From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Consumption Up, Production Mixed; Monitor Alchevsk

Ukraine’s steel sector presents a mixed picture. While domestic consumption is rising, production faces headwinds. Satellite data shows varying plant activity, requiring careful procurement strategies. These trends correlate with reports like “Consumption of steel products in Ukraine rose to 1.56 million tons in January-May” highlighting increased internal demand, coupled with “Steel production in Ukraine fell by 14% in May – Worldsteel” noting production declines. No direct relationship between these news articles and specific observed activity shifts across plants could be clearly established.

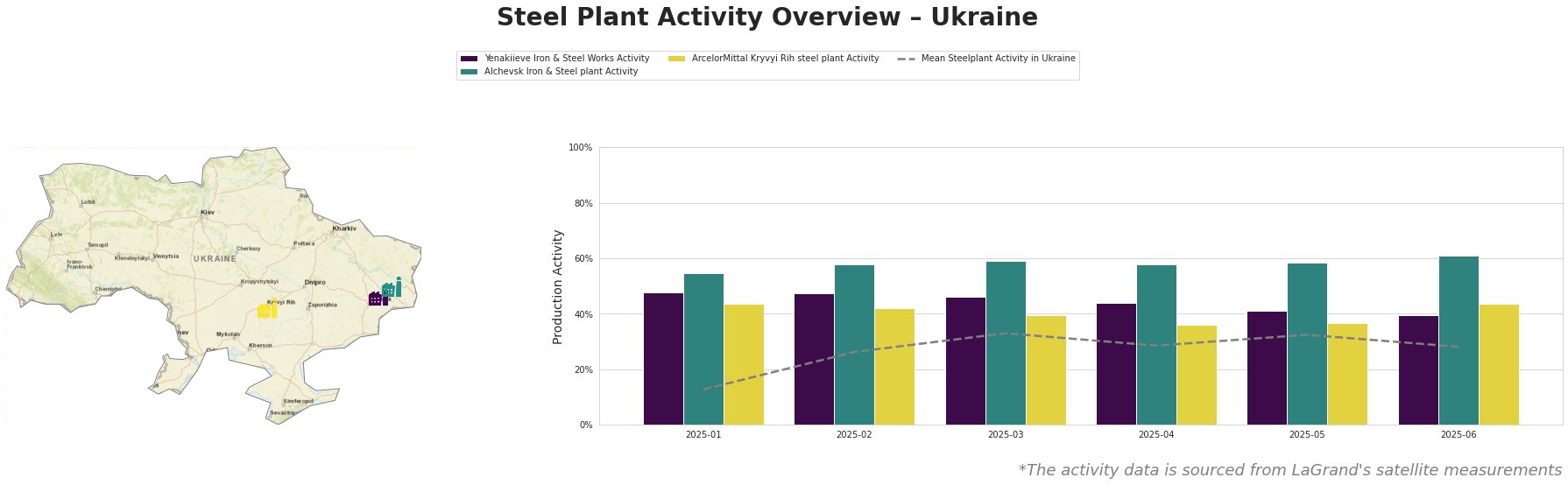

The average steel plant activity in Ukraine has fluctuated, peaking in March at 33% and decreasing to 28% in June. Yenakiieve Iron & Steel Works, a BOF-based plant in Donetsk with a crude steel capacity of 3.3 million tons, has shown a consistent decline in activity from 48% in January to 39% in June. Given its production of semi-finished and finished rolled products, this decline may constrain supply of square billets, rebar, and wire rods. Alchevsk Iron & Steel plant, located in Luhansk and also operating with BOF technology with a significantly larger crude steel capacity of 5.472 million tons, has maintained relatively high activity levels, peaking at 61% in June, contrasting with the overall decreasing trend and potentially offsetting some of the supply impact of the Yenakiieve decline. ArcelorMittal Kryvyi Rih, with the highest crude steel capacity at 8 million tons, is the only plant where activity in June (44%) matches that of January (44%), however in the months in between January and June its activity levels varied between 36% and 42%.

The “Ukraine reduced semi-finished products’ exports by 34% y/y in January-May” news article highlights a significant decrease in semi-finished product exports. With Alchevsk Iron & Steel Plant’s activity holding relatively steady while specializing in slabs and billets, and Yenakiieve Iron & Steel Works experiencing declining activity, the reduction in exports could indicate a shift towards satisfying increased domestic demand, as indicated by “Consumption of steel products in Ukraine rose to 1.56 million tons in January-May“.

Given the reduced steel export and varied production levels, steel buyers should:

- Prioritize Domestic Sourcing for Finished Rolled Products: Considering the decline in activity at Yenakiieve, procurement professionals should focus on securing domestic supply of finished rolled products like rebar and wire rods.

- Monitor Alchevsk Production for Semi-Finished Availability: Closely track Alchevsk’s output and export plans for slabs and square billets to gauge potential supply chain impacts.

- Factor in Import Reliance: As highlighted in “Consumption of steel products in Ukraine rose to 1.56 million tons in January-May” nearly 40% of Ukraine’s steel consumption is met through imports, the increased imports suggest the need to carefully evaluate foreign suppliers in order to secure necessary steel volumes.