From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Long Product Exports Surge Amidst Flat Product Import Growth

Ukraine’s steel market presents a mixed picture, with increasing long product exports offset by rising flat product imports. According to “Ukraine increased exports of long products by 45.3% y/y in January-September,” long product exports surged, while “Ukraine increased imports of flat products by 13.1% y/y in January-September” indicates a significant increase in flat product imports. While there’s a divergence between export and import trends, no direct connection can be established between these news articles and the satellite observed activity levels across key steel plants in Ukraine.

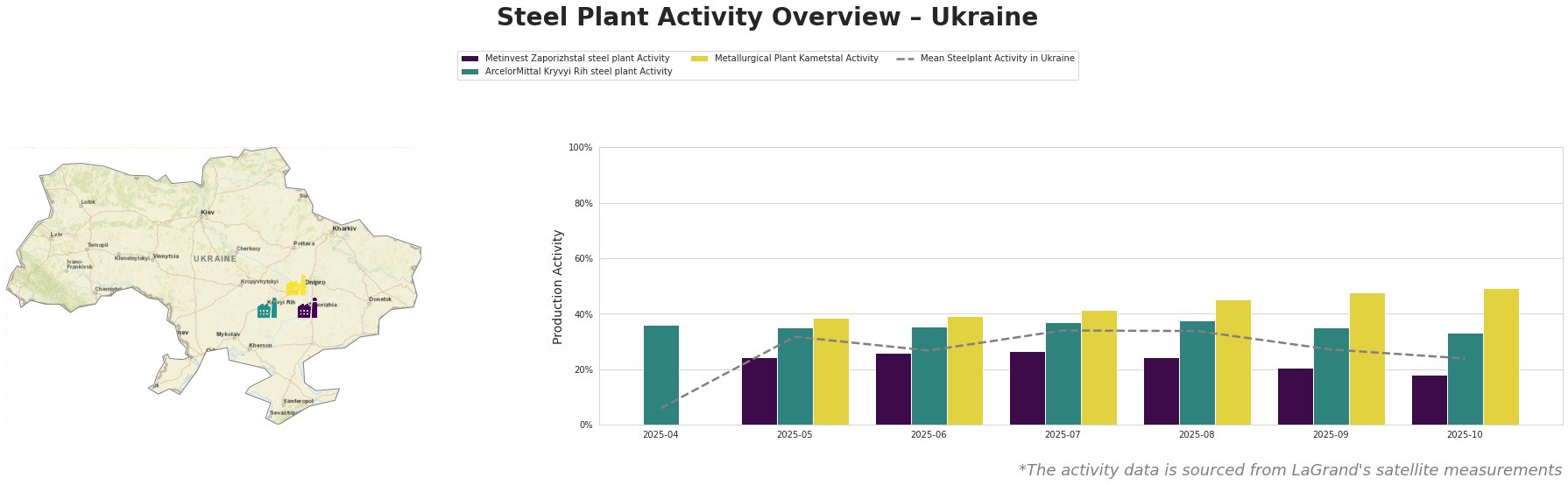

Observed steel plant activity indicates varied performance. Mean steel plant activity in Ukraine peaked in July and August at 34.0% but declined to 24.0% by October. ArcelorMittal Kryvyi Rih generally maintained activity levels above the mean, peaking at 38.0% in August, but falling to 33.0% in October. Metallurgical Plant Kametstal consistently showed rising activity, reaching a peak of 49.0% in October, significantly above the mean. Metinvest Zaporizhstal exhibited activity levels consistently below the mean, with a decrease to 18.0% in October. While “Industrial production in Ukraine fell by 2.5% y/y in January-August” highlights a broader industrial decline, it also notes a 7% increase in the steel industry and finished steel products, and an 8.7% increase in steel industry output in August, seemingly contrasting with recent observed declines at Zaporizhstal and Kryvyi Rih in September and October.

Metinvest Zaporizhstal steel plant

Metinvest Zaporizhstal, an integrated BF-OHF plant with a crude steel capacity of 4.1 million tonnes per annum (TTPA), focuses on finished rolled products, including hot-rolled coil and cold-rolled sheets. Satellite observations indicate a recent activity decline, with levels dropping from 26.0% in July to 18.0% in October. Considering that Metinvest is importing coking coal from the US to ensure supplies according to the news title “Ukraine imported 491 thousand tons of metallurgical coke in January-September“, no direct connection between coal imports and declining activity can be established based on provided information.

ArcelorMittal Kryvyi Rih steel plant

ArcelorMittal Kryvyi Rih, an integrated BF-BOF-OHF plant with a crude steel capacity of 8 million TTPA, produces both semi-finished and finished rolled products like billet, rebar, and wire rod. Its activity levels have been relatively stable but show a slight decline from a peak of 38.0% in August to 33.0% in October. While “Ukraine exported 1.29 million tons of flat products in January-September” mentions specific destinations for Ukrainian flat-rolled products, the article provides no link to this plant’s recent activity levels or possible export challenges.

Metallurgical Plant Kametstal

Metallurgical Plant Kametstal, an integrated BF-BOF plant with a crude steel capacity of 4.2 million TTPA, specializes in semi-finished and finished rolled products, including square billets and wire rods. Notably, Kametstal demonstrates a consistent increase in activity, reaching 49.0% in October. This trend aligns with the general increase in long product exports reported in “Ukraine increased exports of long products by 45.3% y/y in January-September,” potentially indicating that Kametstal is contributing significantly to this export growth.

Given the increase in long product exports reported in “Ukraine increased exports of long products by 45.3% y/y in January-September” and the simultaneously rising imports of flat products per “Ukraine increased imports of flat products by 13.1% y/y in January-September,” Ukrainian steel buyers should:

-

Secure Long Product Supply: Capitalize on increased domestic long product availability driven by increased exports. Buyers should negotiate favorable terms with Metallurgical Plant Kametstal, whose production is trending upwards, to ensure stable supply amidst export demand.

-

Diversify Flat Product Import Sources: Given the reliance on Turkey for flat product imports, explore alternative suppliers to mitigate risks associated with potential supply chain disruptions from a single source. “Ukraine increased imports of flat products by 13.1% y/y in January-September” reveals reliance on Turkey and should trigger diversification.