed activity trends and trade dynamics reported in the news, not on assumptions.