From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Cools: Production Dips Amidst UK Trade Debates

Ukraine’s steel sector shows signs of cooling, as reflected in recent plant activity. While no direct link can be established between Ukrainian steel plant activity and UK-focused news, the potential global implications of trade discussions in the UK steel industry, as highlighted in “Podcast: Can the UK Metals Expo bring ‘positive news’ for the steel industry?” and “Changing the shape of British metallurgy: the debate of MEPs at the UK Metals Expo,” could indirectly influence market dynamics.

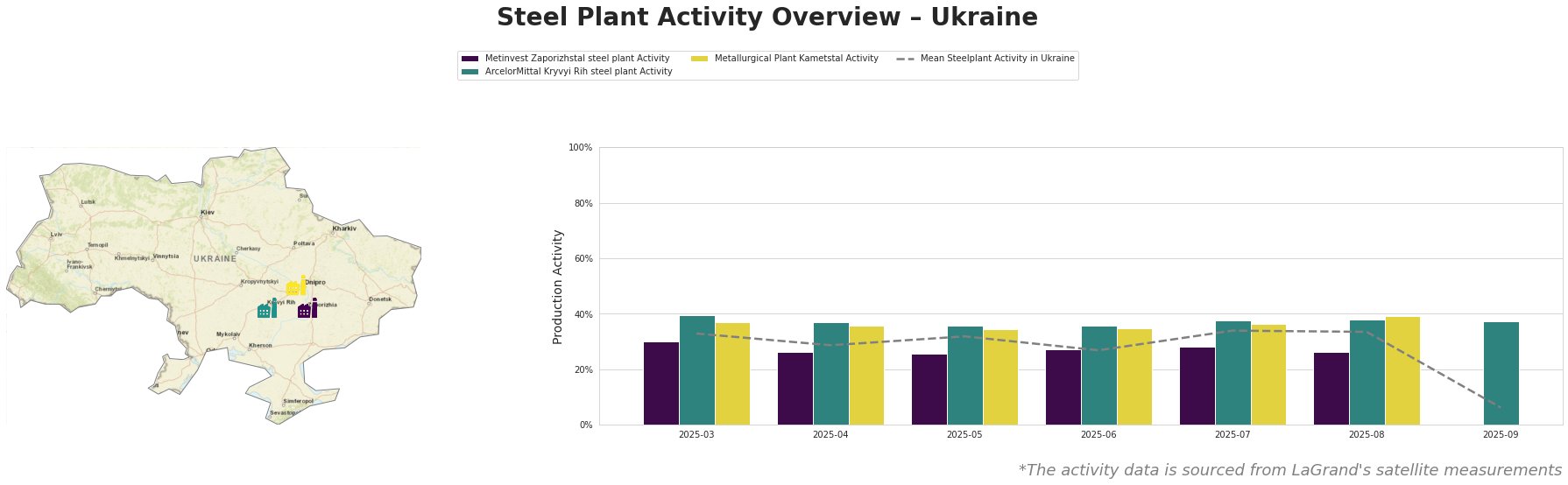

Overall, the mean steel plant activity in Ukraine shows volatility from March to August, peaking at 34.0 in July and August before experiencing a sharp drop to 6.0 in September.

Metinvest Zaporizhstal, an integrated steel plant with a 4,100 TTPA crude steel capacity using older OHF technology, showed a fluctuating activity level, starting at 30.0 in March and reaching a peak of 28.0 in July before dropping to 26.0 in August. No data is available for September. This plant focuses on finished rolled products and caters to automotive, steel packaging, and machinery sectors. No direct connection between the UK-focused news and the plant’s activity can be established.

ArcelorMittal Kryvyi Rih, Ukraine’s largest steel plant with an 8,000 TTPA crude steel capacity relying on both BOF and OHF processes, maintained a relatively stable activity level between 36.0 and 40.0 from March to September. The plant produces a diversified product range, including semi-finished and finished rolled products for the building and infrastructure sectors. The sustained activity at ArcelorMittal Kryvyi Rih, despite the overall market downturn in September, could indicate resilience or strategic stockpiling. No direct connection between the UK-focused news and the plant’s activity can be established.

Metallurgical Plant Kametstal, with a 4,200 TTPA crude steel capacity using BOF technology, shows a gradual increase in activity, peaking at 39.0 in August. No data is available for September. The plant produces semi-finished and finished rolled products catering to the energy and transport sectors. No direct connection between the UK-focused news and the plant’s activity can be established.

The sharp decline in overall Ukrainian steel plant activity in September, coupled with the stable production at ArcelorMittal Kryvyi Rih, may point to concentrated production shifts or potential localized disruptions affecting other plants.

Evaluated Market Implications:

The significant drop in overall Ukrainian steel production in September, combined with the stability of ArcelorMittal Kryvyi Rih, suggests a potential shift in market share or localized supply chain issues.

- Potential Supply Disruption: The absence of data for Metinvest Zaporizhstal and Metallurgical Plant Kametstal in September, combined with a low average activity level, implies potential supply disruptions from these plants, primarily affecting hot-rolled coil, sheets (Metinvest Zaporizhstal), and wire rods and rails (Kametstal).

-

Recommended Procurement Action:

- Steel buyers relying on Metinvest Zaporizhstal or Metallurgical Plant Kametstal should immediately assess alternative supply sources for hot-rolled coil, sheets, wire rods, and rails due to potential disruptions. Given ArcelorMittal Kryvyi Rih’s stable activity, explore potential sourcing options from them, but be mindful of their product mix (billet, rebar, sections).

- Analysts should closely monitor Zaporizhstal’s and Kametstal’s operations and investigate the reasons for the September decline to properly assess the situation.